Navigating student life often comes with a significant financial burden. Tuition, books, rent, and social expenses can quickly add up, making it crucial for students to adopt smart money-saving habits. The good news is that there are numerous strategies that can help reduce costs without sacrificing quality of life. Let’s explore these easy ways to cut costs and ensure your money goes further.

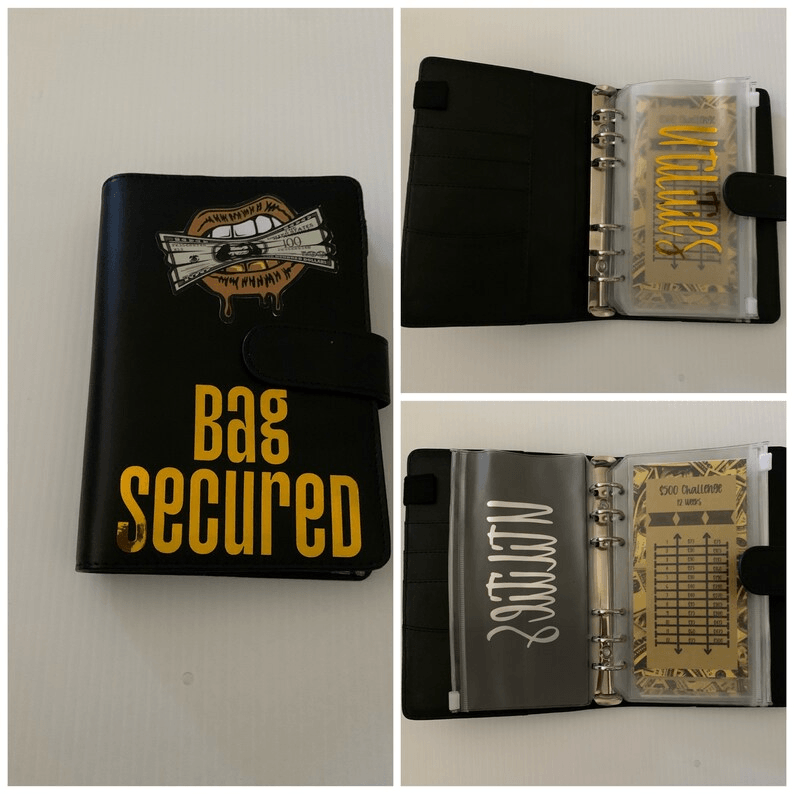

Track Your Spending

How to Create a Simple Budget

A budget is your financial roadmap. Begin by listing your monthly income, including any part-time job earnings, scholarships, or allowances from family. Then, categorize your expenses—rent, groceries, textbooks, entertainment—and set limits for each category. Stick to this budget to avoid overspending.

The Benefits of Financial Awareness

Financial awareness not only helps you manage your current expenses but also prepares you for future financial responsibility. Knowing where your money goes fosters better decision-making and helps you avoid unnecessary purchases.

Use Student Discounts

Where to Find Student Discounts

Your student ID is a powerful tool. Many businesses, from clothing stores to restaurants, offer discounts to students. Sites like UNiDAYS and Student Beans aggregate deals across a variety of sectors, making it easier to spot savings.

How to Maximize Savings with a Student ID

Always ask if a student discount is available, even if it’s not advertised. Carry your student ID with you and sign up for discount programs to make sure you never miss a deal. These small savings add up over time.

Shop Secondhand

Thrift Stores for Affordable Clothing

Fashion doesn’t have to be expensive. Thrift stores offer gently used clothing at a fraction of retail prices, and with a bit of creativity, you can find stylish outfits without breaking the bank.

Buy Used Textbooks: Where and How

New textbooks are notoriously expensive, but there are plenty of alternatives. Websites like Chegg and Amazon offer used textbooks, often at significant discounts. Renting textbooks is another viable option for further savings.

Cook at Home

Easy, Budget-Friendly Meal Ideas

Cooking at home can drastically reduce food costs. Simple meals like pasta, stir-fry, and soups are not only inexpensive but also easy to make. Bulk cooking and storing leftovers ensure you always have a meal on hand.

Meal Prepping: Save Time and Money

Meal prepping is a fantastic way to avoid impulsive eating out. Spend one day a week preparing meals for the coming days, storing them in individual containers. This method saves time and helps you stick to your food budget.

Take Advantage of Free Campus Resources

Free Gym Memberships and Fitness Classes

Most universities offer free or heavily discounted gym memberships to students. Take advantage of these facilities and classes to stay fit without the need for an expensive gym membership.

Campus Events and Activities that Won’t Cost a Penny

From movie nights to guest lectures, universities frequently host free events. Attending these not only provides entertainment but also enriches your student experience without spending a dime.

Utilize Public Transportation

Discounted or Free Public Transit for Students

Many cities offer discounted public transportation passes for students. In some cases, universities include transit passes in tuition, providing students with unlimited access to buses and trains at no additional cost.

Why Ditching a Car Saves You More Than Just Gas Money

Owning a car can be a financial drain. Beyond gas, there’s insurance, maintenance, and parking fees. Public transportation or biking not only saves you money but is often more convenient on a busy campus.

Opt for Affordable Entertainment

Movie Nights at Home

Instead of heading to the theater, organize a movie night with friends at home. Streaming services like Netflix and Disney+ offer vast libraries of movies, allowing for endless entertainment at a fraction of the cost.

Free or Low-Cost Cultural Experiences

Many cities and universities offer free or low-cost entry to museums, galleries, and cultural festivals. Explore these opportunities to enrich your cultural knowledge without spending heavily on tickets.

Limit Eating Out

The Real Cost of Fast Food and Takeout

It may seem convenient, but eating out regularly can take a toll on your wallet. Even fast food, with its seemingly low prices, adds up quickly when consumed frequently.

Simple Alternatives to Dining Out

Instead of takeout, opt for quick, easy meals at home. A homemade sandwich, salad, or even scrambled eggs can satisfy hunger without the hefty price tag.

Use Cashback and Rewards Apps

Top Cashback Apps for Students

Apps like Rakuten and Ibotta allow students to earn cashback on everyday purchases. By shopping through these platforms, you can accumulate rewards that can be redeemed for cash or gift cards.

How to Redeem Points for Maximum Value

When using reward apps, always look for opportunities to maximize your earnings. Some apps offer bonuses for specific categories or partner retailers, allowing you to get even more value from your purchases.

Find Flexible Part-Time Work

Jobs That Fit Around Your Class Schedule

Balancing work and studies can be tricky, but there are plenty of part-time jobs that offer flexible hours. Campus jobs, tutoring, or working as a barista are popular choices that allow students to manage both responsibilities.

Online Gigs for Students

The digital age has opened up new opportunities for students to earn money from home. Freelance writing, graphic design, or virtual assistant roles can provide extra income while fitting into a busy student schedule.

Share Expenses with Roommates

Splitting Rent and Utilities Smartly

Living with roommates can significantly reduce rent and utility costs. To avoid confusion, use apps like Splitwise to fairly divide bills and ensure everyone contributes their share.

How to Share Groceries Without Hassles

If you share groceries with roommates, establish a system to avoid arguments over who owes what. Consider creating a weekly grocery fund that each person contributes to, making food shopping more efficient.

DIY Your Study Materials

Free Online Resources for Learning

There’s no need to purchase expensive study guides when the internet offers so many free resources. Websites like Khan Academy and OpenStax provide free educational materials for a wide range of subjects.

How to Create Your Own Study Guides

Instead of buying study materials, create your own by summarizing textbook chapters and lecture notes. This method not only saves money but reinforces your understanding of the material.

Negotiate for Better Deals

How to Negotiate Rent and Bills

It may feel uncomfortable, but negotiating can save you significant money. If your rent increases unexpectedly, approach your landlord with a reasonable counteroffer. Similarly, contact your service providers to negotiate lower rates for your internet or utility bills.

Leveraging Your Student Status for Better Offers

Many companies offer exclusive deals for students. When signing up for new services or renewing existing ones, mention your student status to access hidden discounts or promotions.

Cancel Unnecessary Subscriptions

Identifying Subscriptions You Don’t Need

Subscription services can sneakily drain your funds. Take a hard look at what you’re subscribed to—are you using that monthly fitness app or streaming service? If not, cancel it and save.

Alternatives to Popular Paid Services

Many popular subscription services have free or lower-cost alternatives. For example, free streaming platforms like Tubi or Crackle offer a variety of movies and TV shows without the need for a monthly fee.

Borrow Instead of Buying

Where to Borrow Books and Tech Gear

Instead of buying new, check if your campus library offers textbook rentals or technology loans. Many universities provide laptops, tablets, or cameras for short-term use, saving you from costly purchases.

How Libraries Can Be Your Best Friend

Beyond textbooks, libraries often offer a treasure trove of other resources, from free workshops to access to academic databases. Make use of these services to cut back on expensive academic tools.

Make Use of Student Health Services

Free or Discounted Health Services on Campus

Most universities have health centers that offer free or reduced-cost medical services to students. Routine check-ups, mental health counseling, and prescription services are often included in your tuition, helping you avoid costly doctor visits.

How to Avoid Costly Healthcare Bills

In addition to campus health services, consider investing in a student health insurance plan. These plans are usually cheaper than standard insurance policies and can help you avoid hefty medical bills in case of emergencies.

Reduce Utility Usage

Easy Ways to Save on Electricity and Water

Small changes can lead to big savings on your utility bills. Turn off lights when you leave a room, unplug devices when not in use, and take shorter showers to reduce water consumption. These habits help lower your monthly expenses.

How to Be Energy-Efficient as a Renter

As a renter, there are limits to how much you can change in your living space, but you can still adopt energy-efficient habits. Use energy-saving light bulbs, keep your thermostat at a moderate temperature, and seal drafty windows with weatherstripping.

Cut Back on Mobile Data

How to Reduce Your Phone Bill

If you find yourself paying too much for your phone plan, consider switching to a cheaper provider or reducing your data usage. Many budget-friendly carriers offer plans specifically tailored for students.

Wi-Fi Hacks for Always Staying Connected

To avoid eating through your mobile data, use free Wi-Fi whenever possible. Most campuses and public spaces offer free internet, making it easier to stay connected without paying for extra data.

Shop Smarter

Comparing Prices Online Before Buying

Before making any purchase, always compare prices across different retailers. Online tools like Honey or CamelCamelCamel track price changes, ensuring you get the best deal on your purchase.

The Power of Waiting for Sales

Impulse buying often leads to regret. Instead, wait for sales events like Black Friday, end-of-season sales, or student discount days to make larger purchases at a fraction of the regular price.

Rent, Don’t Buy Big-Ticket Items

Why Renting Furniture and Appliances is a Good Idea

As a student, investing in big-ticket items like furniture or appliances may not be necessary, especially if you’re only staying in one place for a short period. Renting these items can save you a significant amount upfront and prevent hassle when moving.

Where to Find Student-Friendly Rental Services

Several companies specialize in furniture rentals for students. Sites like CORT and Rent-A-Center offer affordable rental options, allowing you to furnish your living space without the financial burden of buying new.

Limit Impulse Purchases

Why Impulse Buys Add Up

Impulse purchases can sabotage your budget without you even realizing it. Whether it’s a small snack or an unnecessary gadget, these seemingly minor expenses accumulate over time, leaving you with less cash for important things.

Tips to Develop a Mindful Spending Habit

To curb impulse buying, implement the 24-hour rule: wait at least a day before making non-essential purchases. This cooling-off period often leads to a more thoughtful approach to spending.

Buy Generic Brands

The Hidden Savings in Store Brands

Generic or store-brand products are often just as good as their name-brand counterparts but cost significantly less. From groceries to cleaning supplies, opting for generic brands can lead to consistent savings.

How Quality Compares Between Generic and Name-Brand Items

Contrary to popular belief, many generic items are manufactured by the same companies that produce name brands. Often, the only difference is the packaging. Save money by choosing the generic option whenever possible.

Take Advantage of Student Grants and Scholarships

Where to Find Grants You Qualify For

Grants and scholarships are essentially free money that you don’t have to pay back. Many organizations offer financial assistance to students based on merit, financial need, or specific fields of study. Websites like Fastweb can help you discover opportunities you qualify for.

How to Apply for Scholarships Without Stress

Applying for scholarships can feel overwhelming, but it doesn’t have to be. Start by creating a calendar to track deadlines and gather all the necessary documents, such as transcripts and letters of recommendation, ahead of time.

Avoid Credit Card Debt

The Risks of Relying on Credit Cards

Credit cards can be a convenient way to cover expenses, but they come with the risk of accumulating debt. Interest rates can quickly balloon, turning a small purchase into a financial burden.

Alternatives to Using Credit for Emergencies

Instead of relying on credit cards for emergencies, build a small emergency fund to cover unexpected expenses. Even saving a little each month can create a cushion to fall back on without going into debt.

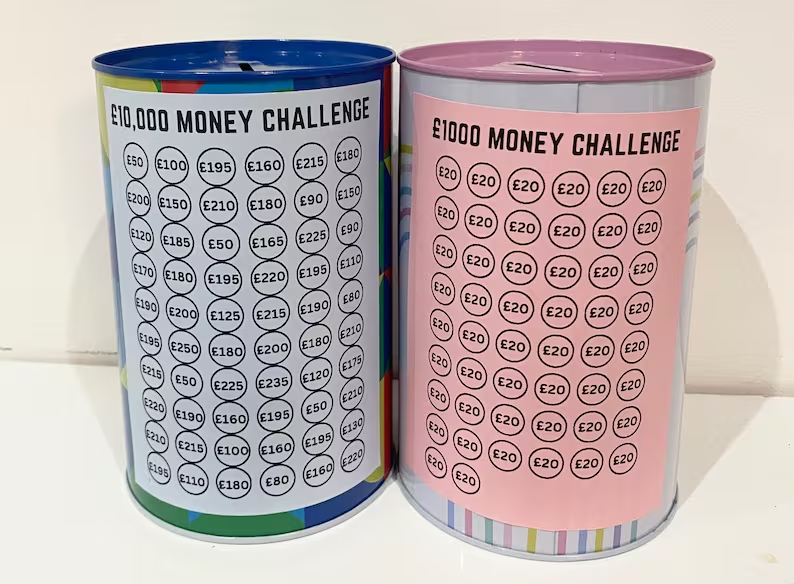

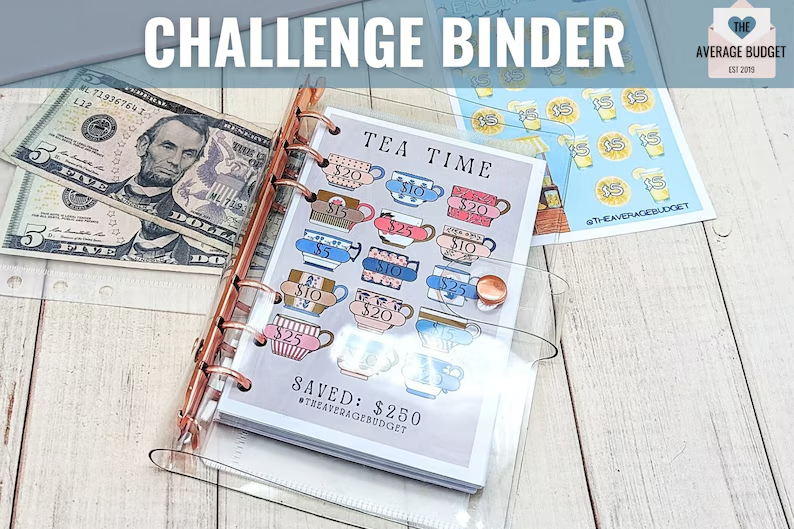

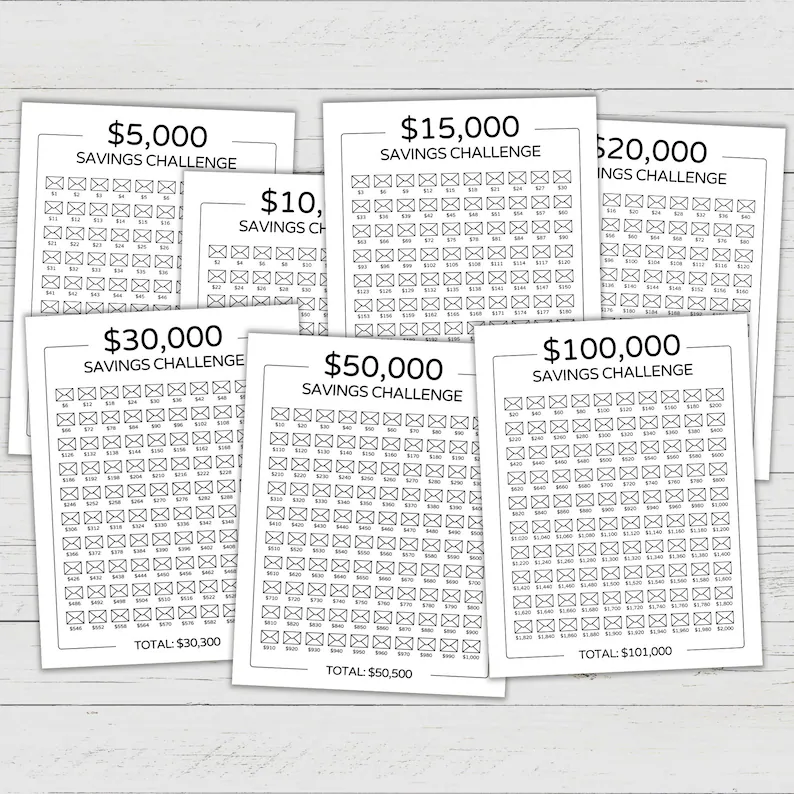

Make Saving a Priority

How to Build an Emergency Fund on a Student Budget

Saving money might seem impossible on a student budget, but even small amounts add up. Set aside a portion of your income each month, even if it’s just a few dollars, and watch your emergency fund grow over time.

Small, Consistent Savings that Add Up Over Time

Consistency is key when it comes to saving. By making small, regular contributions to your savings account, you’ll develop a habit that pays off in the long run. Eventually, these small sacrifices will lead to financial security.

Conclusion

Cutting costs as a student doesn’t have to be daunting. With a bit of financial mindfulness, you can stretch your budget, make the most of your resources, and reduce unnecessary spending. By adopting these strategies, you’ll not only survive student life but thrive without the weight of financial stress.