How to Grow Your Savings This Spring

The Season of Renewal: Why Spring is the Perfect Time to Boost Savings

Spring isn’t just for blooming flowers and warmer days—it’s the perfect time to rejuvenate your finances. Just as we declutter our homes and reset our routines, we can also clean up our spending habits, optimize savings, and set fresh financial goals.

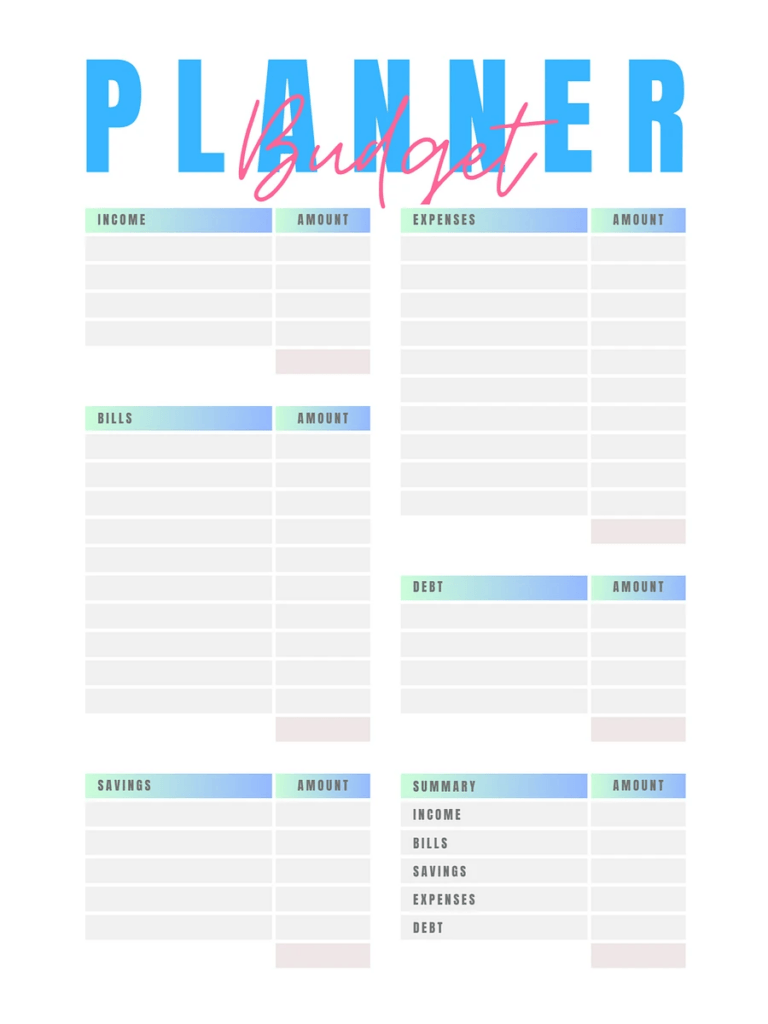

A Fresh Financial Start: Setting Goals for the Months Ahead

The start of a new season is a great opportunity to evaluate where your money is going and where you want it to be. Setting clear and realistic savings goals—whether it’s building an emergency fund, saving for a summer vacation, or paying off debt—creates motivation and direction.

The Power of Small, Consistent Changes in Your Budget

Saving money doesn’t require drastic lifestyle changes. Small, steady improvements—like cutting unnecessary expenses, automating savings, and taking advantage of seasonal opportunities—can have a significant impact over time.

Spring Cleaning Your Finances

Declutter Your Budget: Identify and Cut Unnecessary Expenses

Spring cleaning isn’t just for closets—your budget could use a refresh too. Review your bank and credit card statements from the last few months and highlight any unnecessary charges. Are there services you rarely use? Are you dining out more than expected? Identifying these leaks is the first step to plugging them.

The Subscription Purge: Cancel What You Don’t Use

Streaming services, magazine subscriptions, fitness apps—these small recurring charges can quietly drain your savings. If you’re subscribed to multiple platforms, consider canceling the ones you don’t use regularly. If you miss them, you can always re-subscribe.

Spring into Action: Reviewing and Renegotiating Bills

Spring is an excellent time to call service providers and negotiate better rates on your internet, phone, and insurance plans. Many companies offer discounts for long-term customers, but you have to ask!

Hidden Costs in Your Spending: How to Spot and Eliminate Them

Bank fees, late charges, and impulsive purchases can eat away at your savings. Set up alerts for bill due dates to avoid late fees, and use budgeting apps to monitor spending habits and flag unnecessary costs.

Boosting Your Income This Spring

Springtime Side Hustles: Fun and Profitable Seasonal Gigs

Spring brings plenty of side hustle opportunities, from pet-sitting during spring break to lawn care services. You can even cash in on seasonal demand by selling handmade spring-themed crafts or baked goods.

The Great Declutter Sale: Turn Your Unused Items Into Cash

Use the season’s fresh start as an excuse to purge your home of items you no longer need. Sell clothes, electronics, and furniture through online marketplaces or host a yard sale to turn clutter into cash.

Leveraging Cashback and Rewards: Free Money at Your Fingertips

Sign up for cashback apps like Rakuten or Honey to earn money back on everyday purchases. If you have credit cards with rewards, maximize their benefits by using them strategically and paying off balances in full.

Gig Economy Goldmine: Exploring Flexible Work Opportunities

If you have free time, consider flexible gig work like food delivery, rideshare driving, or freelance writing. Many platforms offer seasonal boosts in earnings, making spring a profitable time to pick up extra work.

Monetizing Spring Hobbies: Gardening, Crafting, and More

Love gardening? Sell homegrown herbs or flowers. Passionate about crafting? Spring is the perfect time to sell handmade Easter decorations or Mother’s Day gifts. Turning hobbies into income is both fulfilling and financially rewarding.

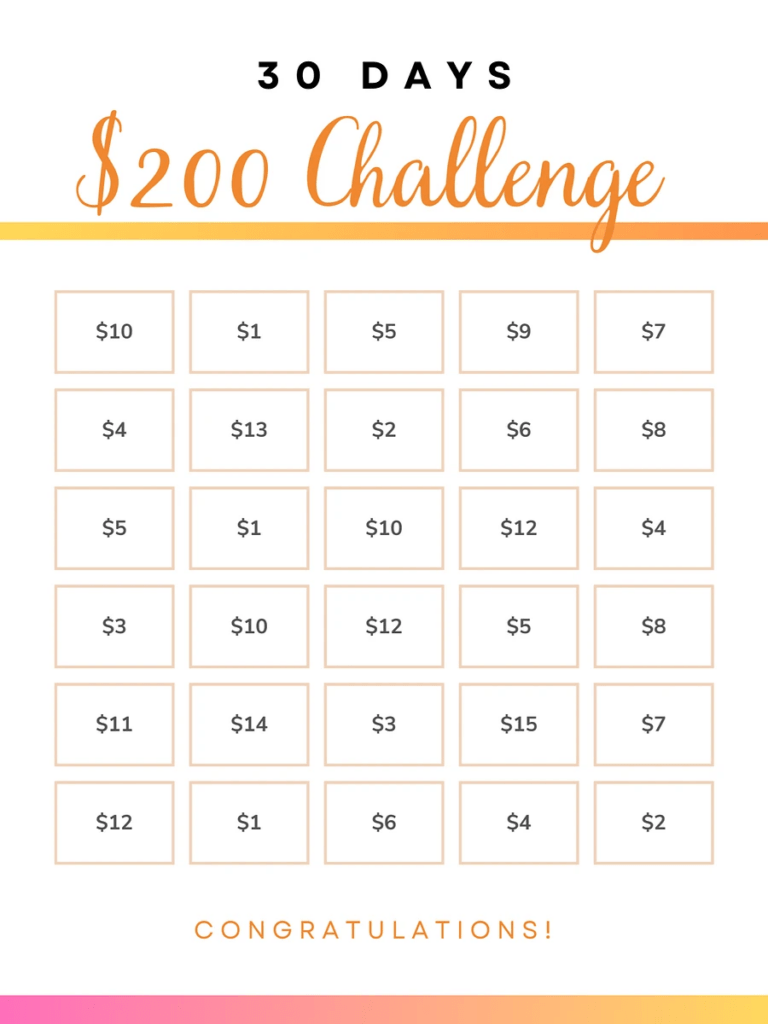

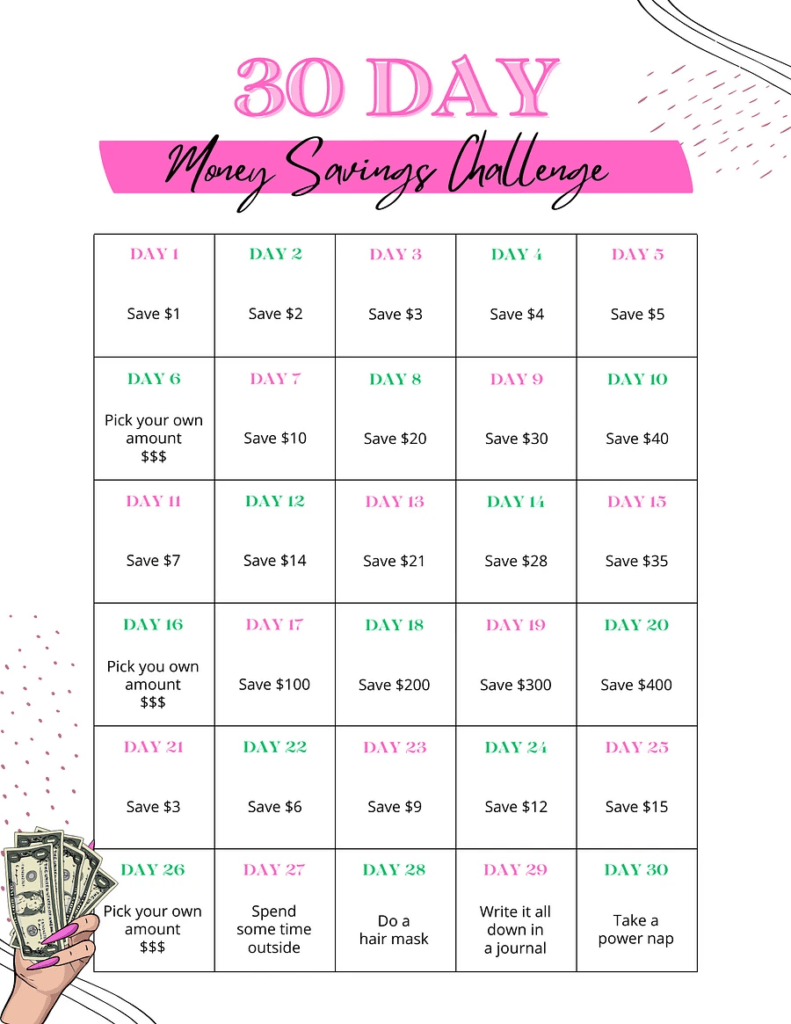

Spring Savings Challenges to Supercharge Your Progress

The 30-Day No-Spend Challenge: A Budget Reset

Challenge yourself to a month of spending only on essentials. Avoid shopping for non-necessities, and watch how much you can save in just 30 days.

The Spare Change Challenge: Automating Small Savings

Use apps like Acorns or round-up savings features from your bank to automatically round up purchases to the nearest dollar and save the difference.

The “Save Every $5 Bill” Challenge: Watching the Savings Grow

Every time you receive a $5 bill, stash it away. By the end of spring, you’ll be surprised at how much you’ve accumulated!

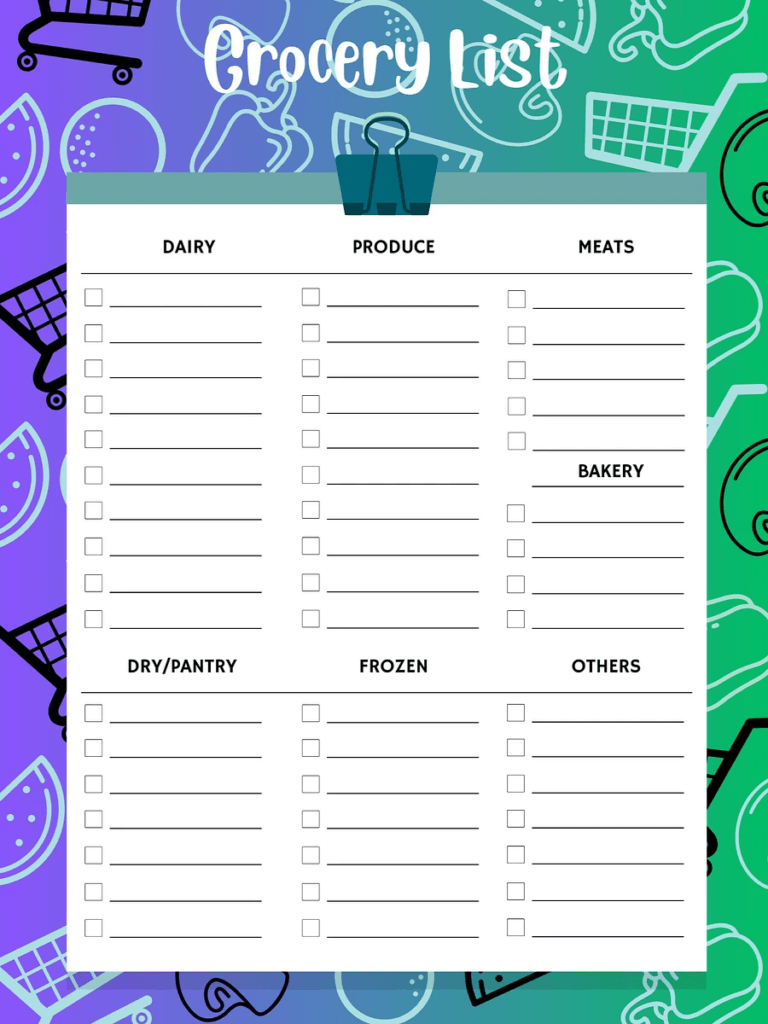

The Pantry Challenge: Save Money by Using What You Have

Before grocery shopping, challenge yourself to create meals using items you already have in your pantry. Not only does this cut down on food waste, but it also saves money.

The Declutter-to-Save Challenge: Organizing and Cashing In

Each week, pick five items you no longer need and sell, donate, or repurpose them. The extra cash can go straight into savings.

Spring-Smart Shopping Strategies

Seasonal Buying Guide: What’s Cheaper in Spring?

Spring is the best time to buy winter gear, fitness equipment, and even electronics, as retailers clear out older stock. Take advantage of these seasonal discounts!

Mastering the Art of Clearance Sales and Discounts

Sign up for store loyalty programs and track seasonal sales for discounts on clothing, home goods, and gardening supplies.

Buying in Bulk Without Breaking the Bank

For non-perishable essentials, bulk buying can lead to major savings. Split larger purchases with friends or family if storage space is a concern.

The Farmers’ Market Advantage: Fresh, Affordable Produce

Spring produce like asparagus, strawberries, and spinach is at its peak. Shopping at farmers’ markets supports local growers while often being cheaper than grocery store prices.

Couponing and Cashback Apps: Stack Savings Like a Pro

Use apps like Ibotta and Fetch Rewards to scan receipts and earn cashback. Combining coupons with these apps can double or triple your savings.

Maximizing Home and Lifestyle Savings

Spring Energy Savings: Reduce Utility Bills Without Sacrifice

Take advantage of warmer temperatures by opening windows instead of running the AC, and swap out old bulbs for energy-efficient LED lighting.

The Power of DIY: Home Repairs and Projects to Save You Money

Minor home improvements like fixing leaky faucets or repainting furniture can save you hundreds of dollars compared to hiring a professional.

Gardening for Savings: Growing Your Own Produce

Start a backyard garden with vegetables and herbs to reduce grocery costs while enjoying fresh, homegrown food.

Car Maintenance for Spring: Avoid Expensive Repairs Later

Simple car maintenance like checking tire pressure, changing the oil, and cleaning air filters can extend your vehicle’s lifespan and prevent costly repairs.

Fun on a Budget: Spring Activities That Won’t Cost a Fortune

Spring offers plenty of free outdoor entertainment, from picnics in the park to hiking. Take advantage of nature’s playground!

Why Saving This Spring is More Important Than Ever

Spring is more than just a season of renewal—it’s an opportunity to refresh your financial outlook. While saving money is always a smart move, here’s why spring is the perfect time to focus on growing your savings:

1. Preparing for Summer’s Price Surge

As temperatures rise, so do expenses. Whether it’s higher utility bills from air conditioning, vacation costs, or summer camp fees for kids, spring savings can cushion the financial hit before summer spending spikes.

2. Tax Refund Windfall: A Chance to Build Wealth

Many people receive tax refunds in the spring. Instead of spending it all immediately, allocating a portion to savings can provide financial security, act as an emergency buffer, or jumpstart an investment.

3. Seasonal Employment and Side Hustle Opportunities

Spring offers unique earning opportunities like lawn care, event staffing, and selling seasonal products (think Easter-themed crafts or fresh produce). Taking advantage of these income streams and saving the extra earnings can help build a strong financial foundation.

4. Spring Sales and Smart Investments

Retailers clear out winter stock in spring, meaning major discounts on big-ticket items like clothing, appliances, and fitness equipment. Saving up beforehand allows you to buy essentials at a fraction of the cost, preventing unnecessary credit card debt.

5. A Mental and Financial Reset for the Year Ahead

Just as people declutter their homes in spring, it’s the perfect time to reset financial habits. A refreshed budget, optimized savings, and smarter spending habits established in spring can set the tone for a more financially secure year.

By focusing on saving this spring, you’re not just stashing money away—you’re setting yourself up for a stress-free summer and a more stable financial future. 🌿💰

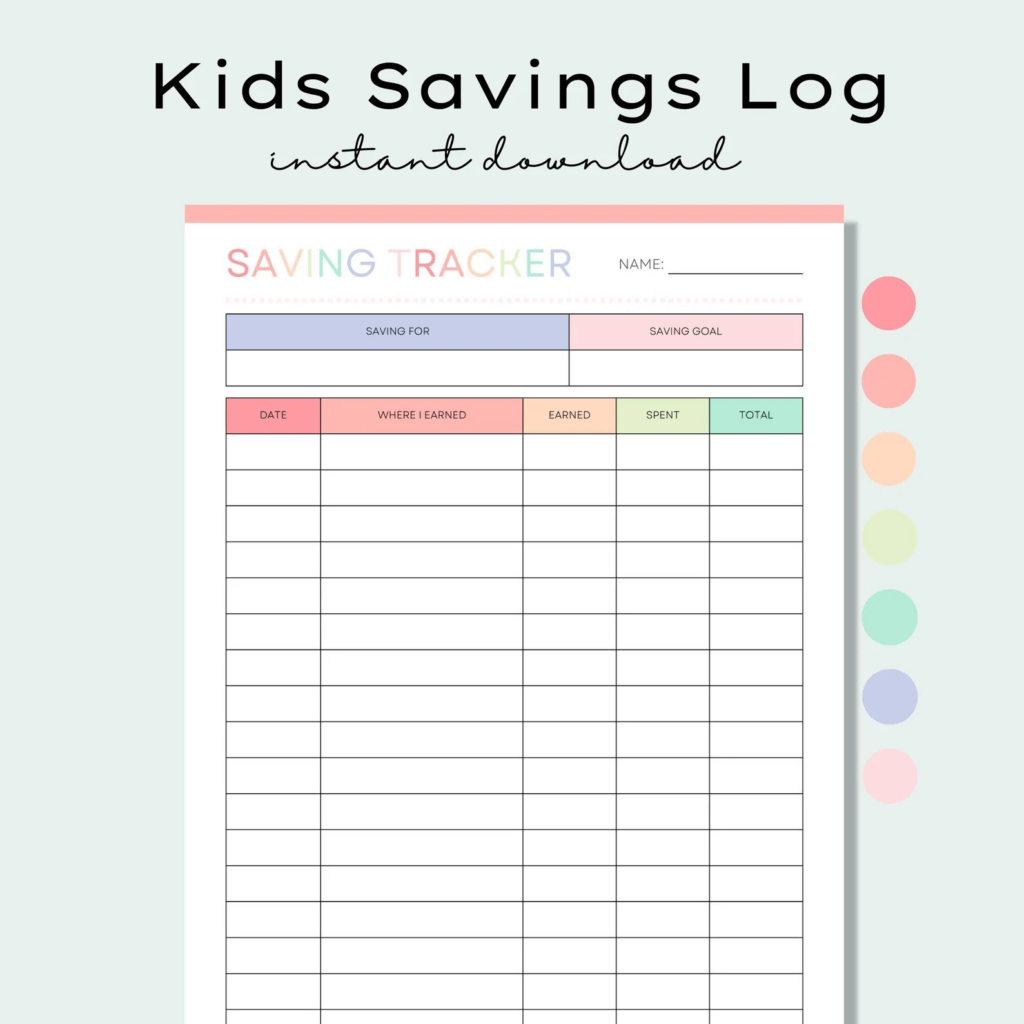

Teaching Kids to Save Money This Spring: 5 Fun and Effective Tips

Spring is the perfect season to introduce children to smart money habits. With nature in bloom and new opportunities for learning, kids can start building lifelong financial skills in a fun and engaging way. Here are five creative ways to help children save money this spring:

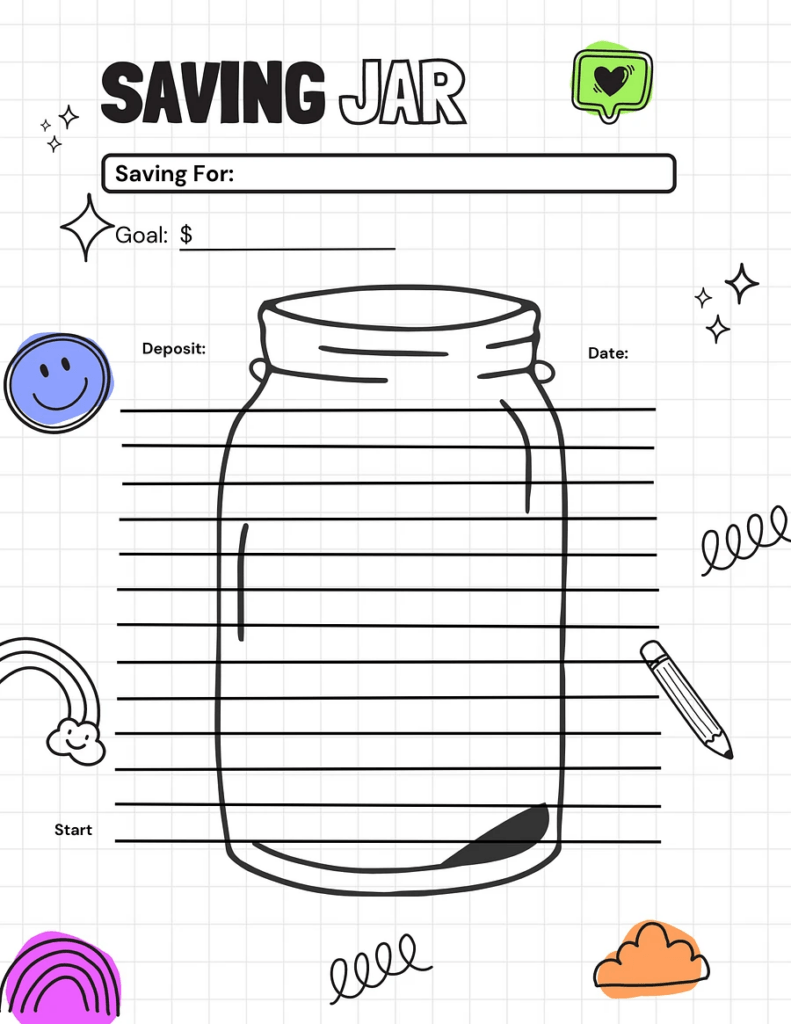

1. The “Spring Savings Jar” Challenge 🌸💰

Turn saving into a fun game by decorating a jar with a spring theme—flowers, butterflies, or even a “money garden.” Encourage kids to add coins and small bills every time they earn or receive money. Set a goal (like a special toy or springtime activity), and watch their excitement grow as they see their savings increase.

2. Earnings Through Spring Chores 🌿🧹

Spring cleaning offers plenty of earning opportunities! Kids can save money by helping with tasks like organizing closets, washing the car, or planting a garden. Create a chore chart with a small reward system, teaching them the value of hard work and financial responsibility.

3. Spring Yard Sale: Sell & Save 🏡🎉

A family yard sale is a perfect way to declutter and teach kids about money. Let them sell their old toys, books, or clothes and keep a portion of their earnings. Encourage them to save at least half while allowing them to spend a little on something meaningful.

4. Grow a “Money Garden” 🌱💵

Teach kids about investing by planting actual seeds! Give them a small allowance and encourage them to “invest” in flower or vegetable seeds. As their plants grow, explain how money, like a garden, grows when cared for properly—whether through saving, investing, or smart spending.

5. Spring Break Budgeting 🏖️📊

If your family has a spring break trip or special outings planned, involve kids in the budgeting process. Give them a set amount of spending money and help them decide how to use it wisely. This hands-on experience builds their decision-making skills and shows them the importance of planning ahead.

By making saving money fun and interactive this spring, kids will develop financial habits that will benefit them for years to come! 🌷🐣💰

Final Thoughts: Spring Forward to a Wealthier You

The key to growing your savings this spring is to embrace the season’s renewal mindset. Whether you’re cutting unnecessary expenses, maximizing seasonal income opportunities, or simply making smarter spending choices, small changes add up. By implementing even a few of these strategies, you’ll set yourself up for financial success—not just in spring, but throughout the year. So, start today, embrace the savings mindset, and watch your finances flourish! 🌸💰