Saving for your baby’s arrival within a mere nine months might seem daunting, but with strategic planning, it’s entirely feasible. Establishing a financial cushion for your new arrival is not just about preparation; it’s about providing a stable foundation for their future. Setting clear financial goals early on ensures that you can manage your resources effectively and embark on this journey with confidence.

Create a Detailed Budget

Assessing Your Current Financial Situation

Begin by evaluating your financial landscape. Analyze your income sources, current expenditures, and existing debts. This comprehensive overview will provide insights into your financial strengths and areas needing improvement. Understanding your financial position is crucial for establishing a realistic budget that aligns with your saving goals.

Allocating Funds for Baby-Related Expenses

Next, identify and categorize expected baby-related expenses such as medical costs, baby gear, and ongoing needs. Allocate a specific portion of your monthly budget towards these expenses. This foresight will help you avoid financial surprises and ensure you’re setting aside an adequate amount for your baby’s arrival.

Identifying Areas for Cost Reduction

Review your spending habits to pinpoint areas where you can cut back. Consider reducing discretionary spending on non-essential items. This could involve dining out less frequently, canceling unused subscriptions, or opting for more affordable alternatives for your regular purchases. Implementing these changes will free up funds for your baby savings.

Establish a Separate Savings Account

Benefits of a Dedicated Savings Account

Creating a separate savings account specifically for your baby’s expenses offers several advantages. It allows for clearer tracking of your savings progress and reduces the temptation to dip into these funds for unrelated expenditures. This separation aids in maintaining financial discipline and achieving your savings goals.

Choosing the Right Savings Account Type

Select an account that offers favorable interest rates and minimal fees. Options such as high-yield savings accounts or money market accounts can provide better returns on your savings. Compare various financial institutions to find the best option that aligns with your saving strategy.

Setting Up Automatic Transfers

Automate your savings by setting up recurring transfers from your primary account to your baby savings account. This method ensures consistency in your savings efforts and helps you stay on track without having to manually transfer funds each month. Automating your savings also reduces the risk of forgetting or neglecting this important financial task.

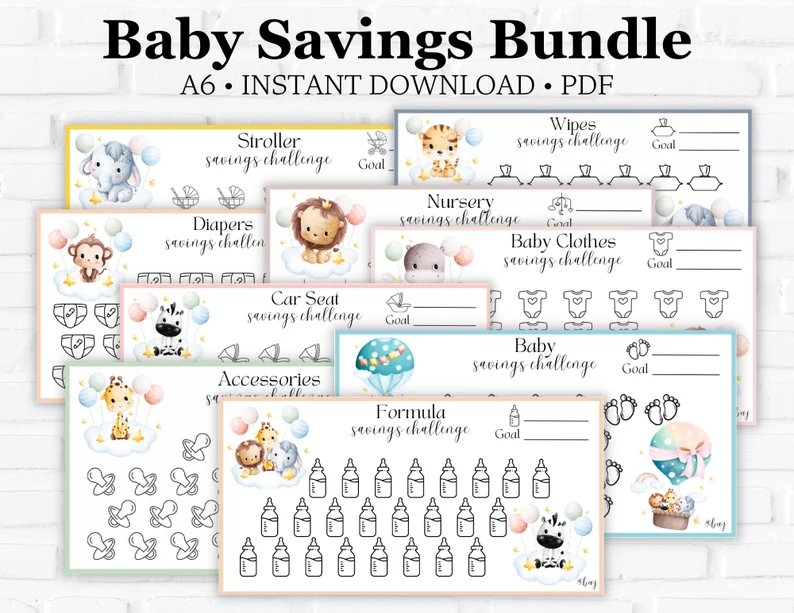

Set Up a Baby Savings Fund

Determining the Right Amount to Save

Calculate how much you need to save by estimating the total costs associated with your baby’s arrival and early years. Factor in medical expenses, baby gear, and any additional costs that may arise. Setting a specific savings target provides clarity and motivation to achieve your financial goals.

Different Savings Fund Options

Explore various savings fund options such as savings accounts, certificates of deposit (CDs), or investment accounts. Each option offers different benefits in terms of accessibility and returns. Choose the option that best suits your needs and risk tolerance, ensuring it aligns with your overall saving strategy.

Monitoring and Adjusting Your Savings Plan

Regularly review your savings plan to ensure it remains on track. Monitor your progress and make adjustments as needed based on changes in your financial situation or unexpected expenses. Flexibility in your plan allows you to adapt to evolving circumstances while staying focused on your savings goals.

Cut Unnecessary Expenses

Reviewing and Cutting Non-Essential Spending

Assess your expenditures and identify non-essential spending that can be reduced or eliminated. This might include luxury items, excessive entertainment costs, or frequent dining out. By cutting back on these expenses, you can redirect funds towards your baby savings.

Adopting a Minimalist Approach

Embrace a minimalist lifestyle to further reduce costs. Simplify your living space, purchase fewer non-essential items, and prioritize needs over wants. This approach not only helps with saving but also promotes a more mindful and intentional way of living.

Utilizing Budgeting Apps for Expense Tracking

Leverage budgeting apps to track your spending and manage your finances more effectively. These tools can provide insights into your spending habits, highlight areas for improvement, and help you stay on top of your financial goals. Utilizing technology can simplify the budgeting process and enhance your financial management.

Utilize Employer Benefits

Understanding Parental Leave Benefits

Familiarize yourself with your employer’s parental leave policies and benefits. This may include paid or unpaid leave, as well as any additional financial support. Understanding these benefits can help you plan your finances and make the most of the resources available to you.

Exploring Flexible Spending Accounts (FSAs)

If your employer offers a Flexible Spending Account (FSA), consider enrolling to take advantage of tax savings on eligible expenses. FSAs allow you to set aside pre-tax dollars for medical and dependent care costs, which can provide significant savings.

Maximizing Employer Matching Contributions

Take full advantage of any employer matching contributions to retirement accounts or other savings plans. Contributing the maximum amount eligible for matching can boost your savings and enhance your overall financial stability.

Take Advantage of Tax Benefits

Understanding Dependent Care Tax Credits

Explore available tax credits for dependent care expenses. These credits can help offset the costs associated with childcare and other baby-related expenses. Consult with a tax professional to ensure you’re maximizing your benefits and complying with tax regulations.

Exploring Health Savings Accounts (HSAs)

If eligible, consider using a Health Savings Account (HSA) to save for medical expenses. HSAs offer tax advantages and can be a valuable tool for managing healthcare costs. Contributions are tax-deductible, and withdrawals for qualified medical expenses are tax-free.

Applying for Child Tax Credits

Take advantage of child tax credits available through the tax system. These credits can provide financial relief and contribute to your overall savings for your baby. Stay informed about any changes to tax laws that may affect your eligibility for these credits.

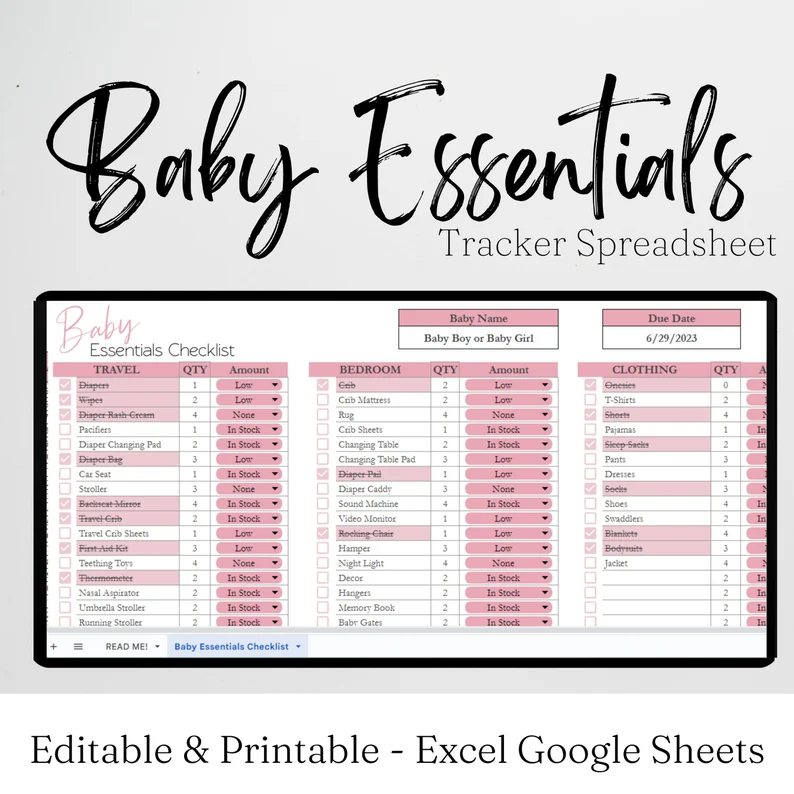

Explore Cost-Effective Shopping Options

Buying Baby Essentials in Bulk

Purchase baby essentials in bulk to save money and reduce the frequency of shopping trips. Items such as diapers, wipes, and formula often come with cost savings when bought in larger quantities. This approach can help you manage expenses and ensure you’re well-stocked for your baby’s needs.

Shopping for Second-Hand Items

Consider buying second-hand baby gear and clothing to cut costs. Many items, such as cribs, strollers, and baby clothes, can be found in excellent condition at lower prices. Explore thrift stores, consignment shops, and online marketplaces for budget-friendly options.

Utilizing Coupons and Discount Codes

Search for coupons and discount codes to save on baby products and services. Many retailers offer promotional deals that can significantly reduce costs.

Utilizing Coupons and Discount Codes

Search for coupons and discount codes to save on baby products and services. Many retailers offer promotional deals that can significantly reduce costs. Sign up for newsletters and loyalty programs to receive exclusive discounts and alerts about upcoming sales. By being proactive and strategic, you can maximize your savings on necessary purchases.

Create a Meal Plan

Budget-Friendly Meal Planning Techniques

Implement a meal planning strategy to manage grocery expenses effectively. Plan your meals for the week ahead, focusing on cost-effective ingredients and recipes. This approach reduces the likelihood of impulse purchases and helps you utilize ingredients efficiently, minimizing food waste and saving money.

Preparing Meals in Advance

Prepare meals in advance to save both time and money. Cook and freeze meals in bulk, so you have ready-to-eat options available. This practice not only simplifies your daily routine but also reduces the temptation to dine out, contributing to your overall savings.

Reducing Food Waste and Saving Money

Adopt strategies to minimize food waste, such as using leftovers creatively and adhering to portion control. By making the most of your grocery purchases and reducing waste, you can stretch your food budget further and allocate more funds towards your baby savings.

Consider Alternative Income Streams

Exploring Part-Time Work Opportunities

Look into part-time job opportunities to supplement your income. Flexible work arrangements or freelance gigs can provide additional earnings without significantly impacting your primary job. Assess your skills and interests to find suitable part-time work that fits your schedule and financial goals.

Investing in Side Hustles

Invest time in side hustles that can generate extra income. Whether it’s creating and selling crafts, offering consulting services, or participating in gig economy jobs, side hustles can provide a substantial boost to your savings. Choose a side hustle that aligns with your skills and interests to ensure long-term success and satisfaction.

Generating Passive Income

Explore ways to generate passive income, such as investing in dividend-paying stocks, rental properties, or peer-to-peer lending. Passive income streams require initial effort or capital but can provide ongoing financial benefits with minimal active involvement. Assess your investment options carefully to select those that fit your risk tolerance and financial objectives.

Review and Adjust Your Insurance Policies

Assessing Your Health Insurance Coverage

Review your health insurance policy to ensure it provides adequate coverage for prenatal and postnatal care. Consider factors such as out-of-pocket costs, coverage limits, and network providers. Adequate health insurance is crucial for managing medical expenses and avoiding unexpected financial burdens.

Reviewing Life Insurance Policies

Evaluate your life insurance coverage to ensure it meets the needs of your growing family. Consider increasing your coverage if necessary to provide financial security in the event of unforeseen circumstances. Life insurance can offer peace of mind and financial stability for your baby’s future.

Evaluating Additional Coverage Options

Explore additional insurance options that may be beneficial, such as disability insurance or critical illness coverage. These policies can provide financial support if you face health challenges or become unable to work. Assess your needs and consult with an insurance advisor to determine the best coverage for your situation.

Start an Emergency Fund

Importance of Having an Emergency Fund

An emergency fund is essential for financial stability, particularly with a new baby on the way. This fund provides a financial cushion for unexpected expenses, such as medical emergencies or job loss. Building an emergency fund ensures that you can manage unforeseen costs without derailing your savings plan.

Setting a Realistic Emergency Fund Goal

Determine a realistic goal for your emergency fund based on your monthly expenses and potential emergencies. Aim to save three to six months’ worth of living expenses to provide adequate coverage. Setting a clear goal helps you stay focused and motivated to build your emergency fund.

Strategies for Building an Emergency Fund

Start by setting aside a small, manageable amount each month and gradually increase your contributions as your financial situation improves. Automate your savings to ensure consistency and make use of any windfalls or bonuses to boost your emergency fund. Regularly review and adjust your fund as needed to stay on track.

Reduce Debt

Prioritizing High-Interest Debts

Focus on paying off high-interest debts first, such as credit card balances or payday loans. These debts accrue interest quickly and can significantly impact your financial stability. Prioritizing their repayment will reduce your overall interest costs and free up more funds for saving.

Exploring Debt Consolidation Options

Consider consolidating your debts into a single loan with a lower interest rate. Debt consolidation can simplify your payments and reduce your overall interest burden. Explore options such as personal loans or balance transfer credit cards to find the best solution for your financial situation.

Implementing a Debt Repayment Plan

Develop a structured debt repayment plan that outlines how much you will pay towards each debt and by when. Adhere to this plan consistently and adjust it as necessary based on changes in your financial situation. A well-organized repayment strategy helps you stay focused and make steady progress towards becoming debt-free.

Make Use of Financial Apps and Tools

Overview of Budgeting Apps

Budgeting apps can streamline your financial management and help you stay on top of your spending. These apps often offer features such as expense tracking, budget creation, and financial goal setting. Choose an app that aligns with your needs and preferences to enhance your budgeting efforts.

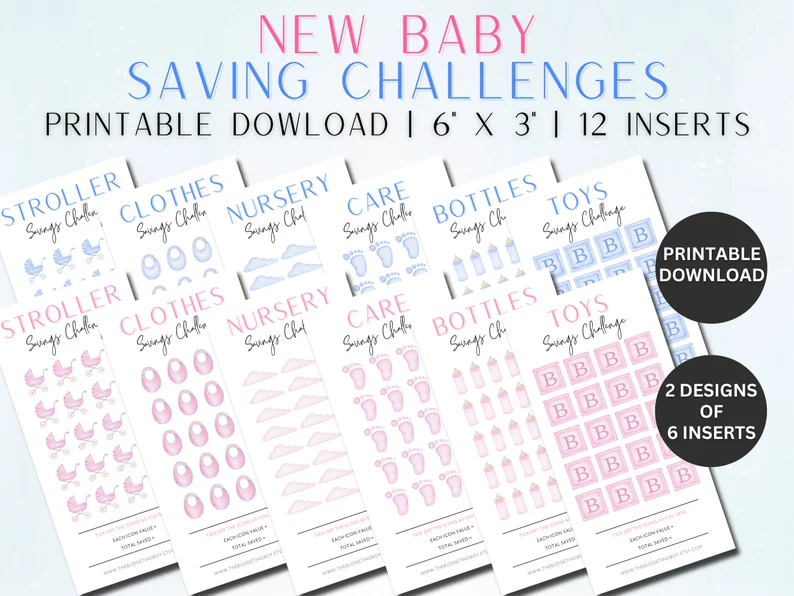

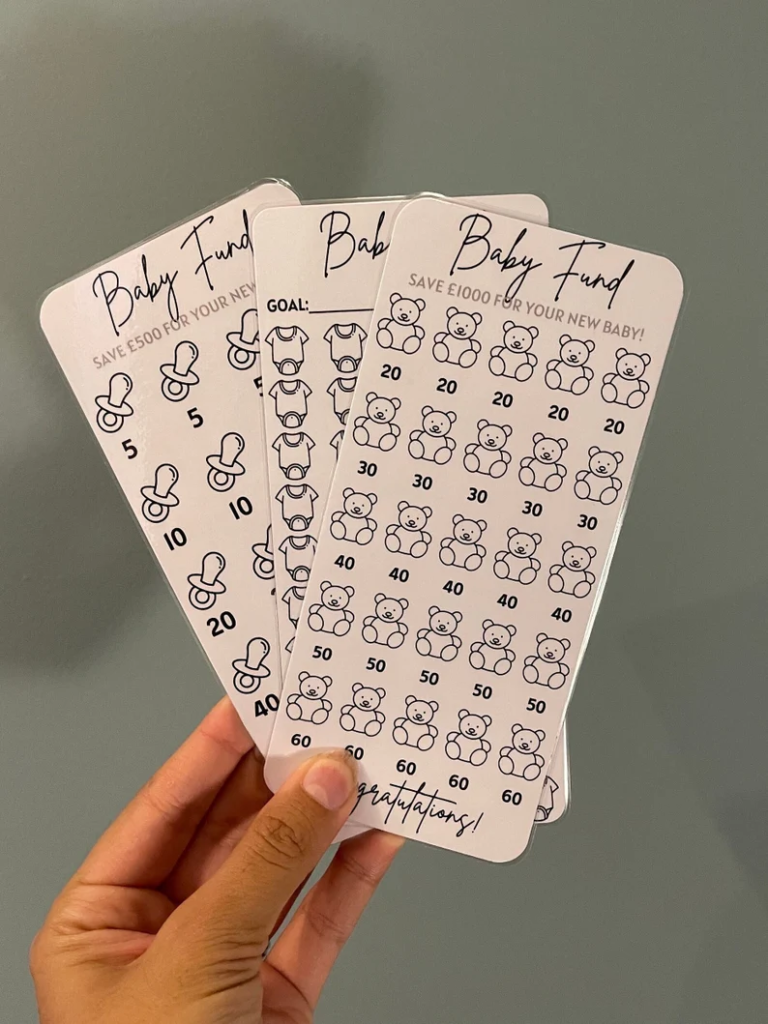

Utilizing Savings Trackers

Use savings tracker apps to monitor your progress towards your savings goals. These tools provide visual representations of your savings milestones and help you stay motivated. By regularly checking your progress, you can make necessary adjustments and celebrate your achievements.

Leveraging Financial Planning Software

Invest in financial planning software to gain a comprehensive view of your finances. These tools offer advanced features such as scenario analysis, investment tracking, and long-term financial planning. Utilizing financial planning software can provide valuable insights and support your overall saving strategy.

Seek Financial Advice

Consulting a Financial Planner

Consult with a financial planner to receive personalized advice and strategies tailored to your financial situation. A financial planner can help you develop a comprehensive savings plan, optimize your investments, and provide guidance on achieving your financial goals.

Participating in Financial Literacy Workshops

Attend financial literacy workshops to enhance your understanding of personal finance and saving strategies. These workshops often cover topics such as budgeting, investing, and debt management. Gaining knowledge from experts can empower you to make informed financial decisions.

Joining Parent-Focused Financial Forums

Join online forums or social media groups focused on parenting and financial planning. Engaging with other parents can provide valuable insights, tips, and support for managing your finances while preparing for your baby’s arrival. Sharing experiences and learning from others can enrich your financial planning efforts.

Review and Adjust Your Budget Regularly

Importance of Regular Budget Reviews

Regularly reviewing your budget is essential to ensure it remains aligned with your financial goals. Periodic assessments help you identify any discrepancies, adjust for changes in income or expenses, and stay on track with your savings plan. Consistent budget reviews promote financial discipline and help you adapt to evolving circumstances.

Making Adjustments Based on Changes

Be prepared to adjust your budget based on changes in your financial situation, such as a new job, unexpected expenses, or changes in income. Flexibility in your budgeting approach allows you to accommodate shifts in your financial landscape and continue working towards your savings goals.

Setting Milestones for Financial Goals

Establish milestones to track your progress towards achieving your financial goals. These milestones can include reaching specific savings targets, paying off debts, or achieving other financial objectives. Celebrating these achievements can provide motivation and reinforce your commitment to your financial plan.

Plan for Long-Term Savings

Setting Up a 529 College Savings Plan

Consider setting up a 529 college savings plan to start saving for your child’s education early. These plans offer tax advantages and allow for growth over time. Contributing to a 529 plan can provide financial support for your child’s future education expenses.

Exploring Custodial Accounts

Explore custodial accounts as a way to save for your child’s future financial needs. Custodial accounts, such as Uniform Transfers to Minors Act (UTMA) accounts, allow you to manage investments on behalf of your child until they reach adulthood. These accounts can be a valuable tool for long-term savings.

Understanding the Benefits of Long-Term Investments

Invest in long-term financial instruments to grow your savings over time. Options such as stocks, bonds, and mutual funds offer potential for higher returns compared to traditional savings accounts. Assess your risk tolerance and investment goals to select suitable long-term investment strategies.

Encourage Family Contributions

Asking Family Members to Contribute

Request financial contributions from family members to support your baby savings plan. Consider asking for monetary gifts or contributions towards specific baby-related expenses. Communicating your savings goals with family members can help them understand and support your financial efforts.

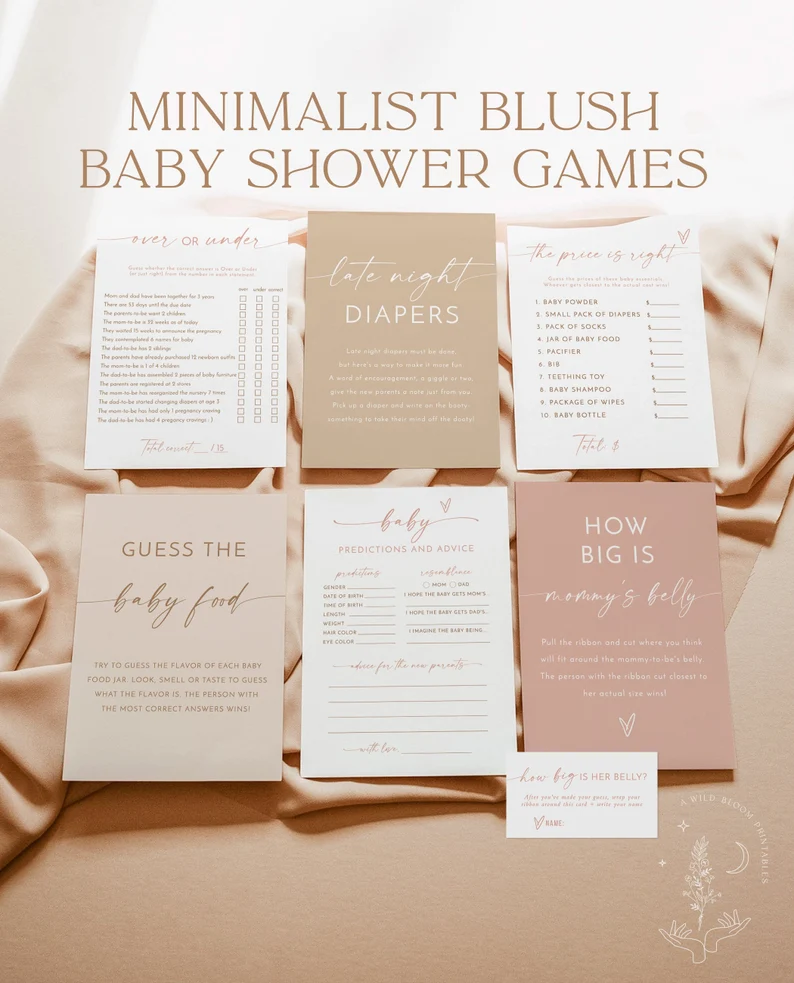

Creating a Baby Registry for Financial Gifts

Create a baby registry focused on financial contributions or specific baby items. This approach allows friends and family to contribute directly to your savings goals or purchase essential items for your baby. A well-curated registry can streamline gift-giving and align with your financial needs.

Discussing Savings Goals with Relatives

Discuss your savings goals with relatives to gain their support and understanding. Sharing your financial plan can foster a sense of community and encourage family members to contribute in ways that align with your objectives. Open communication about your goals can strengthen your support network.

Monitor and Manage Your Savings Progress

Tracking Savings Milestones

Regularly track your savings milestones to assess your progress and stay motivated. Utilize tools such as savings trackers or financial apps to monitor your achievements. Tracking milestones provides a clear view of your progress and reinforces your commitment to your savings goals.

Reviewing Progress Towards Financial Goals

Periodically review your progress towards your financial goals and make adjustments as needed. Assess whether your savings plan is on track and identify any areas requiring improvement. Regular reviews ensure that you remain focused on achieving your objectives and making necessary modifications.

Making Adjustments as Needed

Be prepared to make adjustments to your savings plan based on changes in your financial situation or goals. Flexibility allows you to adapt to evolving circumstances and continue working towards your objectives. Adjustments ensure that your savings plan remains effective and aligned with your financial needs.

Conclusion

Saving for your baby within nine months is an achievable goal with careful planning and disciplined execution. By implementing strategies such as creating a detailed budget, establishing a separate savings account, and cutting unnecessary expenses, you can build a solid financial foundation for your baby’s arrival. Embrace cost-effective shopping options, explore alternative income streams, and review your financial plan regularly to stay on track. With commitment and proactive management, you can ensure a secure financial future for your new arrival and set the stage for a successful and fulfilling journey into parenthood.