The Imperative of Financial Discourse

In every enduring relationship, open dialogue about finances is not merely prudent—it is indispensable. This exploration of money questions is designed to illuminate the often-overlooked facets of shared economic realities.

Clear communication on monetary matters can transform latent uncertainties into opportunities for deeper connection.

What are your current income sources, and how stable are they?

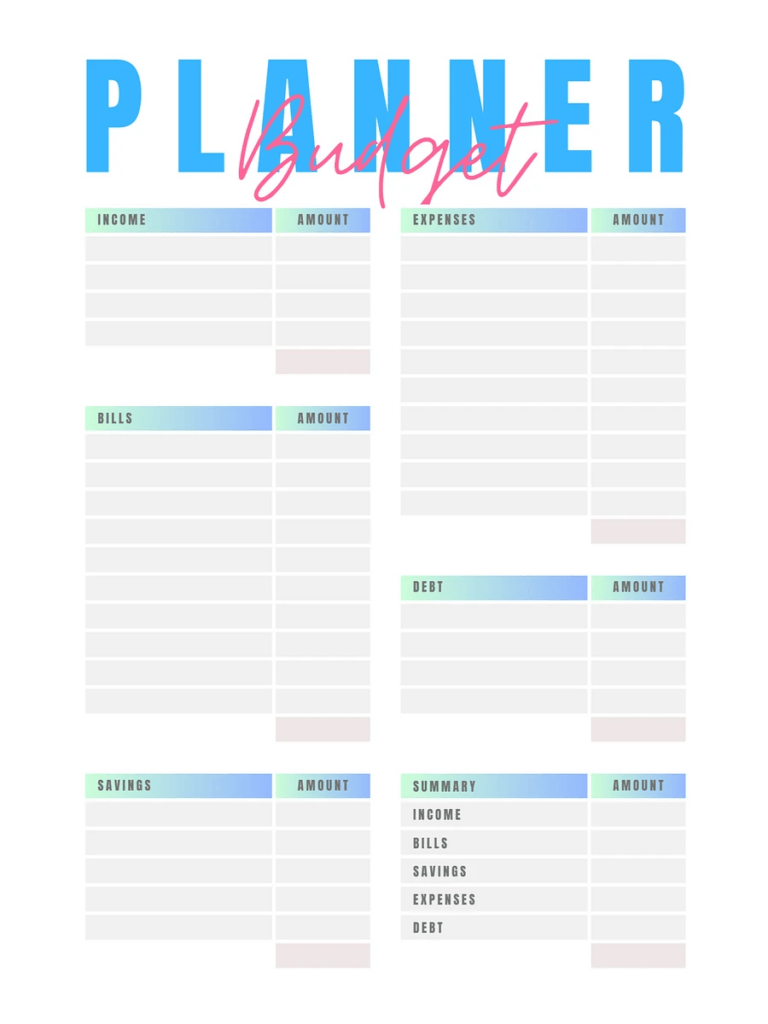

How do you manage your personal budget on a monthly basis?

What is your current debt situation, including credit cards and loans?

Do you have any outstanding student loans or other educational debts?

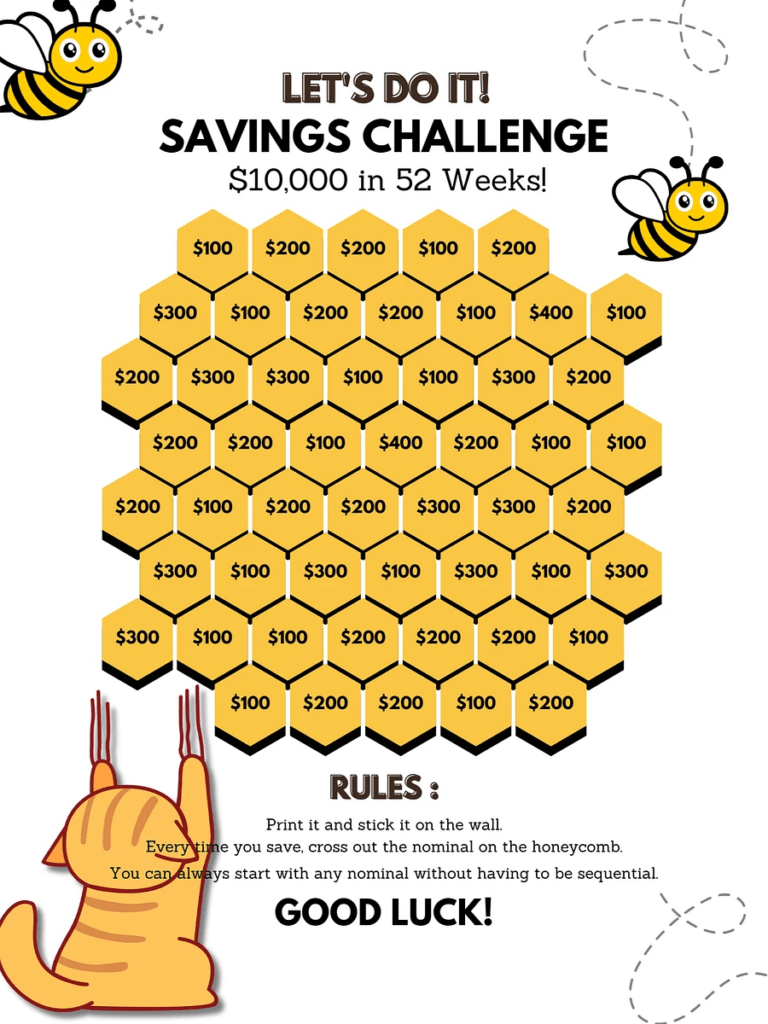

How do you prioritize saving versus spending in your daily life?

What are your long-term financial goals and aspirations?

How would you describe your current credit score and credit history?

How comfortable are you with the idea of having joint bank accounts in the future?

What are your typical spending habits when it comes to discretionary items?

How do you approach budgeting, and do you follow a specific method?

What strategies do you use to prepare for unexpected expenses?

What financial advice or principles have significantly influenced you?

How do you view debt—do you consider it a necessary tool or a burden?

Have you ever experienced bankruptcy or had to restructure your debt?

How do you envision managing finances as a couple once married?

Are you comfortable discussing money openly and honestly?

What is your philosophy on investing, and how do you educate yourself on it?

Do you have any experience with the stock market or other investment vehicles?

How have you handled financial setbacks or unexpected losses in the past?

What does your emergency fund look like, and how many months of expenses does it cover?

What are your plans for retirement, and at what age do you envision retiring?

Do you plan to save for a major purchase such as a home, and how will you approach it?

How do you feel about using credit cards and managing credit limits?

What does “living within one’s means” mean to you in practical terms?

Have you ever worked with a financial planner or advisor, and would you consider doing so?

In your view, what role does money play in your overall happiness and life satisfaction?

How do you plan to balance personal expenses with shared expenses in a relationship?

Are there any financial red flags in your past that we should address openly?

How do you typically handle financial stress or unexpected financial pressure?

What is your approach to discretionary spending versus essential expenditures?

How often do you review or adjust your personal finances and budget?

Do you believe in full financial transparency, and what does that look like for you?

What are your top financial priorities at this stage in your life?

How would you describe your history of financial stability over the years?

What methods do you use to save for future goals or large purchases?

How do you manage and monitor your credit on a regular basis?

What types of investments do you currently hold, if any?

Are you planning any significant financial changes in the near future?

How do you feel about taking financial risks, and what level of risk are you comfortable with?

What financial values or lessons did you inherit from your family or upbringing?

How do you plan for large, one-time purchases such as appliances or vacations?

What role do financial planning tools (apps, spreadsheets, etc.) play in your life?

How have your family’s financial dynamics influenced your money management habits?

What does effective money management mean to you personally?

Have you ever consulted with a financial advisor, and would you consider it again?

What are your biggest financial fears, and how do you work to mitigate them?

How do you typically resolve disagreements about money with friends or family?

What does financial security mean to you, and how do you plan to achieve it?

How would you describe your overall relationship with money?

What steps do you take toward achieving financial independence?

In Marriage: Navigating Shared Financial Realities

How do we plan to combine our incomes once we’re married?

What strategy will we use to pay off any shared or individual debts?

How should we set and track our joint financial goals together?

Should we maintain separate bank accounts, or opt for a combined approach?

How do we handle the tracking and management of our daily expenses as a couple?

What financial plan should we develop for major life events, such as buying a home or starting a family?

How will we manage financial emergencies together if unexpected expenses arise?

What is our joint plan for saving for retirement, and how will we balance contributions?

How do we allocate money for leisure, hobbies, and entertainment within our budget?

How will we balance short-term spending desires with long-term investment strategies?

How should we approach making large, one-time purchases as a team?

How often will we review our joint finances and adjust our strategies?

What will be our process for creating and maintaining a shared budget?

How do we decide on investment opportunities as a couple?

What contingency plans do we have for unexpected financial setbacks?

How can we support each other’s ongoing financial education and literacy?

What is our strategy for tax planning and optimizing our filings as a couple?

How do we plan to handle fluctuations in income or periods of reduced earnings?

How will we address differences in spending habits without causing conflict?

What plan should we establish for dividing household expenses fairly?

How do we plan to save for our children’s education or future family needs?

What is our strategy for discussing money during stressful or challenging times?

How do we balance immediate desires with long-term financial security?

What role does charitable giving play in our joint financial planning?

How will we handle financial disputes if our opinions on money diverge?

Which financial decisions will require mutual agreement, and which can be made independently?

How do we plan to adjust our financial strategy as our circumstances change over time?

How will we communicate changes in our financial situation as they occur?

What process will we use for revisiting and revising our budget periodically?

How do we ensure that transparency remains a core value in our financial discussions?

What is our plan for managing and growing shared investments?

How do we allocate funds for future opportunities or unexpected chances for growth?

How can we integrate our financial planning into our overall lifestyle seamlessly?

What procedures will we follow when we encounter a financial setback as a couple?

How do we strike a balance between enjoying our money today and saving for tomorrow?

What are our plans for home ownership, renting, or relocation in the future?

What strategies will we use to grow our wealth collectively over the years?

How can we incorporate regular financial check-ins into our relationship routine?

How do we prepare for the financial impact of potential career changes for either partner?

What is our strategy for maintaining and improving our joint credit score?

How will we manage our finances during times of unemployment or reduced income?

How do we explore and potentially develop additional income streams together?

What emergency protocols should we establish for unforeseen financial crises?

How do we assess and mitigate financial risks as a united front?

What steps will we take to ensure long-term wealth accumulation and security?

How can we incorporate financial planning into our annual or quarterly routines?

How do we decide on and allocate funds for charitable contributions?

What is our method for evaluating and celebrating our financial progress together?

How do we plan to celebrate financial milestones without compromising our goals?

How will we ensure that our shared financial journey remains a source of empowerment and unity rather than discord?

Conclusion

In any relationship, financial compatibility and mutual understanding are the cornerstones of a robust, enduring partnership. By engaging in these 100 money questions, couples are invited to traverse the intricate landscape of shared financial realities—from understanding individual pasts to forging a unified path for the future.

These questions are not merely a checklist; they are stepping stones toward building a foundation of trust, transparency, and resilience.

This dialogue is a call for deeper engagement—a deliberate exploration that transforms potential conflicts into opportunities for growth. It encourages partners to share their vulnerabilities, learn from past experiences, and embrace a shared vision for a secure and prosperous future.

As challenges arise, a commitment to open communication ensures that both individuals can navigate financial setbacks together, turning adversity into an opportunity for mutual empowerment.

Ultimately, this comprehensive inquiry into money matters nurtures not only fiscal well-being but also emotional intimacy. It reinforces the understanding that every discussion about money is, in fact, a discussion about values, dreams, and the kind of life you wish to create together.

With every honest conversation, every plan for savings, and every strategy for overcoming obstacles, you are not just managing money—you are cultivating a partnership that is prepared to thrive in both calm and storm.