When it comes to managing money as a couple, having clear goals can make a big difference. Setting money goals together helps you stay on the same page and work towards shared dreams.

Whether saving for a vacation, paying off debt, or planning for retirement, these goals keep you focused and motivated.

In this blog, we’ll explore 10 simple money goals that every couple should consider. We’ll share tips on staying on track and making the journey fun and rewarding.

1. Set Long-term Goals

Setting long-term goals as a couple is super important. These goals are about what you want to achieve in the next 5, 10, or even 20 years. Think about buying a home, starting a family, or retiring comfortably.

Talk with your partner about your dreams and make a plan to reach them. Break down the big goals into smaller steps so they feel more manageable.

By having these long-term goals, you’ll both have something exciting to look forward to and work towards together. Plus, it helps keep you motivated and focused on what really matters in the long run.

2. Set Short-term Goals

Just like long-term goals, setting short-term goals is essential. These are the smaller, more attainable goals you want to achieve in the next few months or years.

They could be anything from increasing your emergency fund to paying off a credit card balance.

Discuss with your partner what short-term goals you want to focus on and create an action plan for reaching them.

Celebrate each time you accomplish one of these mini-goals – it will give you both a sense of progress and accomplishment!

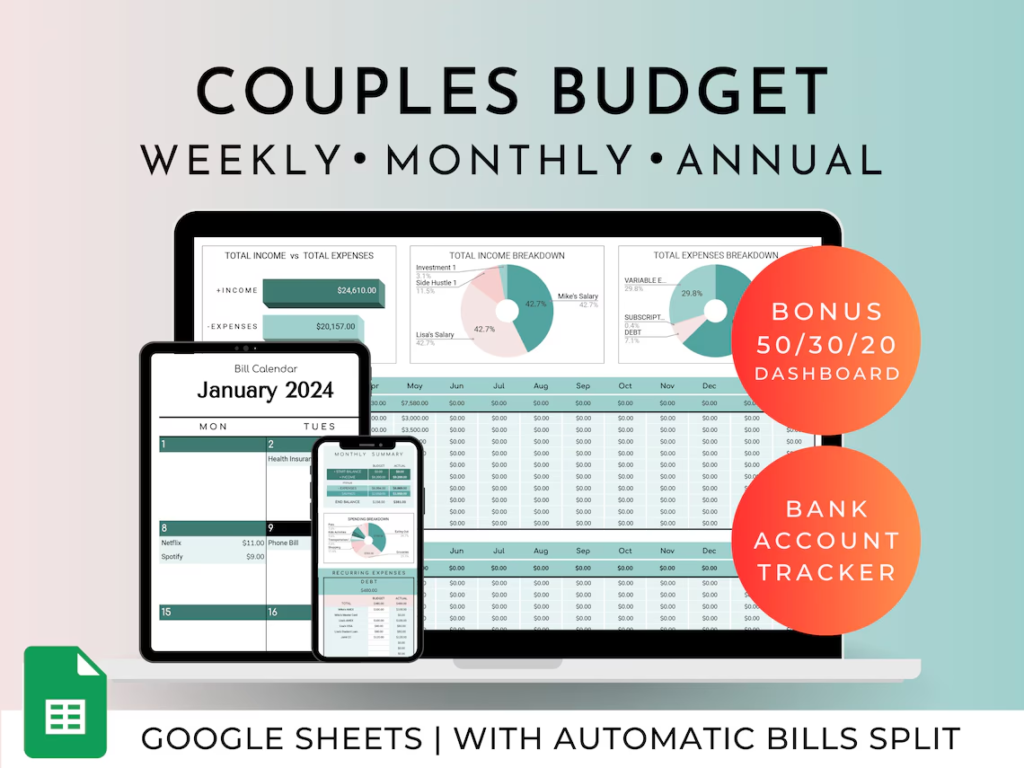

3. Budget Together

Budgeting together is key for any couple. When you create a budget as a team, you can see where your money is going and make sure you’re both on the same page.

This is how you budget together:

1. List all sources of income.

2. Identify and list fixed expenses (rent, utilities, etc…).

3. Identify and list variable expenses (groceries, entertainment, etc…).

4. Set savings goals and amounts.

5. Allocate funds to each expense category.

6. Track daily spending.

7. Review and adjust the budget monthly.

8. Discuss any financial changes or challenges.

9. Repeat the process regularly to stay on track.

Working together on a budget helps avoid surprises and keeps you both accountable. Plus, it can even be fun! Turn it into a monthly date night where you review your progress and celebrate your successes.

4. Create a Joint Savings Account

Creating a joint savings account is a smart move for couples. This account helps you save money together for shared goals, like a vacation, a new car, or a down payment on a house.

Having a joint account makes it easier to track your progress and stay motivated. Start by researching banks to find one with good interest rates and no fees.

Once you open the account, both of you should contribute regularly. Talk about how much each person will add and stick to your plan.

Teaming up to save money can bring you closer and make hitting your goals even more rewarding.

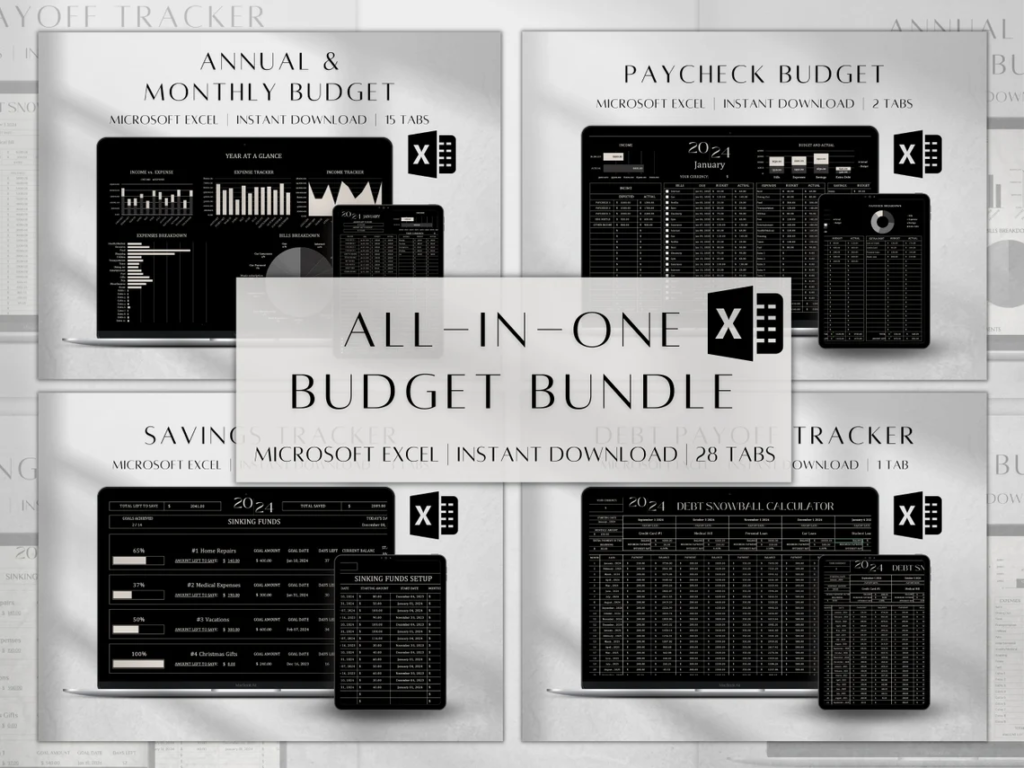

5. Pay off Debt as a Team

Debt is the biggest issue that most couples have – it could be anything from credit cards to student loans, or car payments.

Debt can create significant stress and strain on a relationship. That’s why it’s essential to tackle it as a team.

Let’s take a look at how you can pay off your debt as a couple:

1. List all your debts and their interest rates.

2. Decide which debt to pay off first.

3. Create a budget that includes debt payments.

4. Cut unnecessary expenses to free up extra money.

5. Make extra payments on the chosen debt.

6. Celebrate small victories to stay motivated.

7. Repeat the process with the next debt until all are paid off.

As you can see it’s not that complicated, but it does take dedication and teamwork. Talk to your partner and come up with a plan that works for both of you.

6. Invest in Your Future

Investing in your future is a crucial step for any couple. Start by discussing your long-term goals, such as retirement, buying a home, or starting a business.

Look into different investment options like stocks, bonds, or mutual funds that can help grow your money over time.

Consider talking to a financial advisor to get expert advice. Make a plan to regularly invest a portion of your income.

The earlier you start, the better, as it gives your investments more time to grow. Take your time and discuss it with your partner to make informed decisions.

7. Prioritize Retirement Planning

Retirement planning should be a priority for any couple, no matter their age. It’s essential to discuss how you envision your retirement and what steps you need to take to achieve it.

Let’s take a look at some ways you can prepare for your retirement:

1. Start saving for retirement as early as possible.

2. Consider opening a 401(k) or Individual Retirement Account (IRA).

3. Take advantage of employer-matching contributions.

4. Monitor your investments regularly and adjust as needed.

5. Discuss potential retirement locations and lifestyle preferences with your partner.

6. Plan for unexpected expenses, such as healthcare costs, in retirement.

Talk to your partner openly about your retirement goals and work together to create a plan.

8. Set Goals for Self-care and Fun

The healthier you are, both physically and mentally, the better you can support your partner and your relationship. Make self-care a priority by setting goals for exercise, healthy eating, and mental well-being.

Also, don’t forget to make time for fun as a couple. Plan date nights or weekend getaways to reconnect and have some lighthearted fun together.

The goal is to maintain a healthy balance between work, personal life, and your relationship.

9. Celebrate Milestones

Celebrating milestones, no matter how small, is important for staying motivated. When you reach a financial goal, like paying off a debt or hitting a savings target, take the time to celebrate.

It could be a special dinner, a weekend getaway, or even just a fun night in. These celebrations keep you excited about your progress and make the journey more enjoyable – plus, it strengthens your bond as a couple.

10. Keep Communicating and Revising Goals

Regular communication is key to staying on track. Make it a habit to talk openly about your finances and any changes in your goals. Life happens, and sometimes your priorities may shift.

Revisit your goals regularly and adjust them as needed. Maybe you are planning to get married or have children, or perhaps your retirement plans have changed.

Whatever the case may be, keep communicating and working together towards a shared financial future.

Additional Tips

Here are some additional tips that you can follow:

- Don’t be afraid to seek professional help if needed. A financial advisor can provide valuable guidance and expertise in creating a financial plan that works for both of you.

- Don’t compare your progress to others. It’s important to focus on your own goals and journey as a couple.

- Celebrate the small wins along the way, not just the big milestones. This will help keep motivation high and make the journey more enjoyable.

- Be patient and understanding with each other. Everyone has different spending habits and financial priorities.

- Remember to have fun! Finances can be a serious topic, but it’s important to also enjoy your life as a couple.

Final Thoughts

At the end of the day, the most important thing is that you and your partner are on the same page when it comes to finances. It might take some time to see some progress, but with patience and determination, you can achieve your financial goals together. So start communicating and do whatever suits your financial goals as a couple and enjoy the journey.