Being a single mom is hard and combining with low savings can be even more challenging.

But it doesn’t have to be – with some basic financial planning, you can save money fast and improve your financial situation as a single mom.

In this blog article, we will share 12 things you can do to save money fast and improve your financial health. So, if you are a single mom or know someone who is struggling with finances, keep reading!

Create a Budget

The first thing you want to do is to create a budget that allows you to keep track of your income and expenses.

This will give you a clear picture of where your money is going and help you identify areas where you can cut back on unnecessary spending.

To create an effective budget, start by listing all your sources of income and then list out all your expenses such as rent/mortgage, utilities, groceries, childcare, etc.

Then compare the two to see if there are any areas in which you can decrease spending or find ways to increase your income.

Meal Plan

Food is one of the biggest expenses you will have – so you must find ways to save money in this area – meal planning is a great way to do this.

Sit down at the beginning of each week and plan your meals based on what you already have in your pantry. Then look for offers at your nearest grocery store and plan your meals around them.

Buy in bulk to save even more money and consider making meals in advance so you have quick, healthy options when life gets busy.

Buy Second Hand

Secondhand items are a great way to save money on essential items such as clothes, furniture, and appliances. Look for local thrift stores or online marketplaces to find quality items at a fraction of the cost.

You can find some best deals on items that are hardly used, and you can also sell items you no longer need to make some extra cash.

But check the item multiple times before buying to make sure it is in good condition. You don’t want to end up spending money on something that will break or wear out quickly.

Cut Down On Entertainment Expenses

From going out to movies, concerts, and dining out, entertainment expenses can add up quickly. It’s okay to go once in a while, but going out too much can dent your budget.

Look for free or low-cost alternatives like community events, local parks, or hosting a game night with friends at home.

You can also use streaming services instead of going to the movies and cooking at home instead of eating out.

The goal is to cut back on unnecessary expenses and focus on experiences that bring you joy without breaking the bank.

Increase Your Income

Thanks to the internet, now there are tons of ways to make extra money from the comfort of your own home. Graphic design, content writing, and virtual assistant work are just a few examples of online jobs that you can do on your own time.

Don’t worry if you don’t know any of these – you can easily learn through online courses or YouTube tutorials.

Or, consider taking on a part-time job in addition to your current one. It may be tiring, but the extra income can help you reach your financial goals faster.

Don’t Fall Into FOMO

With social media constantly bombarding us with images of luxury vacations and expensive things, it’s easy to fall into the trap of feeling like we’re missing out.

But remember, not everything you see on social media is real or necessary.

Don’t let the fear of missing out (FOMO) pressure you into making impulse purchases or going on trips that you can’t afford.

Instead, focus on your own financial goals and make decisions based on what’s best for your budget and future.

You have to remember that an expensive dress might give you happiness for a day, but if you are struggling to pay rent, it won’t bring you long-term joy.

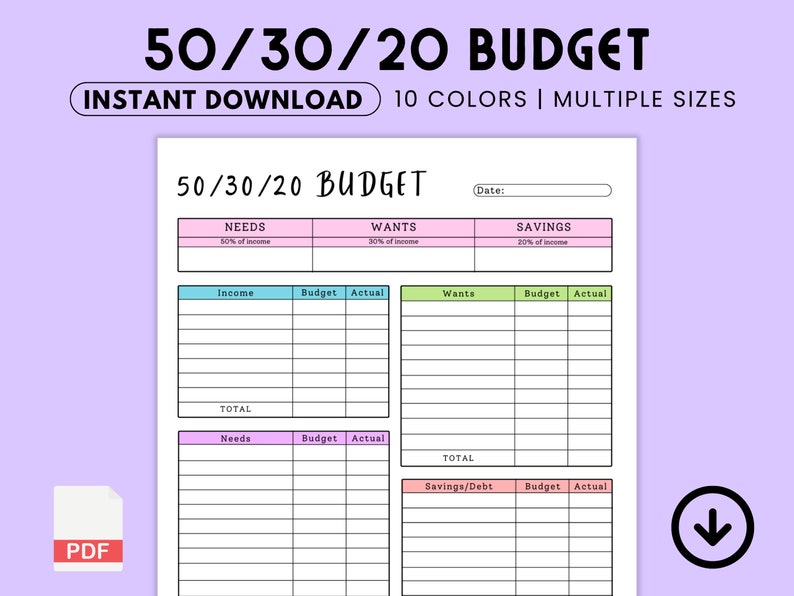

Use the 50:30:20 Rule

A simple and effective way to manage your finances is by following the 50:30:20 rule.

This means allocating 50% of your income towards necessities such as rent, bills, groceries, and transportation – 30% towards wants like dining out, shopping, and entertainment; and the remaining 20% towards savings.

It’s a well-known rule in personal finance and can help you keep your spending in check while also building up your savings.

If possible, try to increase the amount you put towards savings – even a small increase can make a big difference in the long run.

Automate Your Savings

Speaking of savings, one of the best ways to ensure you’re consistently putting money away is by automating it.

Set up automatic transfers from your checking account to your savings account on a regular basis, whether it’s weekly or monthly.

This way, you won’t even have to think about saving – it will happen automatically and effortlessly. Plus, when you don’t see the money in your hand, you’ll be less likely to spend it.

Invest

If you want to grow your savings fast, consider investing a portion of your income. While it has some risk involved, it will help gain higher returns on your money compared to just keeping it in a savings account.

For example, a savings account might give you a 1% interest rate, while investing in stocks or mutual funds could give you returns of 7-10%.

Make sure to do your research and consult a financial advisor before investing – with a little bit of knowledge and patience, you can make your money work for you.

Don’t Forget About Retirement

While it may seem far off, saving for retirement should also be a priority in your financial plan, especially if you are a single mom.

Start contributing to a retirement account as soon as possible, whether it’s through your employer’s 401(k) plan or an individual retirement account (IRA).

The earlier you start, the more time your money has to grow and compound over the years. Plus, many employers offer matching contributions to your 401(k), so make sure to take advantage of that free money.

Take Advantage of Discounts and Freebies

While there aren’t grants just for single moms, there are plenty of income-based programs that can help you out. You can get financial aid for education through Pell Grants, FAFSA, and scholarships.

For housing and utilities, programs like Housing Choice Vouchers and LIHEAP can be a big help. When it comes to food, SNAP, WIC, and school lunch programs can make a huge difference.

Taking advantage of these resources can lighten your load and help you save money in your daily life.

Don’t Be Afraid to Ask for Help

Lastly, don’t be afraid to ask for help if you need it. There are many organizations and programs available that can provide financial assistance or resources to single moms.

Do your research and reach out to local nonprofits, churches, or government agencies for support.

You can also join online communities or support groups for single moms to connect with others who may be going through similar financial challenges.

Remember, you don’t have to do it all alone – there are resources and people willing to help if you just ask.

Conclusion

Being a single mother is hard – but if you prioritize financial stability and make smart choices with your money, you can create a better future for yourself and your family. All you need to do is manage your finances properly and take care of yourself and your children. By following these tips, you can set yourself up for financial success as a single mom.

Thank you so much for this article. Learning how to handle money and finances is so very important. It is not something taught in school and it should be.