Low income has always been a challenge for many people, especially in today’s fast-paced world.

From the high cost of living to increasing prices, it can be difficult to make ends meet.

However, with the right mindset and strategies, anyone can learn how to save money even on a low income. In this blog, we will be sharing a few practical tips that can help you save money and improve your financial situation.

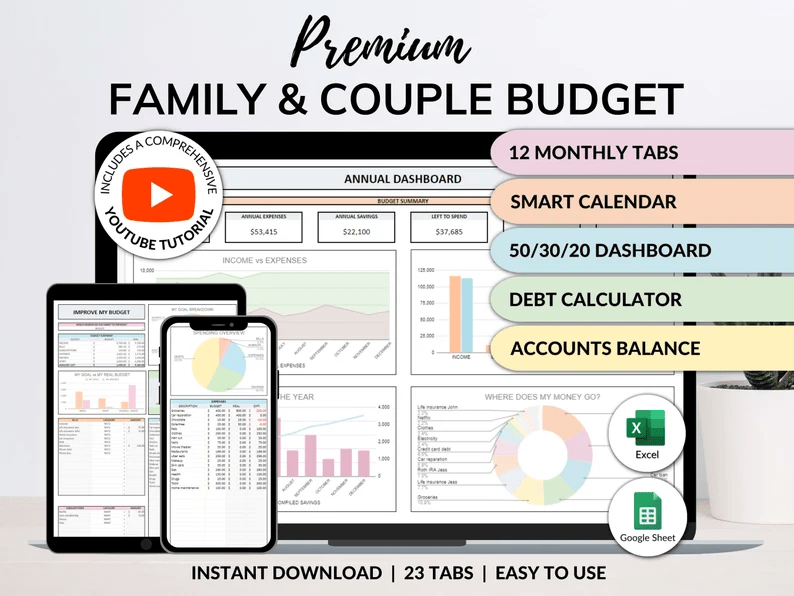

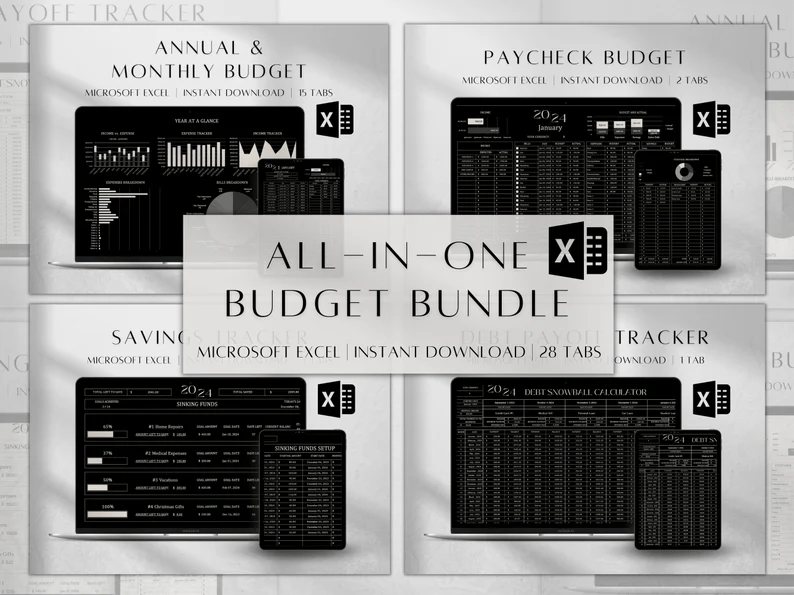

1. Create A Budget

Creating a budget is the first step to saving money. Start by listing all your income sources and monthly expenses.

Categorize your spending into needs like:

- Rent

- Utilities

- Groceries

- Eating out

- Entertainment, etc…

This helps you see where your money goes and where you can cut back. Use a simple spreadsheet or a budgeting app to keep track. Stick to your budget by setting spending limits for each category.

It might feel hard at first, but it gives you control over your finances and helps prevent overspending. With a budget, you know exactly where your money is going.

2. Track Your Spending

Tracking your spending is essential for staying within your budget. Write down every purchase, no matter how small it is.

This includes cash, credit cards, online payments, etc… You can use a notebook, an app, or a spreadsheet to write down your expenses.

Review your spending weekly to see if you’re sticking to your budget. Tracking helps you identify patterns and areas where you might be overspending. It’s easy to lose track of small purchases that add up quickly.

By keeping a close eye on your spending, you can make better financial decisions and find more opportunities to save money.

3. Use Coupons And Discounts

Using coupons and discounts is a great way to save money on everyday items. You can find coupons in newspapers, magazines, or online coupon sites. Many stores also offer digital coupons through their apps.

Before you shop, check for any available discounts on the items you need. Sign up for loyalty programs at your favorite stores to get extra savings and special offers. Even if it’s 5% or 10%, those savings add up over time.

So go ahead and clip those coupons, or take advantage of that buy-one-get-one-free deal.

4. Cook At Home

Cooking at home is a simple way to save a lot of money. Eating out can be expensive, so try making your meals instead. Plan your meals for the week and make a shopping list to avoid buying unnecessary items.

Look for easy recipes that you enjoy and can make quickly. Cooking in larger batches and freezing leftovers can also save both time and money. Plus, homemade meals are often healthier and cheaper than restaurant food.

We are not saying that you should never eat out, but cutting back on eating out and choosing to cook at home can make a big difference in your budget.

5. Avoid Impulse Purchases

Impulse purchase is basically when you buy something without planning or thinking about it beforehand. It’s easy to get caught up in the moment and make purchases you don’t really need.

To avoid this, create a list and stick to it when shopping. Take a moment to think about whether you really need the item or if it’s just a fluke that you want it.

If you do find something you want, wait 24 hours before making the purchase. This will give you time to evaluate if it’s worth spending your hard-earned money on.

The goal is to avoid unnecessary purchases and focus on buying things that truly add value to your life.

6. Buy Generic Brands

Buying generic brands can save you a lot of money without sacrificing quality. Many store-brand products are just as good as name-brand items but cost much less.

You can find generic versions of almost anything, from groceries to household supplies.

Compare the ingredients and reviews if you’re unsure about a product. Often, the only difference is the packaging. Try switching to generic brands for items you use regularly and see the savings add up.

Over time, these small changes can make a big difference in your budget, allowing you to spend your money on more important things.

7. Sell Unused Items

Selling unused items is an easy way to make extra cash. Look around your home for things you no longer need or use, like clothes, electronics, or furniture.

You can sell them online through platforms like eBay, Facebook Marketplace, or local selling apps. You can also have a garage sale if you have a lot of items to sell.

Not only does this declutter your space, but it also gives you money that you can save or use for other needs. It’s a win-win situation – getting rid of stuff you don’t need while boosting your income.

8. Cancel Unnecessary Subscriptions

Do you have any subscriptions that you no longer use or need? It may be time to cancel them.

Many subscription services have automatic renewals, which can easily go unnoticed and add up over time.

Take a look at your bank statements or credit card bills and identify any subscriptions you may have forgotten about.

If you’re not using the service enough to justify the cost, it’s best to cancel it and put that money towards something else.

9. Use Public Transportation

Car maintenance, gas prices, and insurance can be significant expenses. It can cost you hundreds of dollars a month to own and maintain a car.

However, if you use public transportation, you can save a significant amount of money. Not only is it cheaper, but it is also good for the environment.

You can save more if you get a weekly or monthly pass instead of paying individually every time.

Plus, you can use the time spent on public transportation to read, work, or just relax without having to worry about traffic and parking.

10. Shop Secondhand

Shopping secondhand is a smart way to save money on clothes, furniture, and more. Thrift stores, consignment shops, and online marketplaces offer great deals on gently used items.

You can often find high-quality brands at a fraction of the original price. Take your time to browse and be open to finding unique pieces.

But make sure to check the item for any damages before purchasing. If you find something that needs minor repairs, you can often negotiate an even lower price.

Conclusion

Low income doesn’t have to limit your ability to save money. By implementing these tips, you can start making small changes that will lead to big savings over time. Don’t be too hard on yourself – start slow and take your time to adjust. Life is unstable, so don’t be afraid to make changes or try new things to save even more money. Soon enough, you’ll see your savings account grow and feel more in control of your finances.

Selling things around the house is a great idea. I’ve sold 3 items and already made almost $100 dollars. No l the hard part is not spending that money on more stuff.