Money stress is a silent epidemic, an invisible burden carried by millions. Whether it stems from mounting debt, unexpected expenses, or simply making ends meet, financial anxiety can be overwhelming. But while it’s a universal struggle, it’s not insurmountable. Taking proactive steps to manage money stress can transform fear into confidence, opening doors to financial peace.

Understanding the Root Causes of Financial Stress

Unexpected Emergencies: When Life Throws a Curveball

Life has a way of surprising us—car repairs, medical bills, or sudden job loss can derail even the most prepared budgets. These moments often feel like crises, amplifying the stress of financial uncertainty.

Debt Accumulation: The Chains of Borrowing

Debt can feel like an anchor, pulling you deeper with each passing month. From student loans to credit cards, the weight of repayment often compounds anxiety, leaving you feeling trapped.

Living Paycheck to Paycheck: A Precarious Existence

When every dollar is allocated before it even arrives, the smallest disruption can feel catastrophic. This cycle perpetuates stress, making it nearly impossible to get ahead.

Insufficient Savings: The Danger of Financial Vulnerability

Without a safety net, even minor setbacks feel catastrophic. The absence of savings magnifies the fear of “what if,” creating a constant undercurrent of tension.

Economic Uncertainty: External Forces at Play

Global recessions, inflation, and job market instability exacerbate personal financial struggles. These external pressures often feel beyond control, intensifying the stress they bring.

Social Pressures and Financial Comparison

Seeing others post about vacations, luxury purchases, or seemingly perfect lives can spark feelings of inadequacy. Social comparison feeds financial stress, especially in the age of social media.

Recognizing the Symptoms of Financial Stress

Emotional Symptoms: Anxiety, Guilt, and Irritability

Financial stress often manifests as persistent worry, guilt over spending, or irritability toward loved ones. These emotions can spiral, affecting overall well-being.

Physical Symptoms: Headaches, Fatigue, and Tension

Chronic stress often takes a physical toll, leading to headaches, muscle tension, and even fatigue. These symptoms are your body’s way of signaling distress.

Behavioral Changes: Avoidance and Impulsive Spending

Avoiding bills, procrastinating on financial decisions, or resorting to impulsive shopping for a fleeting dopamine boost are common behavioral patterns linked to financial stress.

Impact on Relationships and Social Connections

Money problems often create conflict in relationships, driving wedges between partners, friends, and family. Financial secrecy and disagreements compound the issue.

The Psychological Impact of Financial Stress

Decision Paralysis: The Fear of Making the Wrong Choice

Stress can cloud judgment, making even simple decisions feel monumental. This paralysis often exacerbates financial struggles, creating a vicious cycle.

Chronic Overthinking: A Cycle of Worry

Obsessing over worst-case scenarios can drain your energy, leaving you emotionally depleted. Breaking this cycle is essential for mental clarity.

Self-Worth and Money: Breaking the Link

Many people tie their self-esteem to their financial status, which can lead to feelings of inadequacy during tough times. Untangling this association is vital for emotional health.

How Financial Stress Affects Productivity

Work performance often suffers under the weight of money worries, leading to missed opportunities and diminished career growth.

Immediate Steps to Alleviate Financial Stress

Breathe: Quick Stress-Relief Techniques

Deep breathing exercises can calm your nervous system, providing instant relief from overwhelming emotions.

Acknowledge Your Stress Without Judgment

Recognizing that financial anxiety is a natural response can help you approach it with compassion rather than shame.

Write it Down: Journaling Your Financial Concerns

Putting your thoughts on paper can clarify your worries and reveal actionable steps to address them.

Talk to Someone You Trust for Emotional Support

Opening up about your struggles can lighten the emotional load and offer fresh perspectives.

Developing a Financial Game Plan

Taking Inventory of Your Finances

List all your assets, liabilities, income, and expenses. This clarity is the first step toward regaining control.

Prioritizing Your Financial Responsibilities

Focus on necessities like housing, utilities, and food before tackling discretionary expenses.

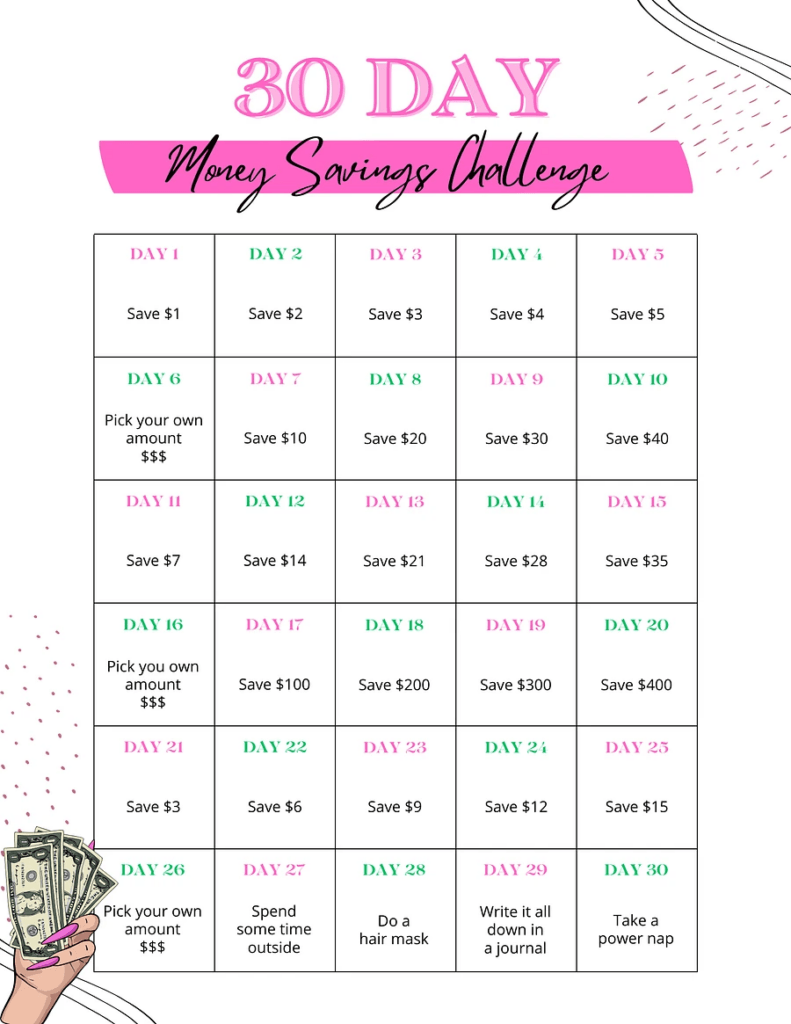

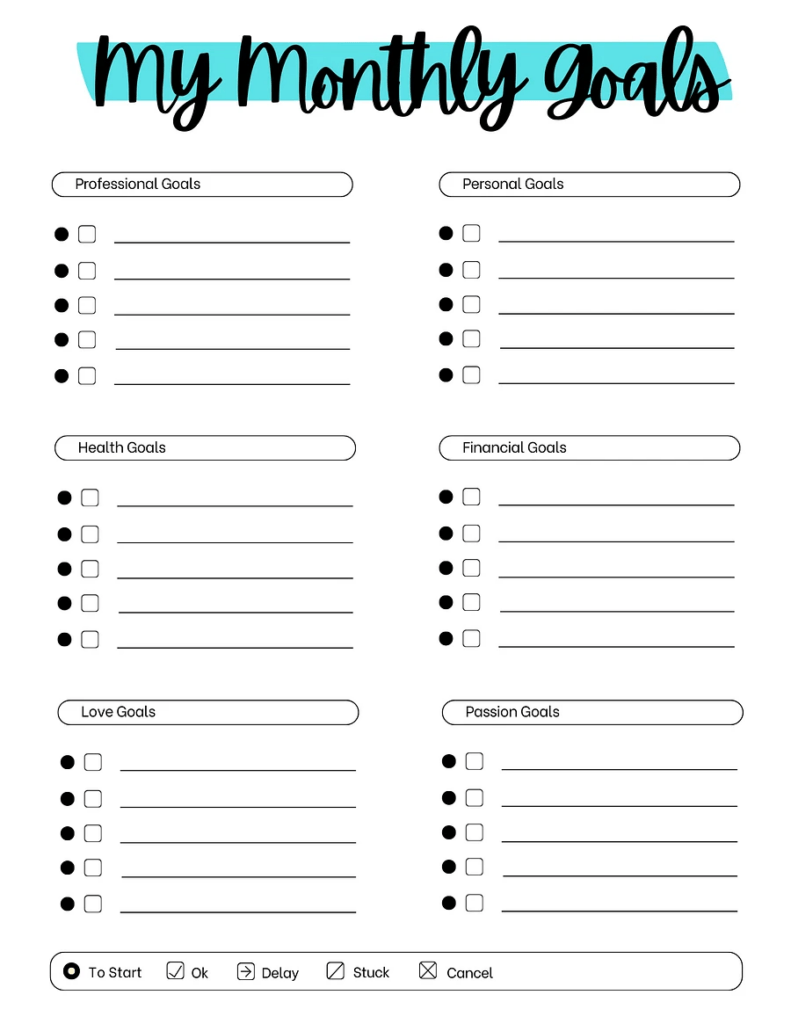

Setting Short-Term and Long-Term Goals

Define clear, actionable objectives to guide your financial journey. Small wins build momentum.

Creating a Flexible Budget that Works for You

A budget isn’t a straitjacket—it’s a tool. Build one that accommodates both structure and adaptability.

Tracking Spending to Identify Problem Areas

Understanding where your money goes can highlight habits that need adjustment.

Building a Financial Safety Net

The Importance of an Emergency Fund

An emergency fund acts as a financial cushion, providing peace of mind during unexpected events.

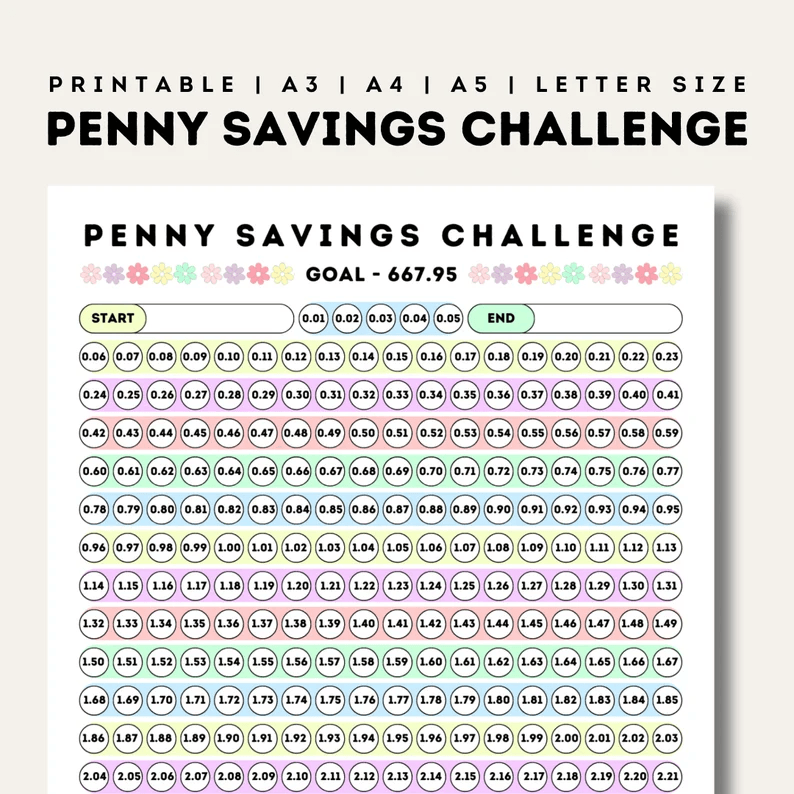

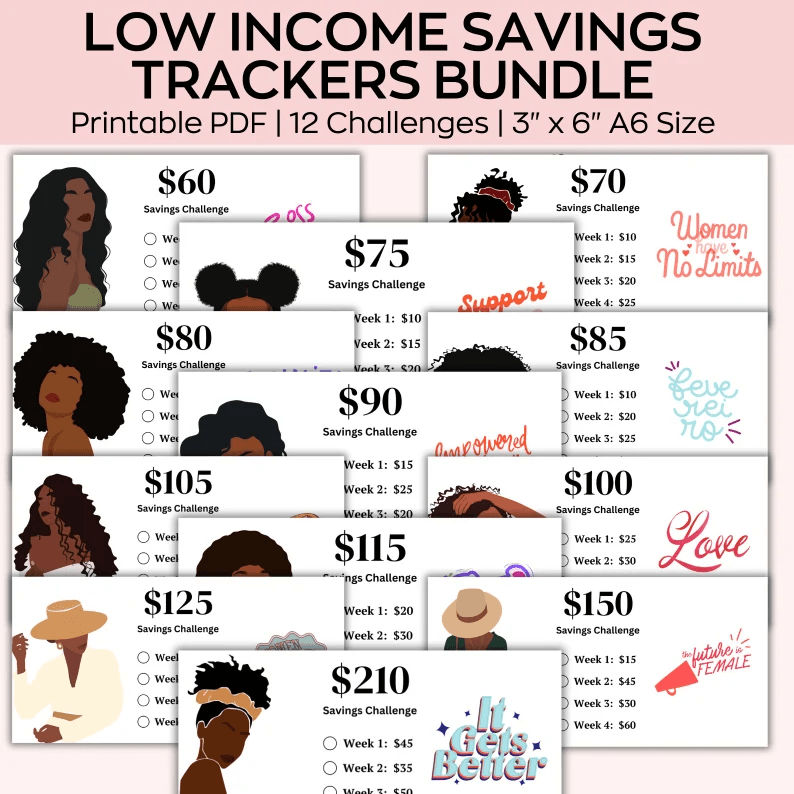

How to Start Saving with Minimal Income

Even small, consistent contributions add up over time. Start where you can and increase as you’re able.

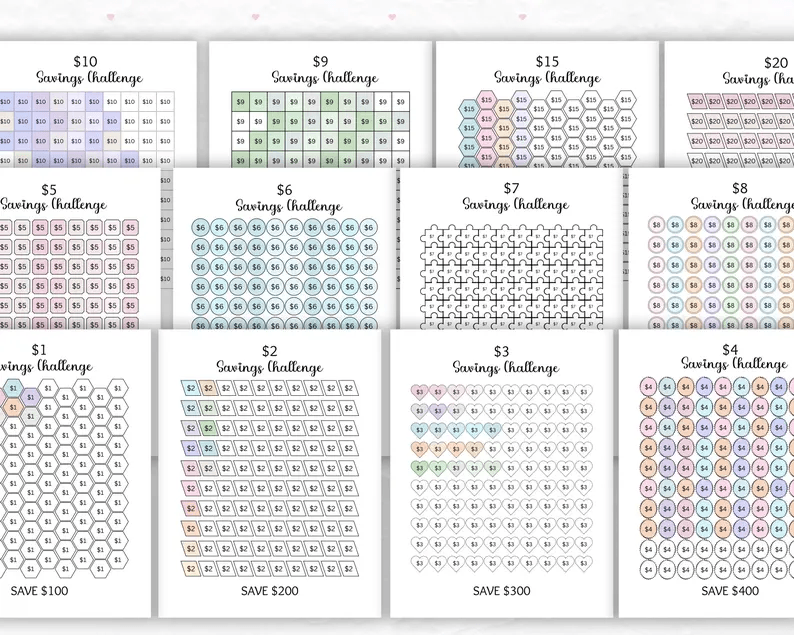

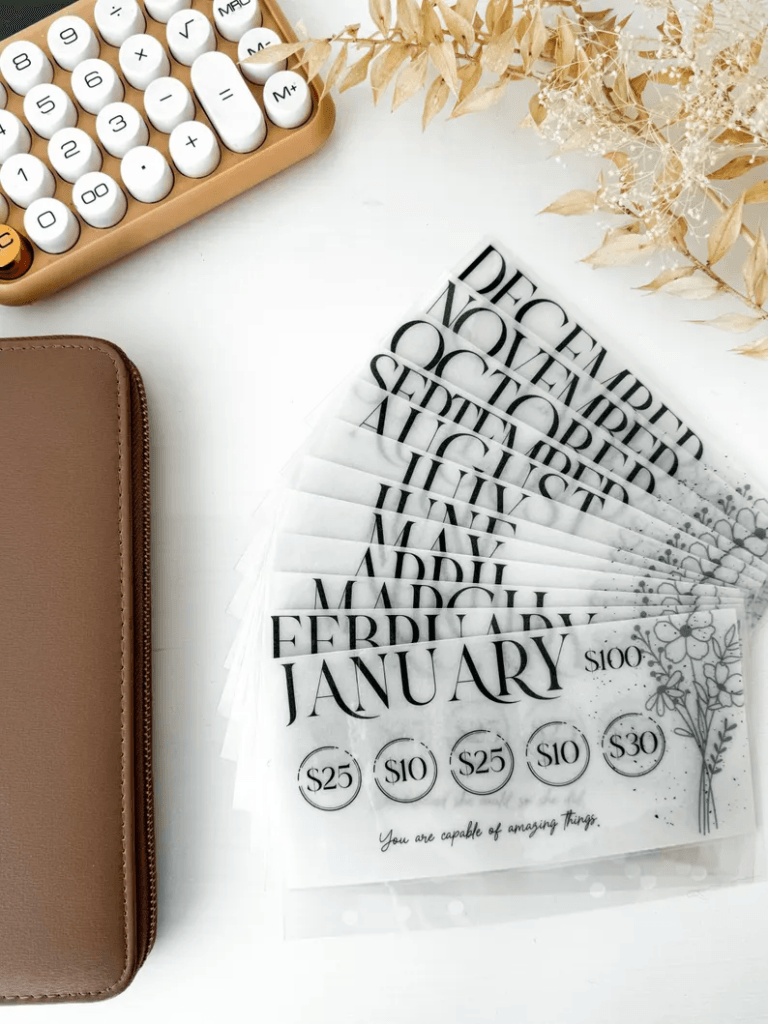

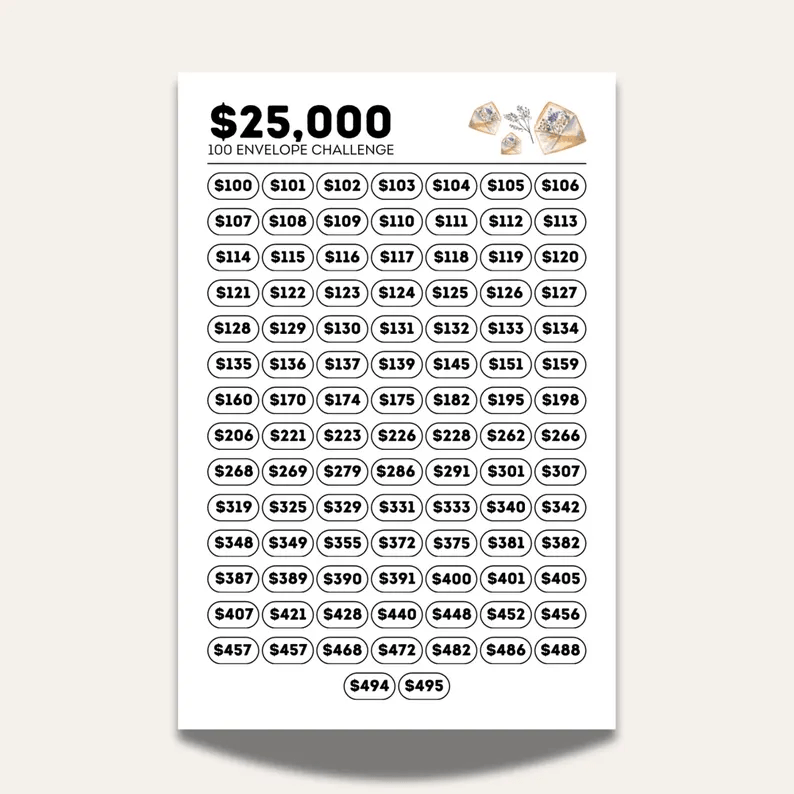

Finding Creative Ways to Increase Savings

Cutting unused subscriptions, negotiating bills, or selling unused items can free up funds.

Automating Savings for Long-Term Success

Set up automatic transfers to make saving effortless and consistent.

Tackling Debt Strategically

Understanding Different Types of Debt

Not all debt is equal. Distinguish between high-interest and low-interest obligations to prioritize repayment.

Choosing Between the Snowball and Avalanche Methods

Paying off small debts first (snowball) builds momentum, while targeting high-interest debts (avalanche) saves money.

Consolidating Debt: Pros and Cons

Debt consolidation simplifies payments but requires careful planning to avoid new pitfalls.

Negotiating with Creditors for Better Terms

Many lenders are open to renegotiating terms if you reach out proactively.

Knowing When to Seek Professional Debt Counseling

Sometimes, expert guidance is necessary to develop a realistic repayment plan.

Boosting Your Financial Literacy

Essential Financial Concepts Everyone Should Know

Understanding the basics of budgeting, interest rates, credit scores, and investments lays the groundwork for smarter financial decisions. Educate yourself on these fundamentals to feel more empowered when managing money.

Free Resources to Improve Your Financial Knowledge

Take advantage of free online courses, podcasts, and blogs dedicated to personal finance. Libraries often provide access to books and workshops that can deepen your understanding.

Learning from Financial Mistakes

Every setback is an opportunity to grow. Reflect on past financial missteps and use them as lessons to avoid repeating the same patterns.

The Power of Community Financial Education

Local community centers and nonprofits often host financial literacy workshops. Engaging with others on the same journey can provide support and fresh perspectives.

Cultivating Healthy Financial Habits

Consistent Budget Reviews

Regularly assess your budget to ensure it reflects your current financial situation. Adjust as necessary to accommodate changes in income or expenses.

Avoiding Impulse Purchases

Implement a “cooling-off period” before making non-essential purchases. Giving yourself 24 hours to consider can prevent regrettable decisions.

Learning to Say No to Unnecessary Expenses

Practice setting boundaries with friends, family, and yourself. It’s okay to decline outings or purchases that don’t align with your financial goals.

Adopting a “Pay Yourself First” Mentality

Treat savings as a non-negotiable expense by setting aside a portion of your income before paying bills or indulging in extras.

Aligning Spending with Your Values

Spend on what truly matters to you. Whether it’s experiences over material goods or investing in education, let your values guide your financial decisions.

Mindset Shifts for Financial Wellness

Reframing Money as a Tool, Not a Burden

Money is a means to an end, not an end in itself. By viewing it as a tool to achieve your goals, you can reduce its emotional hold over you.

Letting Go of Past Financial Mistakes

Shame and regret only hold you back. Accept that mistakes are part of the journey and focus on building a better future.

Practicing Gratitude for What You Have

Shifting focus to what you already possess—whether it’s a home, supportive relationships, or skills—can ease feelings of lack and scarcity.

Embracing Progress Over Perfection

Small, consistent steps are more sustainable than trying to overhaul your finances overnight. Celebrate incremental progress to stay motivated.

Developing a Growth-Oriented Financial Mindset

Adopt the belief that financial challenges are solvable. With patience and effort, you can continuously improve your situation.

Harnessing Technology for Financial Stability

Budgeting Apps for Tracking Spending

Apps like YNAB, or PocketGuard can simplify budgeting, offering real-time insights into your spending habits.

Investment Platforms for Beginners

Platforms like Acorns or Robinhood allow you to start investing with minimal knowledge or capital, helping you grow wealth over time.

Automating Bill Payments and Savings

Automation reduces the risk of missed payments and ensures savings are consistently growing without relying on willpower.

Using Alerts to Stay On Top of Financial Goals

Set up notifications for bill due dates, low balances, or savings milestones to keep your finances on track.

Exploring Peer-to-Peer Financial Tools

Peer-to-peer lending or crowd-sourced saving apps can provide innovative ways to manage money collaboratively.

Increasing Income Streams to Reduce Stress

Exploring Side Hustles That Fit Your Lifestyle

Freelancing, tutoring, or driving for a rideshare service are flexible options to earn extra income without sacrificing too much time.

Monetizing Hobbies for Extra Cash

Turn your passions—like crafting, baking, or photography—into income streams by selling your creations or services online.

Negotiating a Raise at Work

Prepare a solid case by highlighting your contributions and researching market salaries. Confidence and timing are key to a successful negotiation.

Upskilling to Open New Opportunities

Invest in learning new skills that are in demand. Platforms like Coursera or LinkedIn Learning offer affordable courses to enhance your earning potential.

Starting a Small Business on a Budget

Leverage free or low-cost tools to launch a business idea. Whether it’s an online store or a service-based business, start small and scale as you grow.

Navigating Financial Stress in Relationships

Talking Openly About Money with Your Partner

Honest conversations about finances build trust and ensure both parties are aligned in their goals. Transparency fosters teamwork.

Aligning Financial Goals in a Relationship

Work together to establish shared priorities, whether it’s buying a home, saving for a vacation, or tackling debt. Collaboration strengthens your bond.

Handling Financial Differences with Empathy

Different money habits can cause friction. Approach these differences with understanding and work toward compromises that respect both perspectives.

Teaching Financial Literacy to Your Children

Introduce age-appropriate lessons about saving, budgeting, and smart spending to prepare your kids for financial independence.

Avoiding the Pitfall of Secret Spending

Hiding purchases or debts from your partner can erode trust. Commit to open communication to maintain a healthy relationship.

Practicing Self-Care During Financial Struggles

The Role of Exercise in Stress Management

Physical activity releases endorphins, which naturally alleviate stress. Even a brisk walk can clear your mind and improve your mood.

Meditation for Financial Anxiety

Mindfulness practices can help you stay present, reducing the mental clutter that often accompanies financial stress.

Journaling to Release Pent-Up Emotions

Writing about your worries allows you to process them, turning abstract fears into manageable thoughts.

Prioritizing Quality Sleep for Mental Clarity

A well-rested mind is better equipped to handle challenges. Establish a bedtime routine to ensure restorative sleep.

Small Acts of Joy That Don’t Break the Bank

Enjoy free or low-cost activities like hiking, reading, or cooking at home to nurture your well-being without adding to financial strain.

Seeking Professional Guidance

When to Consult a Financial Advisor

If your financial situation feels unmanageable, a professional advisor can help create a tailored plan to achieve your goals.

Understanding the Role of a Debt Counselor

Debt counselors can negotiate on your behalf, consolidating payments or reducing interest rates to make repayment more feasible.

The Benefits of Therapy for Financial Stress

Therapists trained in financial anxiety can provide tools and coping mechanisms to address the emotional side of money struggles.

Joining Financial Support Groups

Connecting with others who share similar experiences can offer both practical advice and emotional solidarity.

Taking Advantage of Free Community Resources

Nonprofits and government programs often provide free financial education, counseling, or assistance to those in need.

Long-Term Strategies for Financial Security

Building an Emergency Fund for Stability

An emergency fund acts as a financial safety net, protecting you from unexpected expenses like medical bills or car repairs. Start small, aiming for $500 or one month’s worth of expenses, and gradually build to three to six months of essential costs.

Investing in Your Future with Retirement Accounts

Take advantage of employer-sponsored 401(k) plans or individual retirement accounts (IRAs). Compound interest works in your favor, so the earlier you start, the greater your financial cushion for retirement.

Diversifying Income for Greater Stability

Relying on a single source of income can feel precarious. Explore opportunities like dividend-paying stocks, rental properties, or freelancing to create multiple income streams.

Setting Long-Term Financial Goals

Whether it’s buying a home, starting a business, or saving for your children’s education, clearly define your goals. Break them down into achievable milestones and create a timeline for each.

Reviewing and Adjusting Your Financial Plan Regularly

Life circumstances change, and your financial plan should adapt accordingly. Revisit your goals, budget, and investments annually to ensure you’re on the right path.

Celebrating Financial Milestones

Acknowledging Small Wins Along the Way

Paid off a credit card? Reached your first $1,000 in savings? Celebrate these victories! Recognizing progress keeps you motivated and reinforces positive habits.

Planning Rewarding Experiences That Don’t Derail Goals

Celebrate milestones without overspending. Host a potluck dinner, enjoy a day trip, or treat yourself to a small luxury you’ve been eyeing.

Sharing Achievements to Inspire Others

Discussing your financial wins with friends or family can inspire them to pursue their own goals. It also reinforces your commitment to staying on track.

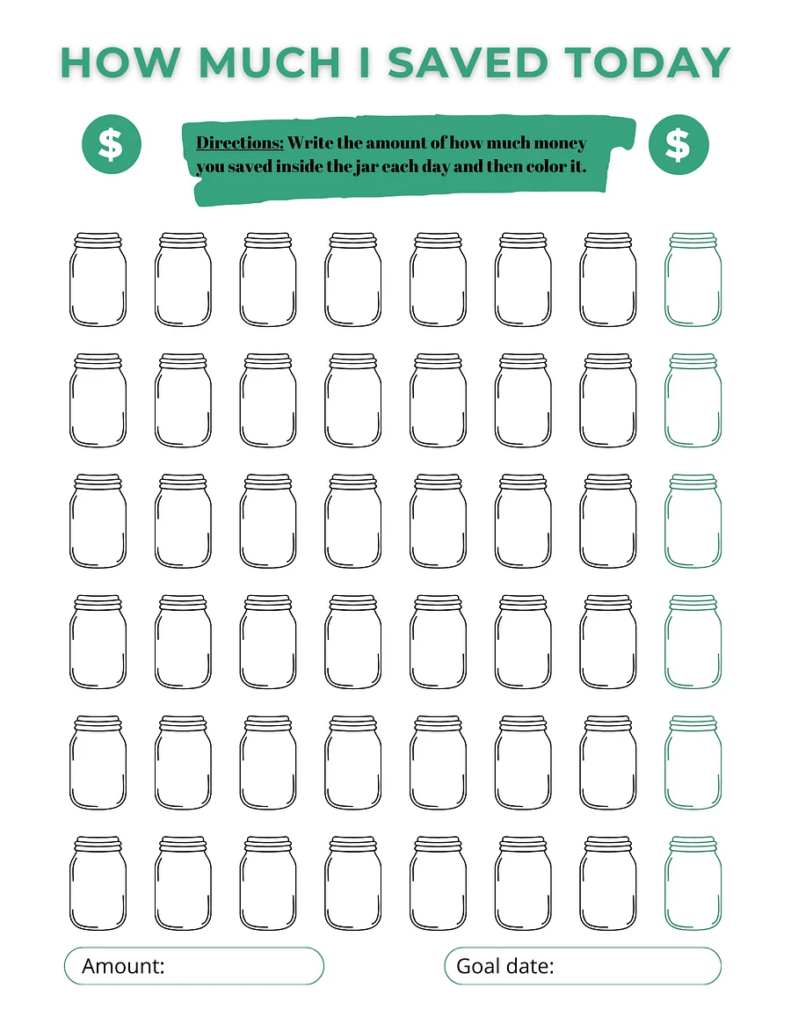

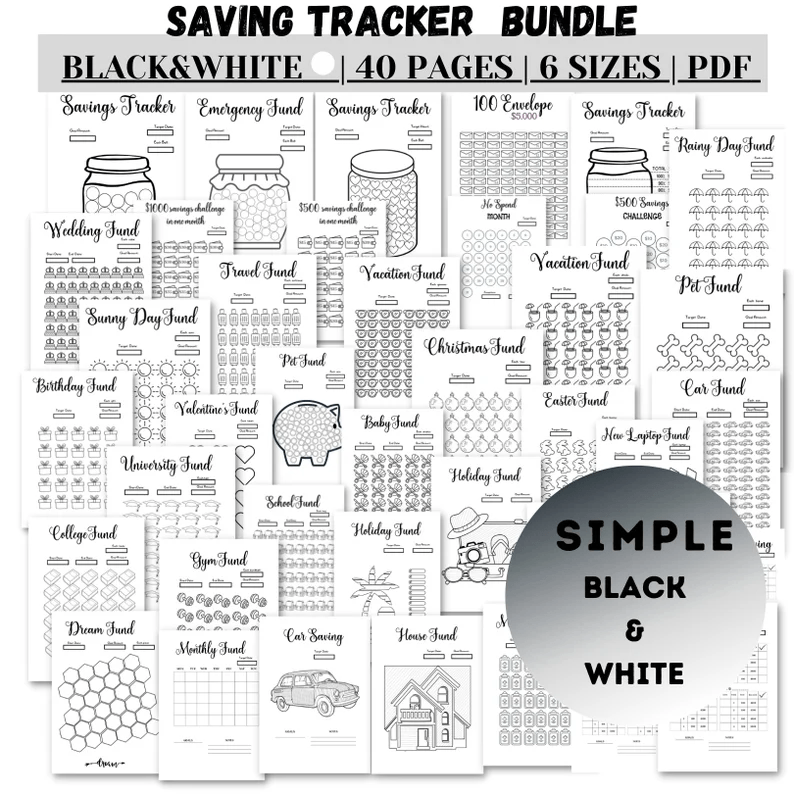

Creating Visual Reminders of Success

Use a progress tracker, vision board, or even a simple checklist to visualize your achievements. Seeing how far you’ve come can be incredibly motivating.

Reinvesting Rewards Back into Your Goals

After celebrating, consider putting any extra money toward your next financial target. This approach keeps momentum going and amplifies your progress.

Overcoming Financial Shame

Recognizing the Root of Financial Shame

Many people feel embarrassed about their financial struggles due to societal pressures or past mistakes. Identifying the source of your shame is the first step toward overcoming it.

Practicing Self-Compassion

Be kind to yourself. Everyone makes financial mistakes, and no one’s journey is without bumps. Remind yourself that improvement is always possible.

Seeking Support Without Fear of Judgment

Talk openly with trusted friends, family, or professionals. Vulnerability can lead to understanding, advice, and encouragement that ease the burden of shame.

Redefining Your Financial Narrative

Instead of dwelling on what went wrong, focus on the steps you’re taking to improve. Create a positive, forward-looking story about your financial journey.

Using Shame as a Catalyst for Change

Turn negative emotions into motivation. Let financial shame propel you toward learning, growing, and achieving financial empowerment.

Maintaining Perspective and Balance

Understanding That Money Is Not the Measure of Self-Worth

Your value as a person is not tied to your bank account. Focus on qualities like kindness, resilience, and creativity, which are far more meaningful.

Balancing Financial Goals with Life Enjoyment

While saving and budgeting are crucial, it’s equally important to enjoy the journey. Allocate funds for experiences and activities that bring joy.

Focusing on What You Can Control

Many financial stressors—like inflation or economic downturns—are out of your hands. Concentrate on what you can manage, like spending habits or skill-building.

Taking Breaks from Financial Conversations

If money talk becomes overwhelming, give yourself permission to pause. Engage in hobbies or spend time with loved ones to recharge.

Reminding Yourself of Your Progress

In moments of doubt, reflect on how far you’ve come. Acknowledge the changes you’ve made and the obstacles you’ve overcome.

Final Thoughts: A New Approach to Financial Stress

Dealing with financial stress is a multifaceted journey. By blending practical strategies with emotional resilience, you can navigate challenges with greater ease and confidence. Start small, remain consistent, and celebrate every step forward. Remember, financial stability isn’t about perfection—it’s about progress, perseverance, and finding balance.

With the right mindset and tools, you can transform your relationship with money and reclaim peace of mind.