Money is an unavoidable part of life, yet many children grow up with little understanding of how to manage it. Teaching kids about money early equips them with crucial life skills, ensuring they develop smart financial habits that will benefit them for a lifetime. Financial education is more than just learning how to save—it’s about understanding earning, spending wisely, budgeting, and even giving back.

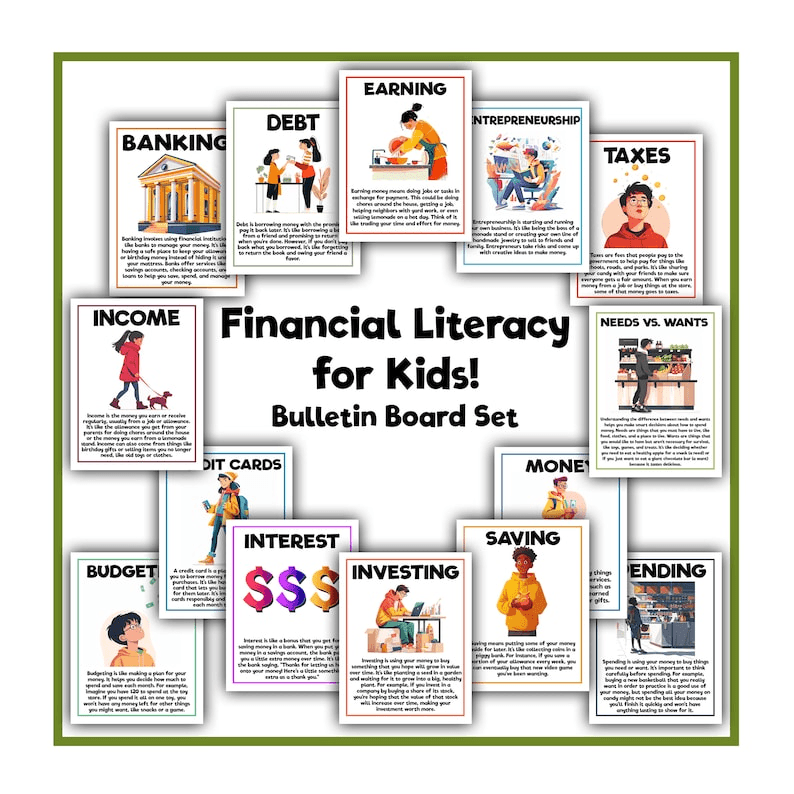

2. Understanding the Basics

Before kids can make smart financial choices, they need to understand what money is and how it works. Explain that money is a tool used to exchange goods and services. Share stories about how ancient civilizations used bartering before money existed, then introduce modern concepts like digital payments and online banking.

3. Building a Healthy Money Mindset

A child’s relationship with money starts with distinguishing between needs and wants. Help them grasp this concept by discussing everyday purchases—food is a need, but candy is a want. Also, encourage gratitude and contentment by highlighting the value of what they already have rather than always desiring more.

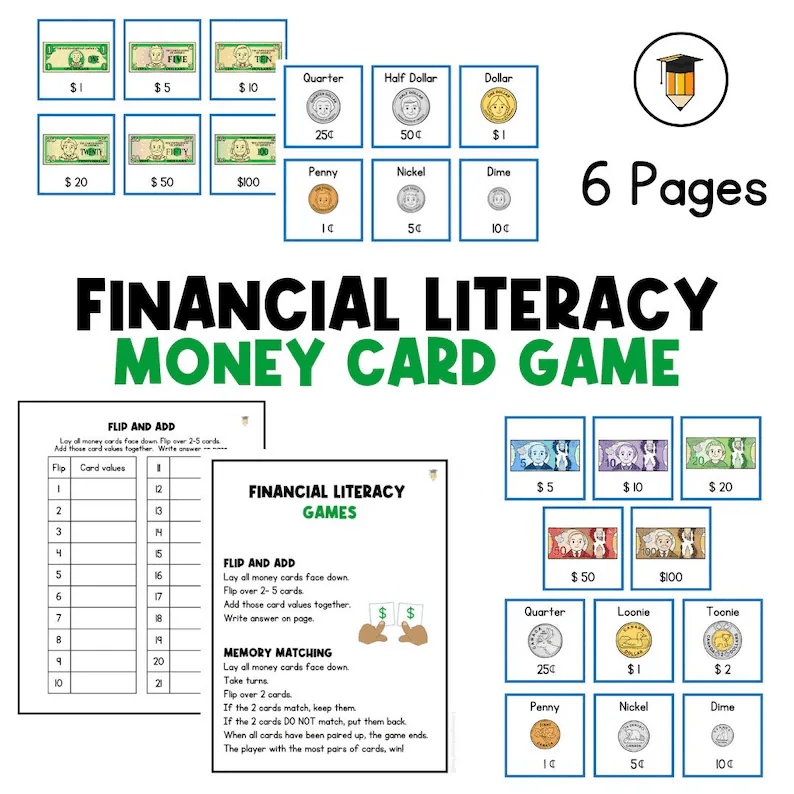

4. Introducing Money Through Play

Learning about money doesn’t have to be dry. Use games like Monopoly, The Game of Life, or digital apps that simulate financial decision-making. Even a simple game of “store” using play money can teach basic financial principles in a fun, interactive way.

5. Earning Money: The First Step to Financial Independence

Kids appreciate money more when they earn it themselves. Whether through household chores, helping neighbors, or starting a small lemonade stand, children should experience the connection between work and financial reward.

6. Saving Money: Developing a Strong Habit Early

Delayed gratification is a key lesson in financial literacy. Teach kids to save by using clear visual tools like piggy banks or savings jars. As they grow, introduce them to savings accounts and explain how interest helps their money grow.

7. Budgeting Basics for Kids

Budgeting isn’t just for adults. Show kids how to allocate their money into categories—spending, saving, and giving. A simple jar system or an easy-to-use budgeting worksheet can make the process engaging and practical.

8. Smart Spending: Making Wise Money Choices

Teach kids to compare prices before buying, showing them how sales and discounts work. Help them recognize marketing tricks and understand the importance of making thoughtful purchasing decisions.

9. Giving Back: Teaching Kids About Charity and Generosity

Money isn’t just about personal gain—it’s also about impact. Encourage kids to donate a portion of their money or give their time to charitable causes. This fosters a spirit of generosity and helps them appreciate the power of financial giving.

10. Understanding Banking and Digital Transactions

As kids get older, they’ll need to understand how banks function. Explain checking vs. savings accounts, how debit and credit cards work, and the potential dangers of digital transactions like in-app purchases.

11. Investing for the Future

Introduce kids to the magic of compound interest with simple examples. Explain how money can grow over time when invested wisely and discuss beginner-friendly investment options like stocks and bonds.

12. Learning From Mistakes: Financial Fails and Lessons

Every financial misstep is a learning opportunity. Share real-life stories of money mistakes and how they were corrected. Teach kids to analyze their spending decisions and reflect on ways to improve.

13. Teaching Teens Advanced Financial Skills

As kids grow into teenagers, they should learn real-world money management skills. Help them open a bank account, understand credit scores, and grasp the long-term impact of financial choices.

14. Making Money Fun and Engaging

Money lessons don’t have to be boring. Incorporate financial literacy books, TV shows, and engaging apps into their routine. Organize family money challenges, such as a savings competition, to keep learning exciting.

15. Preparing Kids for Financial Independence

Transitioning kids from receiving an allowance to managing their own expenses prepares them for adulthood. Guide them in setting up a budget that includes real-life costs like cell phone bills or transportation.

16. Encouraging a Lifetime of Smart Financial Habits

Financial education is a continuous journey. Keep money discussions open, provide guidance as they grow, and reinforce positive financial behaviors. By fostering a strong foundation, parents can set their children on a path toward financial security and independence.

17. The Role of Parents in Financial Education

Parents are a child’s first and most influential teachers, especially when it comes to money. By modeling good financial habits, such as budgeting, saving, and making informed purchases, parents can set a powerful example for their children to follow. This involvement extends beyond lectures—it’s about making financial discussions a regular part of family life, turning lessons into lasting practices.

18. Open Conversations About Money

Creating an open, comfortable atmosphere where children feel safe asking questions about money is key. Avoid making money a taboo subject; instead, normalize talking about financial matters, from household expenses to saving for a vacation. Encourage kids to voice their thoughts on money, fostering transparency and curiosity.

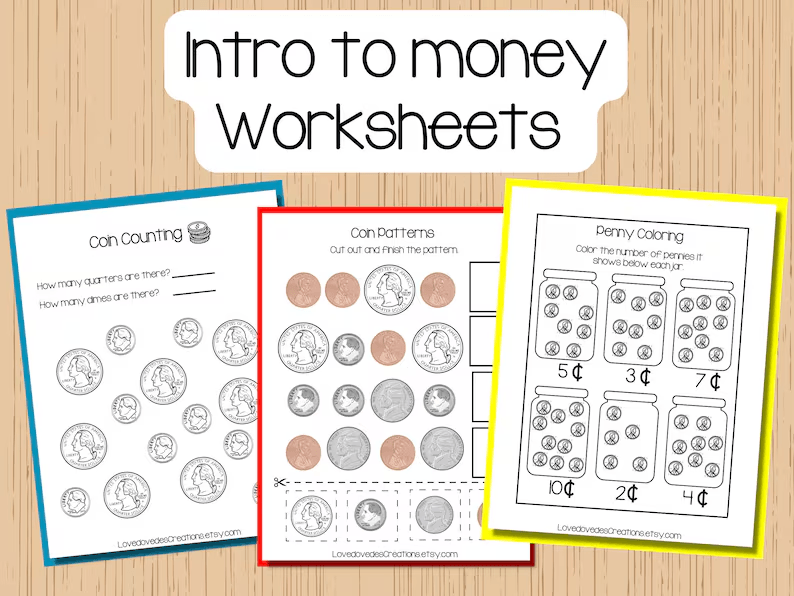

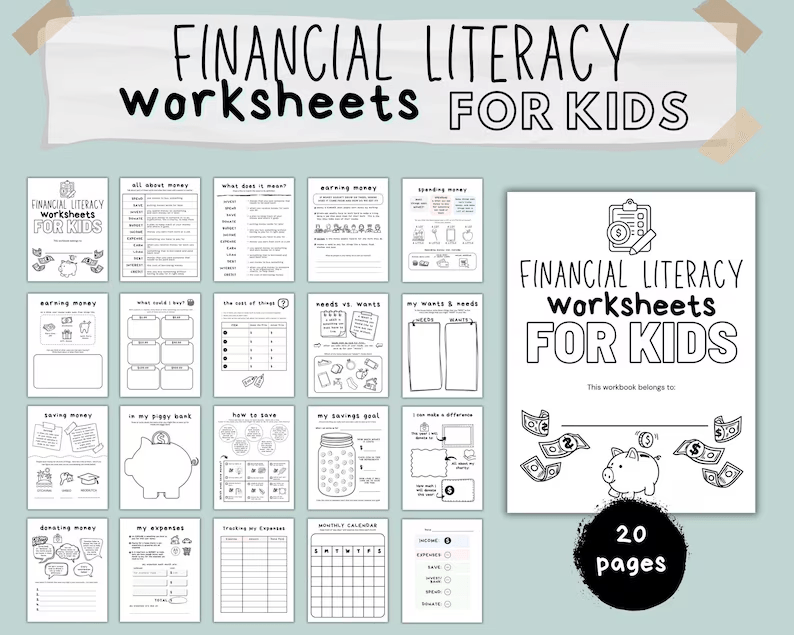

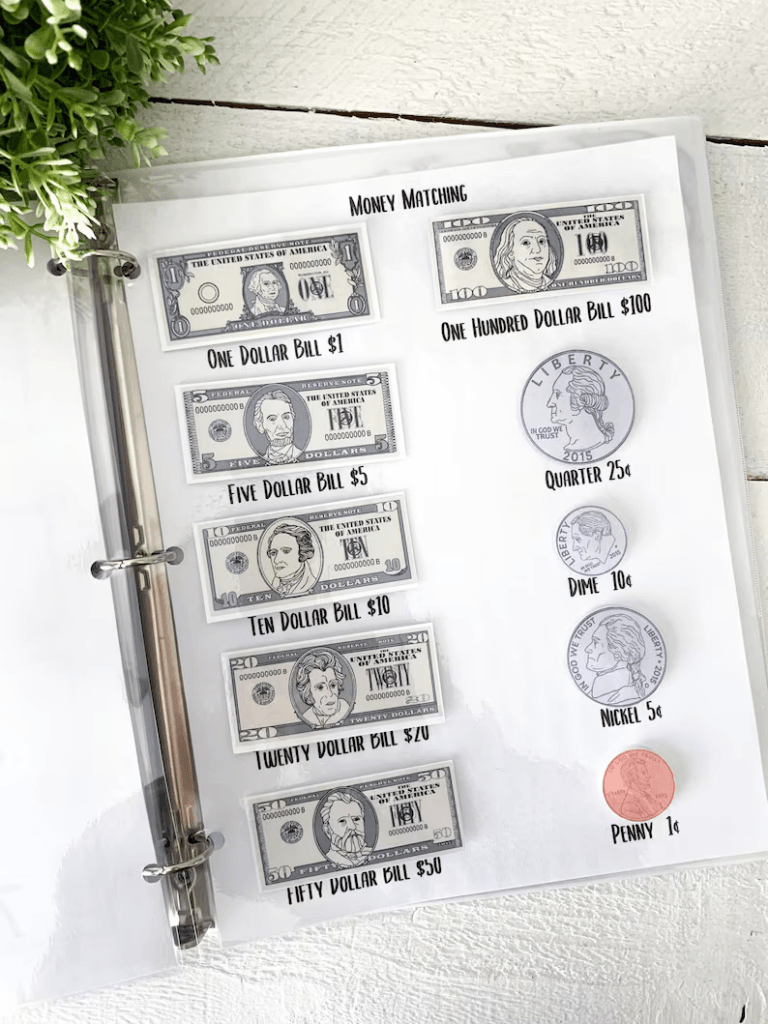

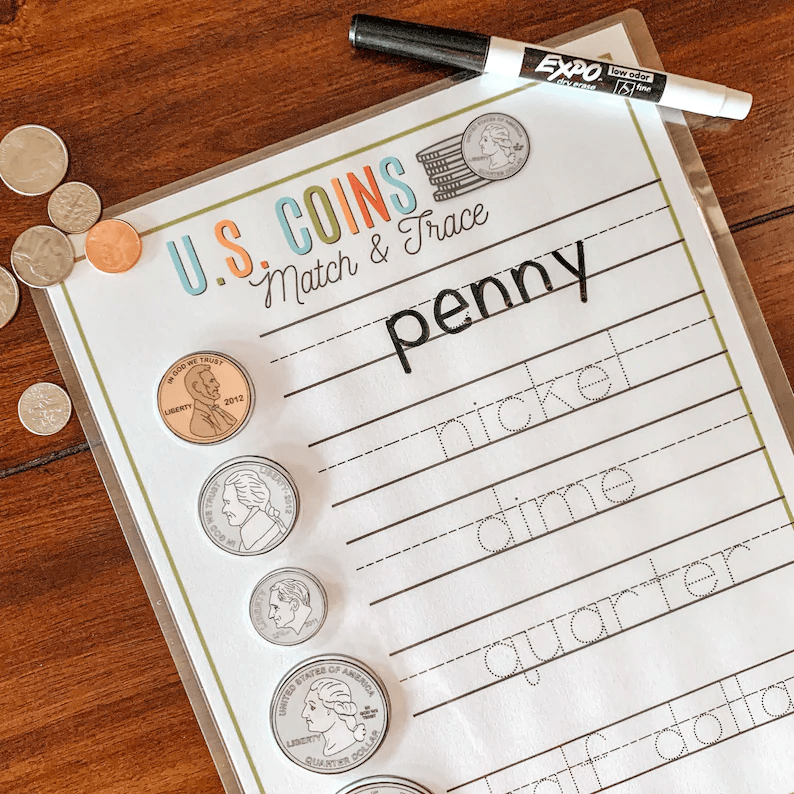

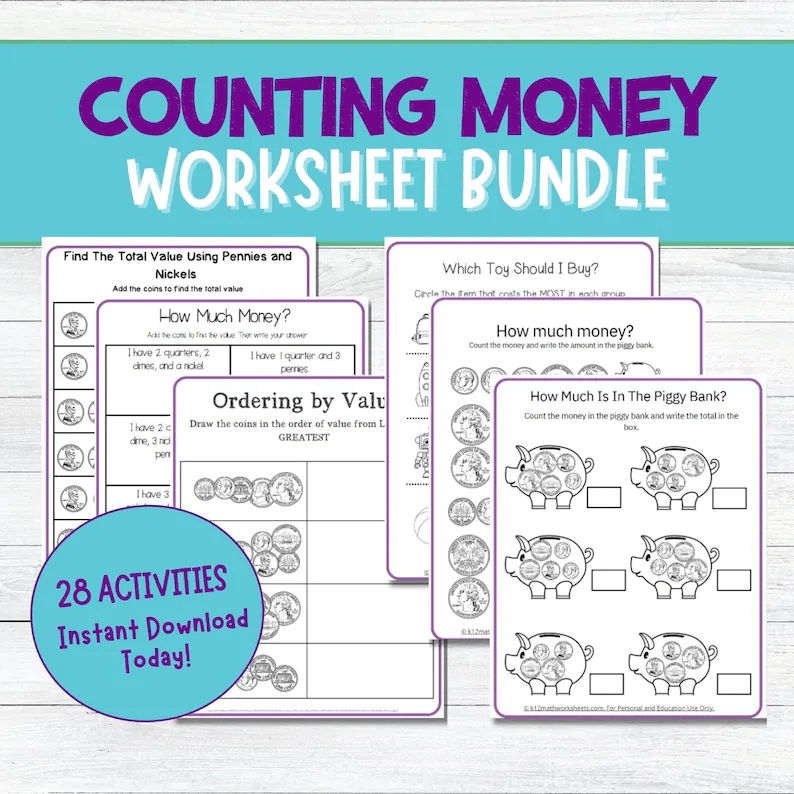

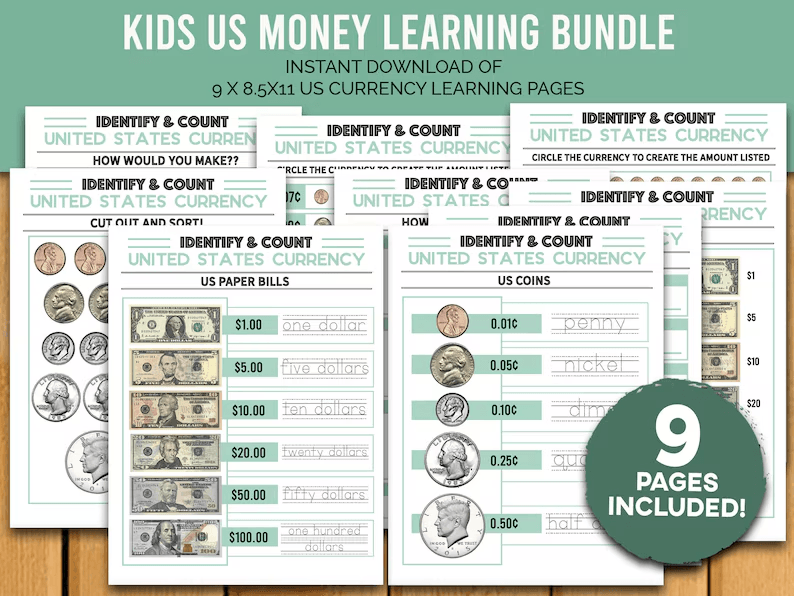

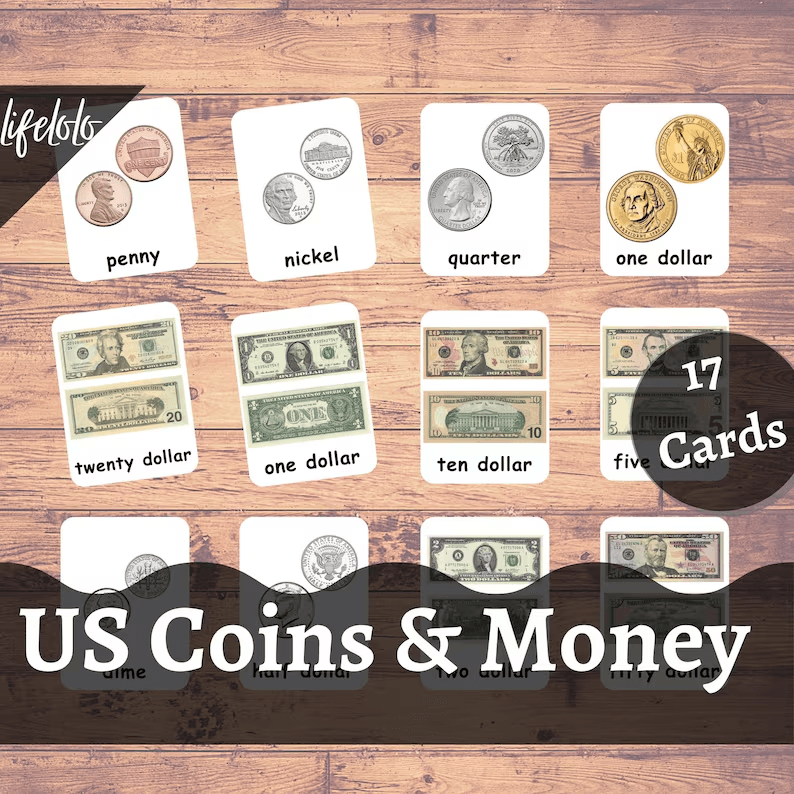

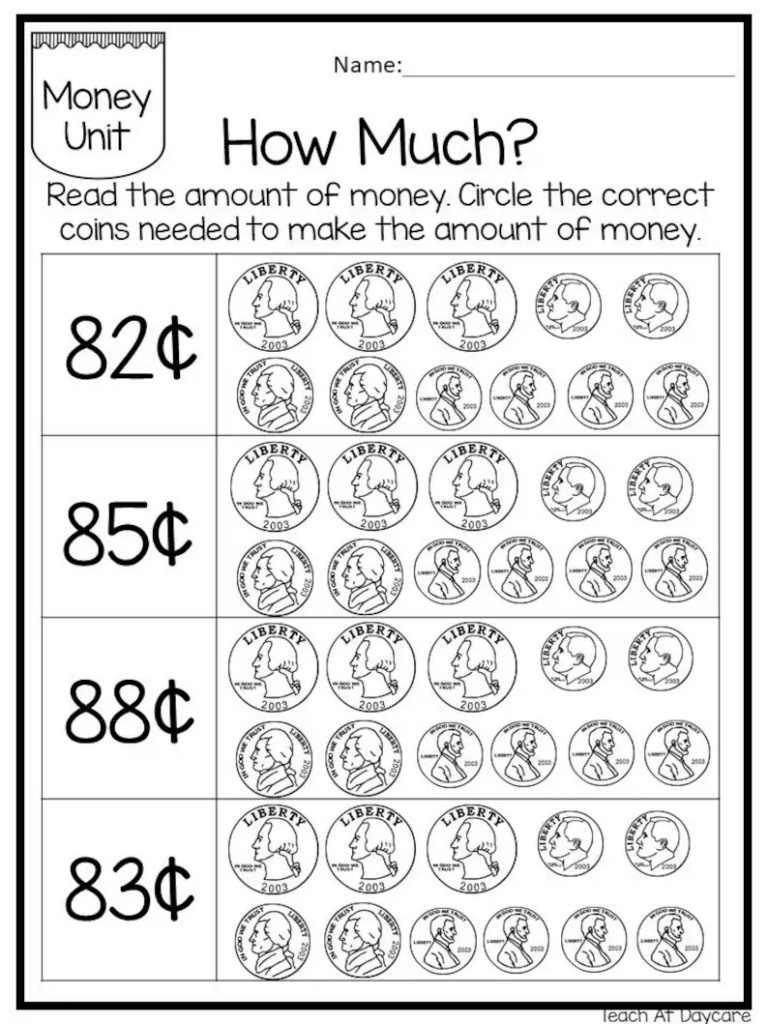

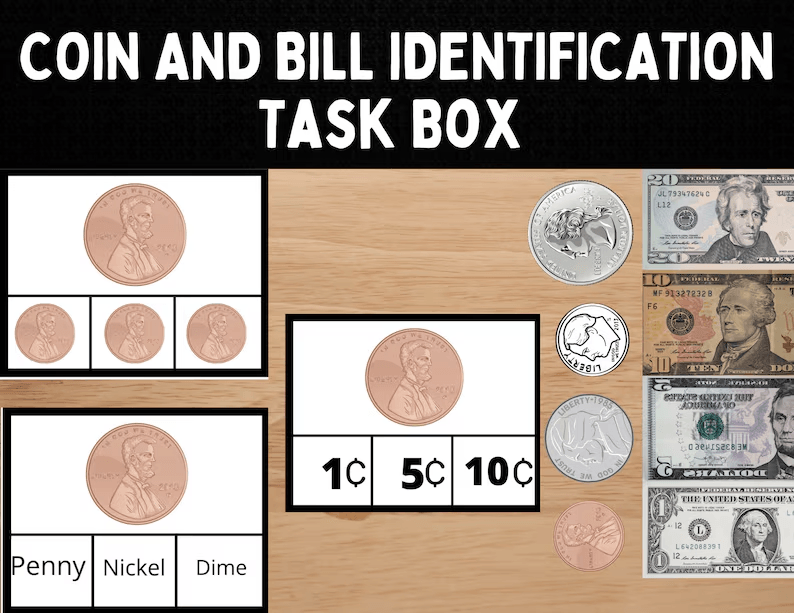

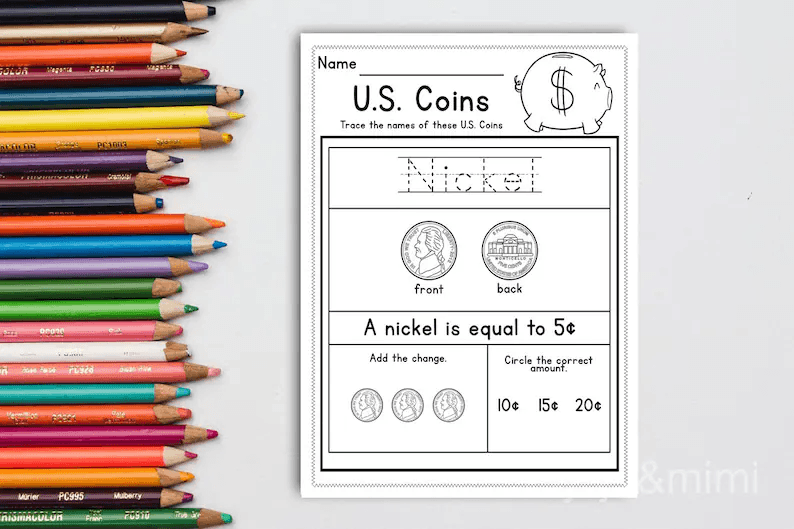

19. Aligning Money Lessons with Their Age

As children mature, their understanding of money should evolve. For younger kids, teach simple concepts like coins and bills, while older children can tackle more complex topics like budgeting, credit, and investing. Tailoring lessons to their developmental stage ensures they grasp the concepts fully and can apply them as they grow.

20. Building Money Skills Through Family Activities

Family activities such as shopping for groceries or planning a vacation can become powerful teaching moments. Involve your children in planning the budget, comparing prices, and discussing the choices you make together. This allows them to experience firsthand the decision-making process that goes into spending money responsibly.

21. Setting Financial Goals Together

Help children set both short-term and long-term financial goals. Whether saving for a toy, a special outing, or even contributing to a college fund, goal-setting encourages patience and perseverance. Keep the process fun by celebrating milestones along the way, making financial success a rewarding journey.

22. How to Manage Money When You’re a Teen

As teenagers become more independent, they must learn how to manage money on their own. Encourage them to open a checking account, track their expenses, and develop the habit of saving for larger purchases, such as a car or college tuition. Provide guidance on managing part-time job earnings and understanding taxes.

23. Teaching the Value of Hard Work

Hard work and earning money go hand in hand. Use real-life scenarios, such as your job or your child’s part-time work, to illustrate the connection between effort and reward. Discuss the sacrifices and responsibilities that come with earning and managing money.

24. Exploring Financial Independence as a Teen

Financial independence is a natural next step as teenagers begin to earn their own money. Guide them through setting up a personal budget, tracking expenses, and understanding the importance of saving for the future. Teaching them to be accountable for their financial choices helps them build confidence and responsibility.

25. Developing a Growth Mindset About Money

A growth mindset is essential for understanding that financial skills can be developed over time. Teach kids that making mistakes with money isn’t a failure but an opportunity to learn and improve. Emphasize that, like any skill, financial literacy gets better with practice.

26. Teaching Kids the Difference Between Good and Bad Debt

Debt can be a tricky concept for children to understand, but teaching them the difference between good and bad debt is essential. Explain how borrowing money for investments, such as education or a house, can be beneficial, whereas credit card debt or loans for unnecessary luxuries can be harmful.

27. Modeling Smart Financial Choices in Daily Life

Kids learn by watching, so it’s important to model responsible financial behavior in everyday situations. This might mean showing restraint when tempted to splurge or prioritizing needs over wants. Demonstrating these decisions in action provides a clear, real-world example of smart money management.

28. Creating a Money-Minded Family Tradition

Start a family tradition that incorporates money lessons, such as an annual budget review or a financial goal-setting meeting. Make it an event where everyone participates, from parents to children, discussing goals, progress, and plans for the upcoming year. This helps make financial learning a consistent, integrated part of family life.

29. Explaining the Concept of Taxes

Introduce the concept of taxes at an early age by explaining how taxes support public services and infrastructure. Discuss how a portion of what they earn or spend goes toward taxes and why this is important for society. As they get older, expand on the idea with practical examples, like how tax rates differ for income, sales, and property.

30. Using Technology to Enhance Financial Literacy

In the digital age, there are countless tools and resources to teach kids about money. From financial literacy apps that simulate saving and investing to online banking tools that help track spending, technology can make learning about money more interactive and engaging. Encourage kids to explore these resources in a safe and monitored environment.

31. Building Financial Confidence Through Decision-Making

Empower children by allowing them to make their own financial decisions within a structured framework. This might include deciding how to allocate their allowance or choosing what to spend their savings on. By giving them a sense of ownership over their financial choices, you help them develop confidence in their ability to manage money.

32. Recognizing the Importance of Credit

As kids approach their teenage years, it’s important to discuss the concept of credit. Teach them about credit cards, loans, and the significance of credit scores. Help them understand that borrowing money comes with responsibility and how mismanaging credit can have long-term consequences.

33. The Role of Money in Society

Teach kids about the role money plays in society, beyond personal purchases. Explain the connection between earning, spending, and the larger economy, including how businesses operate and how financial systems function on a global scale. This broader understanding can inspire curiosity about economics and global markets.

34. Navigating the Digital World of Money

With the rise of digital currencies, online payments, and cryptocurrencies, it’s essential to introduce kids to the digital landscape of finance. Discuss the basics of how digital payments work and teach them about security measures, such as passwords and two-factor authentication, to protect their financial information.

35. Creating a Financial Literacy Curriculum for Kids

Consider creating a personalized financial literacy curriculum for your child. This could be a series of lessons, activities, and projects that cover all the essential topics, from saving and budgeting to investing and taxes. Tailor the curriculum to their age and interests, ensuring it’s engaging and accessible.

36. The Power of Compound Interest

Introduce the concept of compound interest to older children in a simple, relatable way. Explain how interest can grow over time and the importance of starting early when saving. A hands-on example, like a savings chart or an interactive app, can make this concept easier to grasp.

37. Rewarding Financial Responsibility

Recognize and celebrate when your child demonstrates good financial habits. Whether it’s reaching a savings goal, budgeting successfully, or making a smart purchase, praise their effort and reinforce the positive behaviors. This boosts their confidence and encourages them to continue developing their financial skills.

38. Financial Literacy as a Lifelong Journey

Financial literacy is not a one-time lesson; it’s a lifelong journey. Encourage your children to continue learning about money as they grow. By fostering an environment of continual education, you set them on a path to becoming financially responsible and confident adults.

39. Financial Literacy for Younger Kids

For younger children, simplify money concepts through storytelling and hands-on activities. Use toys, such as pretend cash registers or play money, to simulate real-life transactions. By turning learning into play, you lay a foundation for deeper financial understanding as they age.

40. Teaching Kids to Set Realistic Financial Goals

Help kids understand the importance of setting specific, measurable, and achievable financial goals. Whether saving for a toy or planning for a big family vacation, break down the process into small steps. This teaches them patience and helps them track their progress over time.

41. Exploring the Concept of Opportunity Cost

As children grow, introduce the concept of opportunity cost—what they give up when they make a financial decision. For example, explain that if they buy one toy, they might not have enough money for a different toy they also want. This helps children understand the trade-offs involved in financial choices.

42. Introducing the Idea of Money and Happiness

Teach kids that money itself doesn’t bring happiness, but how we use it can. Discuss how experiences, like spending time with loved ones or helping others, often bring greater joy than material possessions. This perspective can help children develop a balanced and thoughtful approach to money.

43. Encouraging Financial Independence in College

As kids approach adulthood, equip them with the tools they need for financial independence. Teach them about budgeting for college life, managing student loans, and handling living expenses. Preparing them for financial responsibility in this transitional phase sets the stage for adulthood and career success.

Conclusion

Teaching kids about money is one of the most valuable gifts parents can offer. It’s not about creating a generation of financial experts, but rather instilling a sense of financial responsibility, independence, and awareness that will serve them throughout their lives. By incorporating financial education into everyday moments, modeling responsible behavior, and creating engaging learning opportunities, parents can ensure their children are well-equipped to navigate the world of money with confidence and wisdom.