Why Saving Money Doesn’t Have to Be Boring

Saving money often feels like eating plain toast when you’re craving a five-course meal. But what if saving could be as exciting as planning a dream vacation or discovering $20 in an old jacket pocket? Savings challenges turn drudgery into delight, making your financial goals not only achievable but genuinely enjoyable.

How Savings Challenges Revolutionize Your Financial Goals

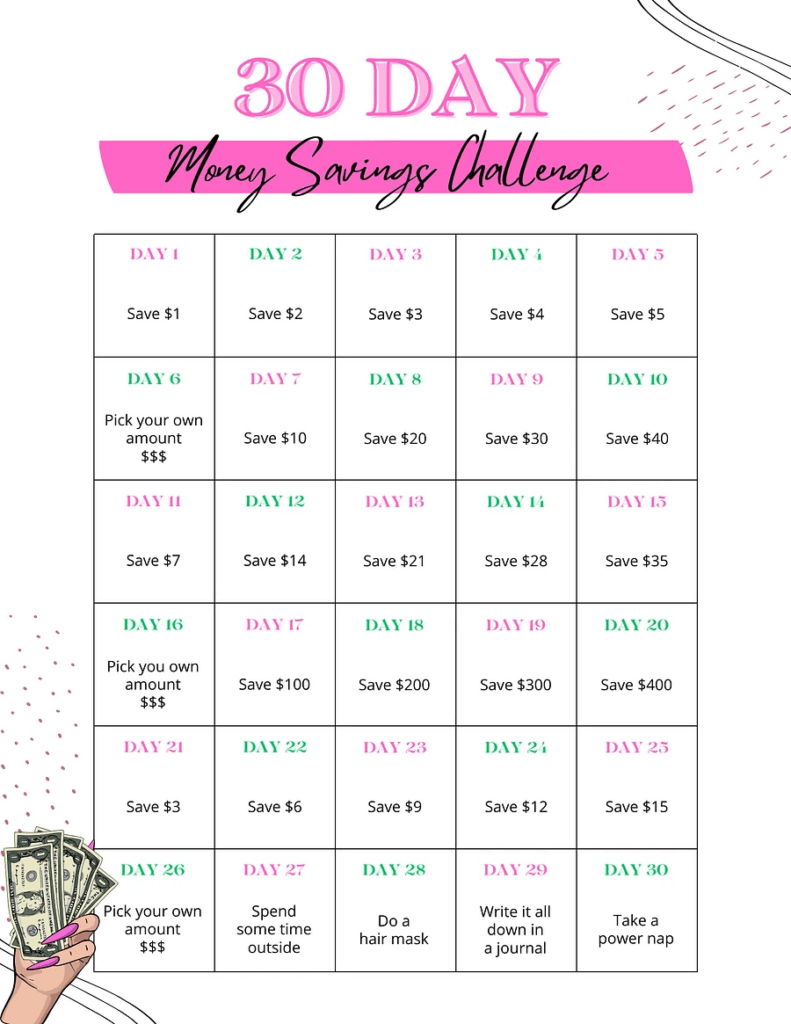

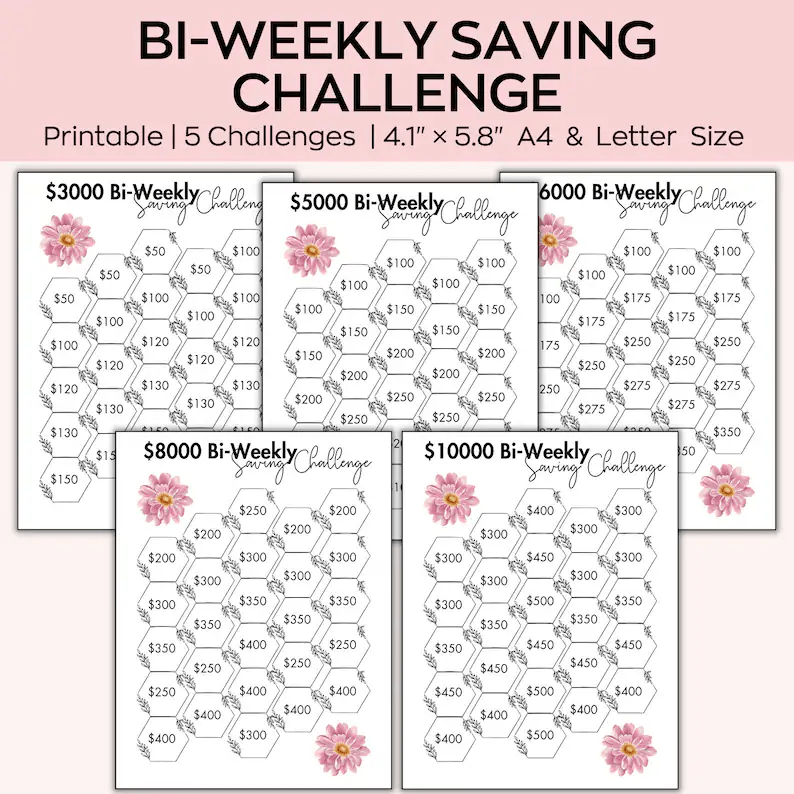

Savings challenges take traditional budgeting and flip it on its head. By gamifying your finances, these challenges provide clear goals, measurable progress, and a sense of achievement with every dollar saved. They’re a surefire way to make money management less daunting and more dynamic.

The Science Behind Fun and Motivation in Saving

When you inject fun into saving, you tap into the brain’s reward system. Every milestone, no matter how small, releases a dose of dopamine—the “feel-good” chemical. This keeps you motivated, consistent, and excited to save more.

Getting Started: Setting the Stage for Success

Know Your “Why”: The Power of Purpose in Saving

Why do you want to save? Is it for a dream home, a family vacation, or simply to create a financial safety net? Understanding your “why” keeps you anchored when the going gets tough.

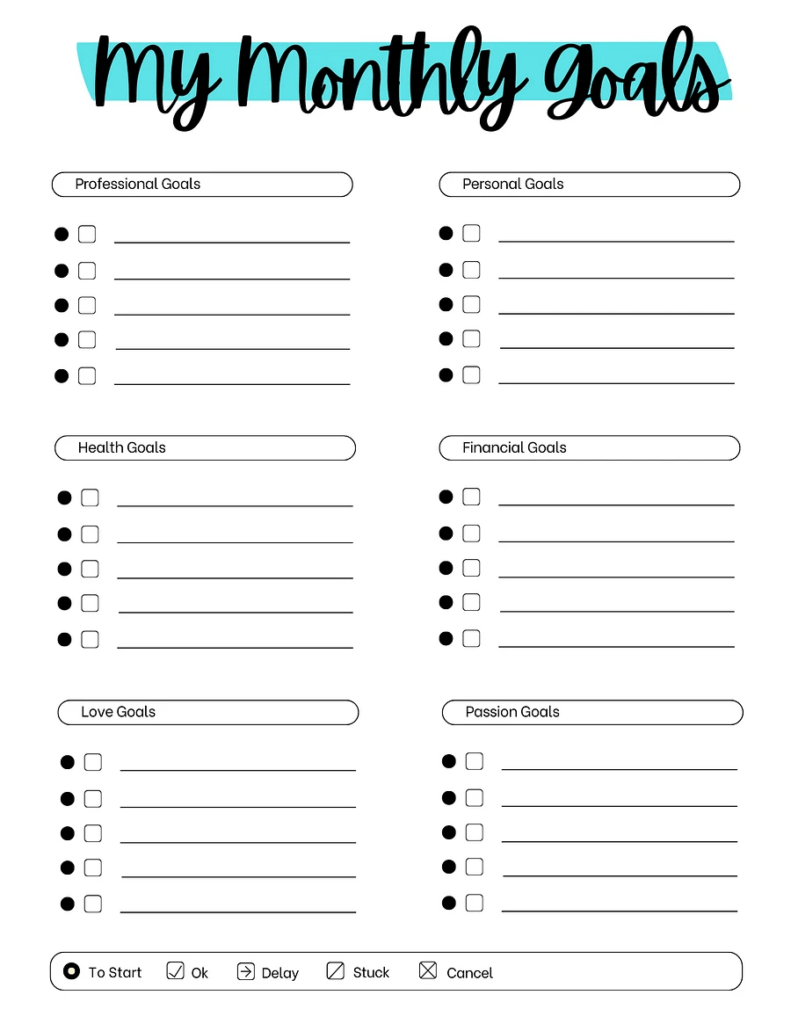

Define Your Goal: Specific, Measurable, Attainable

A vague goal like “save more money” won’t cut it. Be precise: “Save $1,000 in three months for a holiday fund.” Specificity transforms intentions into actionable plans.

Create a Savings Challenge Toolkit

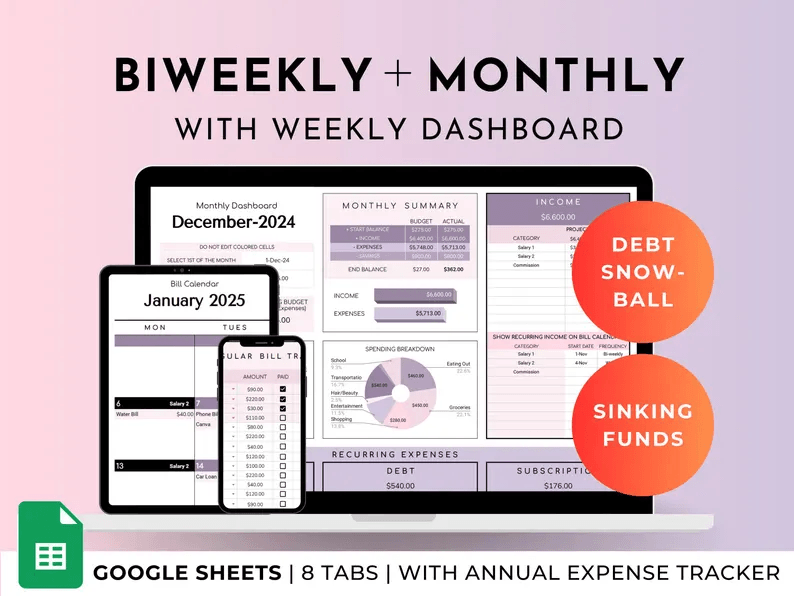

- The Essential Apps: Tools like Mint or YNAB streamline tracking and automate progress checks.

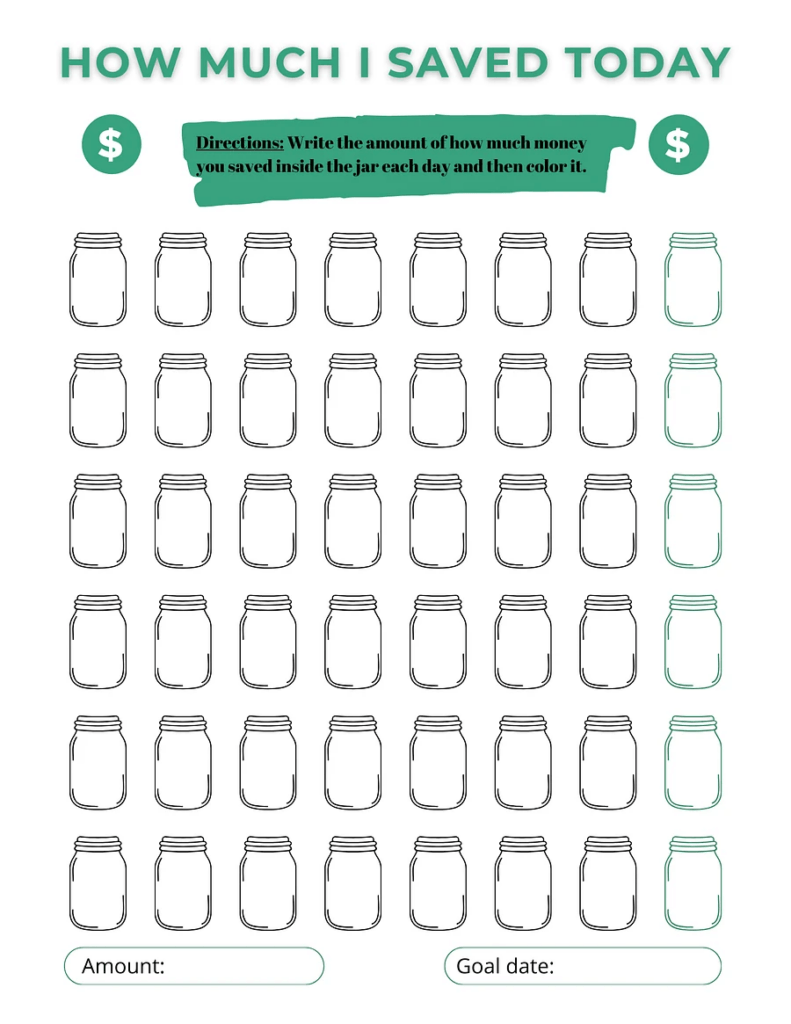

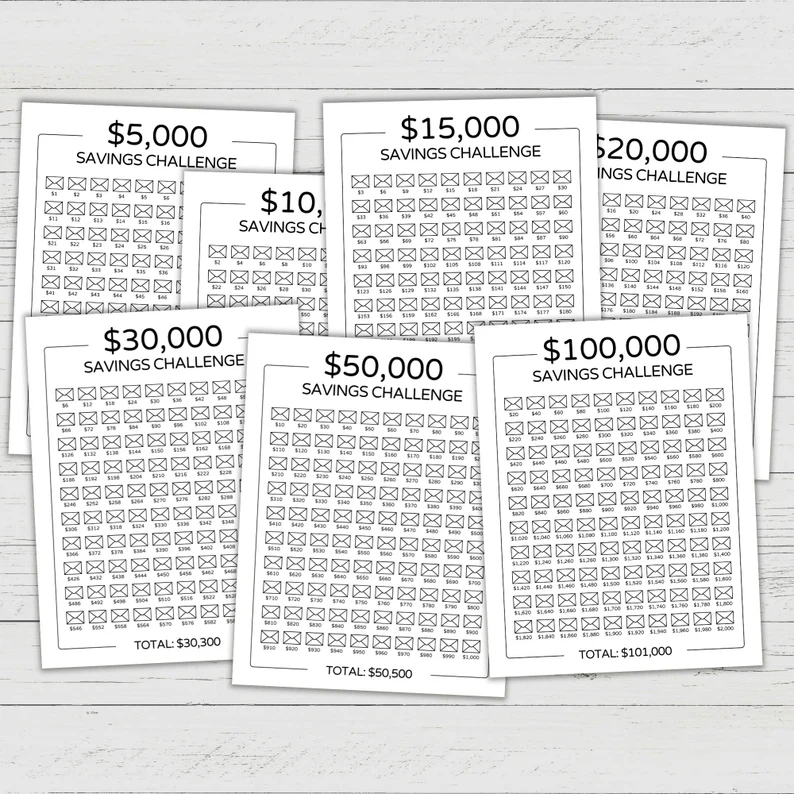

- Visual Tools: Charts and Trackers: A colorful savings tracker on your fridge can be an everyday reminder of your progress.

- Envelopes, Jars, and Clever Containers: Sometimes, the old-school methods—like labeling jars for different goals—have the most charm.

Time Matters: Setting a Realistic Deadline

Saving $500 in two weeks might sound heroic, but it’s not always realistic. Pick a timeline that challenges you without overwhelming you.

Recruit a Savings Buddy: The Role of Accountability

Everything is more fun with a friend! Find someone to embark on the challenge with you. Their encouragement—and the occasional nudge—can make all the difference.

Daily Savings Challenges

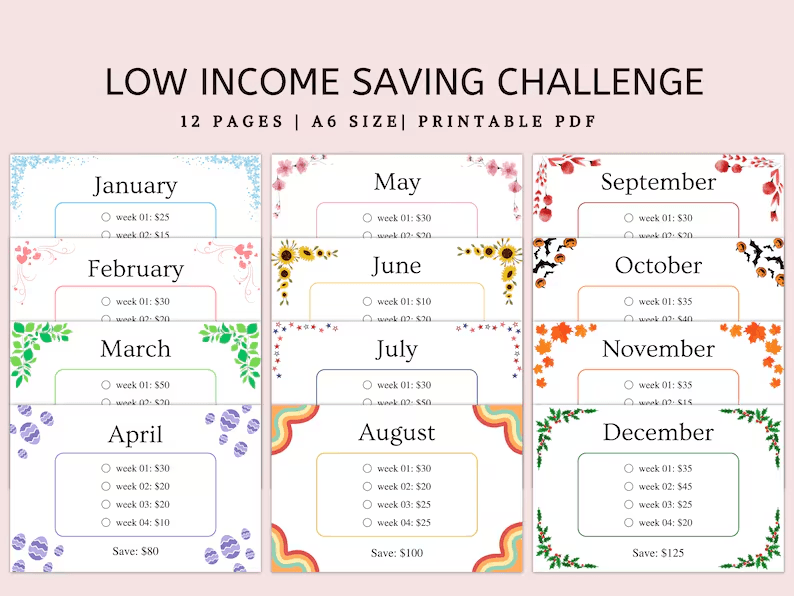

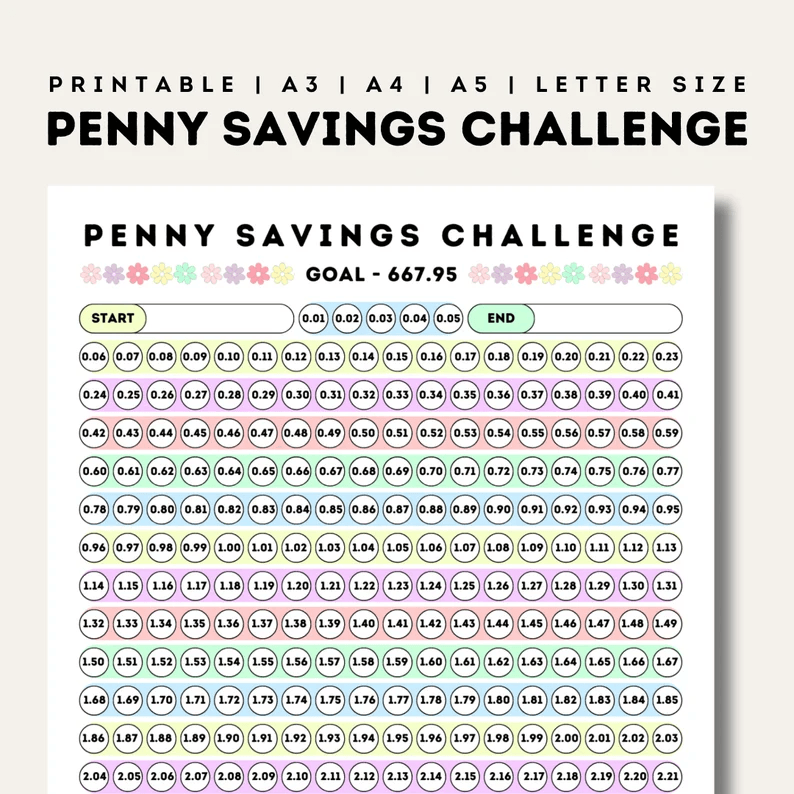

The Penny Parade: Saving Pennies Daily

Small steps lead to big results. Start with just a single penny on day one, then add an extra penny every day. By the end of a year, you’ll have saved over $650. It’s an easy, non-intimidating way to build the habit of saving. Bonus points if you collect actual pennies—there’s something satisfying about watching a jar fill up.

The Coffee Swap: Brew at Home for a Bigger Pot

For coffee lovers, skipping the daily coffee shop run can feel like a sacrifice. But what if you turned it into a challenge? Brew your favorite café-style beverages at home for a week and stash the money you would’ve spent. A latte a day at $5 quickly adds up to $150 a month in savings!

The “Loose Change” Routine

Every time you come home, empty your pockets of loose change and drop it into a designated jar. Once it’s full, deposit the coins into your savings account. It’s old-fashioned, but those nickels and dimes add up faster than you think.

Save on the Weather: Temperature-Inspired Savings

Turn the weather into your savings inspiration. If it’s 75 degrees, save $7.50. On a chilly 45-degree day, save $4.50. It’s quirky, fun, and entirely dependent on Mother Nature’s whims.

The Round-Up Game: Every Purchase Counts

Use a round-up app or do it manually: round up every purchase to the nearest dollar and save the difference. Buy something for $9.25? Round it up to $10 and stash the extra $0.75. It’s effortless, and your savings will grow without you even noticing.

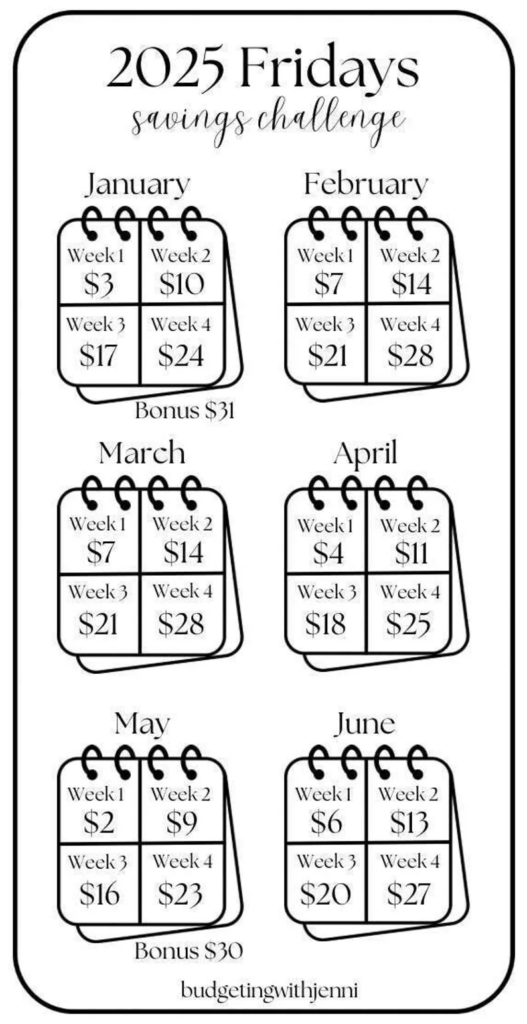

Weekly Savings Challenges

The $5 Stash: Collecting All $5 Bills

Make it a rule: every $5 bill that comes into your possession goes straight into savings. This simple habit can accumulate a surprising amount over time, especially if you regularly use cash.

Grocery Ninja: Weekly Meal Planning on a Budget

Challenge yourself to plan meals for an entire week using only what you already have in your pantry and freezer. Get creative with ingredients! The money you save by skipping a grocery trip can go directly into your savings.

The “One Item Less” Challenge

Every week, choose one thing to eliminate from your spending—a morning muffin, a streaming subscription, or even that midweek takeout. Save the money you would’ve spent on that one item.

Weekly Budget Trimming

Set a weekly budget, then trim it by a small percentage—say, 5%. Challenge yourself to stick to the reduced amount and put the difference into savings.

The Reverse 52-Week Challenge

Instead of starting small and increasing over time, start with the biggest number first. Save $52 in week one, $51 in week two, and so on. It’s a fantastic way to front-load your savings and make later weeks less daunting.

Monthly Savings Challenges

The Envelope Savings Experiment

Divide your monthly income into envelopes marked with spending categories. Once an envelope is empty, that’s it—no more spending in that category. At the end of the month, move any leftover cash into savings.

No-Spend Weekends Challenge

Dedicate your weekends to spending nothing at all. Get creative with free activities like hiking, reading, or hosting potlucks. You’ll be amazed at how much you save by skipping dining out and impulse buys.

Subscription Audit Month

Take a deep dive into your subscriptions. Are you really using all of them? Cancel the ones you don’t need and redirect that money into your savings.

The $100 Monthly Target

Commit to saving $100 a month by cutting back on unnecessary expenses. It might mean skipping a few nights out or swapping brand-name items for generic ones, but the result is a growing nest egg.

DIY Month: Saving on Everything Homemade

For one month, take the DIY approach to as much as possible—cooking, cleaning supplies, gifts, and more. Not only will you save money, but you’ll likely learn new skills along the way.

Fun Savings Games

Bingo Board Savings Challenge

Create a bingo board with savings amounts in each square. Every time you save that amount, mark the square. Completing the board becomes a fun, interactive goal that keeps you motivated.

The Dice Roll Game: Let Luck Decide

Roll a pair of dice every day and save the sum of the numbers. Roll a 3 and a 5? Save $8. It’s unpredictable and keeps things interesting.

“Double or Nothing” Weekly Wager

Set a weekly savings goal, then double it if you meet the goal early. For example, if you aim to save $20 but manage to cut back $40, double the reward and save $80 instead.

The Alphabet Challenge: Save a Letter a Day

Each day, choose a letter of the alphabet and save an amount corresponding to its position. For instance, “A” is $1, “B” is $2, and so on. By the time you reach “Z,” you’ll have saved a tidy sum.

Spin the Wheel of Savings

Create a wheel with different savings amounts and spin it daily or weekly. Whatever amount it lands on gets transferred to your savings.

Family-Friendly Savings Challenges

The Family Jar Challenge

Get the whole family involved by placing a jar in a common area. Everyone contributes loose change or small bills, and together, you save for a shared goal like a family trip or new gadget.

Kids’ Chore-to-Savings Plan

Tie savings to chores by giving kids small rewards for tasks. Teach them to allocate money into savings, spending, and even charity jars.

The “Save Together” Family Fun Night

Turn family game night into a savings challenge. Play games like Monopoly or The Game of Life and agree to match “earnings” with real-life savings.

Teaching Teenagers the Value of Savings

Encourage teens to set their own savings goals—like buying a new gadget—and match their contributions as an incentive.

A Friendly Family Competition

Create a fun competition to see who can save the most in a month. Offer a small, cost-free prize for the winner, like choosing the next family outing.

Seasonal Savings Challenges

Spring Cleaning for Cash

Decluttering isn’t just about organizing your space—it can also boost your wallet. Challenge yourself to sell unused items during spring cleaning. Old clothes, furniture, or gadgets can easily find new homes through online marketplaces or garage sales, and the proceeds can go directly into your savings.

The Summer Savings Stretch

Summer often brings travel temptations and impulse spending. Challenge yourself to save by planning low-cost summer fun, such as picnics, free concerts, or beach days. Add an extra twist: save a set amount every time you skip a splurge.

Fall Frugality Challenge

As the leaves fall, so can your expenses! Commit to a no-spend October or focus on cutting down your grocery bills by cooking hearty meals using seasonal produce like squash, apples, and pumpkins. Save the difference for holiday expenses.

Holiday Spending Freeze

With the holidays around the corner, saving can feel impossible. Flip the script by implementing a “spending freeze” for non-essential items during November or early December. Instead of buying new décor, repurpose what you already have or DIY new creations—and put the savings toward gifts.

The New Year’s Savings Jumpstart

Kick off the year with a fresh start. Begin with a January savings challenge, like the “no-eating-out” month or the reverse 52-week challenge, to set the tone for the year ahead. The momentum you build can carry you through the rest of the year.

Creative Ways to Save

The “One Day, One Dollar” Rule

Dedicate one dollar to savings every day of the month. At first glance, it seems small, but the regularity adds up. Pair it with other challenges, and you might surprise yourself with how fast your savings grow.

The Spending Freeze Challenge

Pick a week—or even a month—and commit to spending only on necessities like groceries and bills. This challenge forces you to get creative with what you have and reveals just how much of your spending is non-essential.

Reward Yourself with Savings: Reverse Splurging

Each time you resist the urge to splurge, reward yourself by transferring the “saved” amount into your savings account. Skipped that $50 pair of shoes? Transfer the money as if you’d spent it—only this time, you’re paying your future self.

Rounding Up Receipts

Take every receipt from your purchases and round up to the nearest dollar. For example, if your grocery bill is $27.38, round it to $30 and save the $2.62. It’s an easy way to save without overthinking it.

The Minimalist Challenge

Adopt a minimalist mindset for one month. Avoid buying any new items unless absolutely necessary. Reflect on what you really need versus what’s just cluttering your life—and watch your savings account grow in the process.

Savings and Lifestyle Goals

Fitness and Savings: The Dollar-for-Workout Challenge

Combine health and wealth by saving a dollar for every workout you complete. Not only will you feel accomplished physically, but you’ll also see tangible rewards in your bank account.

Mindfulness and Money: Save for Every Gratitude Moment

At the end of each day, write down one thing you’re grateful for and save a dollar alongside it. This habit not only fosters a positive mindset but also builds your savings with each act of gratitude.

Eco-Friendly Savings Challenge

Go green and save green! Reduce your energy usage, ditch disposable products for reusable ones, and shop secondhand. Track your savings from eco-friendly swaps and set them aside for future goals.

Combine Decluttering with a Sell-Off

Declutter with purpose: sell off your unused items through online platforms or yard sales. Set a goal to save 100% of the profits. It’s a double win—you’ll have a cleaner home and a fuller wallet.

Cooking and Saving: The “No Takeout” Month

Ban all takeout for a month and commit to cooking at home. Turn it into a culinary adventure by trying new recipes or hosting a homemade pizza night. Every dollar saved by not ordering in can go straight into your savings.

App-Based Savings Hacks

Cashback App Savings Race

Challenge yourself to rack up as much cashback as possible through apps like Rakuten or Ibotta. At the end of the month, transfer all the cashback earnings into your savings account.

Automated Round-Ups

Sign up for apps that automatically round up your purchases and save the difference. It’s a set-it-and-forget-it strategy that builds your savings without requiring much effort.

App Challenges with Friends

Some apps allow you to create savings challenges with friends. Set a collective goal and compete to see who can save the most. Friendly rivalry can make saving money even more fun.

Savings Match Features

Utilize apps or bank accounts that offer savings match features, where every dollar you save is matched by a small percentage. It’s like free money, and it accelerates your progress.

Motivation and Mindset

Rewarding Small Wins

Celebrate each milestone, no matter how small. Whether you’ve saved $50 or $500, treating yourself to a small reward—like a homemade treat or a relaxing night in—keeps you motivated.

Overcoming Savings Burnout

If you’re feeling drained, mix things up. Switch to a new challenge, lower your goals temporarily, or take a short break. Burnout is normal, but the key is to return to your savings plan refreshed.

Visualizing Success with a Dream Board

Create a vision board that represents your savings goals—a vacation, a new home, or a debt-free life. Place it somewhere visible to keep your motivation high.

Sharing Progress with Friends or on Social Media

Sharing your journey can inspire others and keep you accountable. Post updates, savings hacks, or milestone celebrations to stay on track and encourage your network to join in.

The Big Picture

Reflecting on Your Progress

Take time to review your savings journey. What worked? What didn’t? Celebrate how far you’ve come and use the lessons learned to refine your approach moving forward.

Turning Short-Term Challenges Into Lifelong Habits

Once you’ve completed a challenge, don’t stop there. Turn the strategies that worked best into permanent habits that continue to bolster your financial well-being.

Inspiring Others Through Your Journey

Share your success story with friends, family, or even a broader audience. Your experience could be the motivation someone else needs to take control of their finances.

Reaping the Rewards: How Fast Savings Challenges Can Transform Your Life

The rewards of savings challenges go far beyond the dollars in your account. They bring a sense of accomplishment, financial security, and the confidence that comes from taking charge of your future. By turning saving into an adventure, you’ve not only saved money—you’ve transformed your mindset.

Thank you for sharing so many incredible and easy tips to start saving! This post was so inspiring for me!

there are so many incredible options you have offered here! I love saving money. Thank you for the gift of learning to save.

These are great tips! I love the idea of injecting fun. Totally changed mindset makes things a lot easier!

This was such an inspiring post! It makes it seem possible for anyone to save regardless of their situation, especially with The Penny Parade: Saving Pennies Daily Challenge. You can literally find pennies walking through a parking lot. Thanx so much for sharing!

There are so many great ideas here! Thanks for sharing 🙂

Such a good and fun way to save money! Loved this!

A great list and a fun way to accomplish your objective

Love these ideas, thanks!