The holiday season is a time of joy, togetherness, and, let’s face it, a bit of financial stress. Christmas shopping can often feel like a whirlwind of expenses, but it doesn’t have to be that way. With a little planning and some savvy strategies, you can spread holiday cheer without emptying your wallet. Let’s dive into some cheerful, practical ways to save money this Christmas, while still making the season magical.

Planning Ahead for Christmas Savings

Start Your List Early

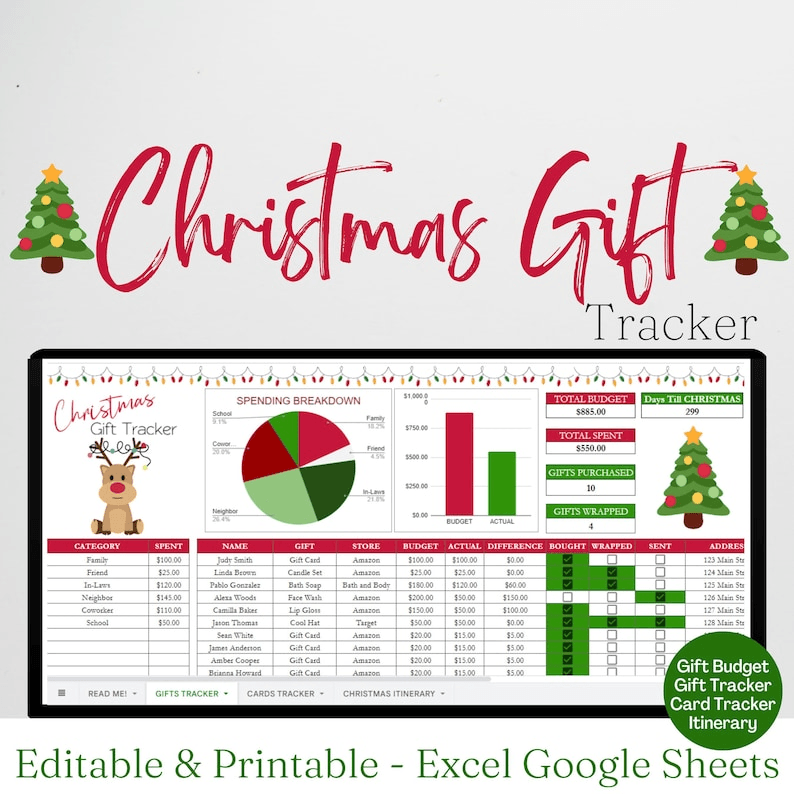

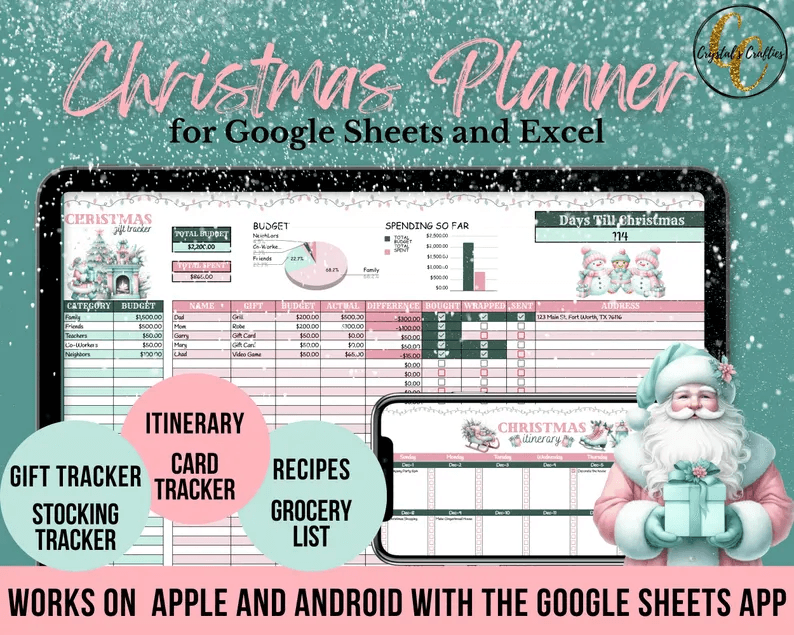

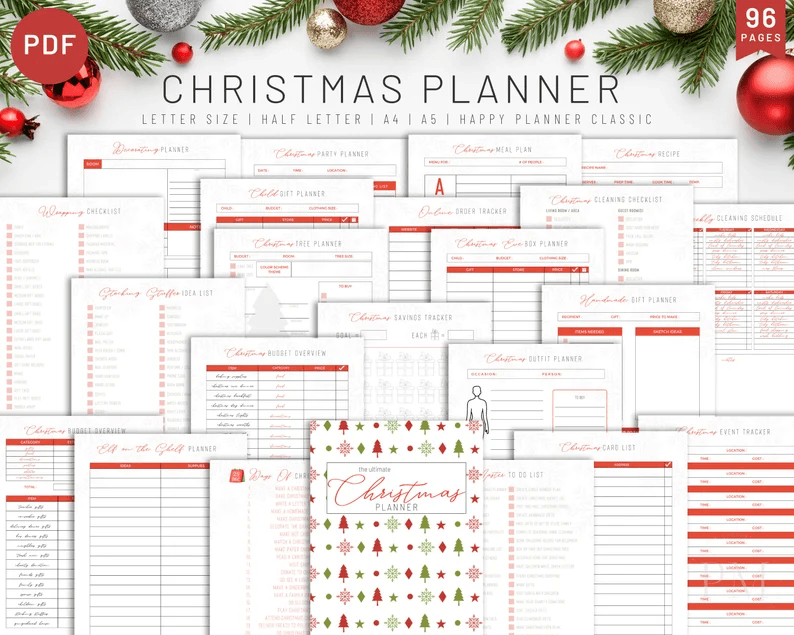

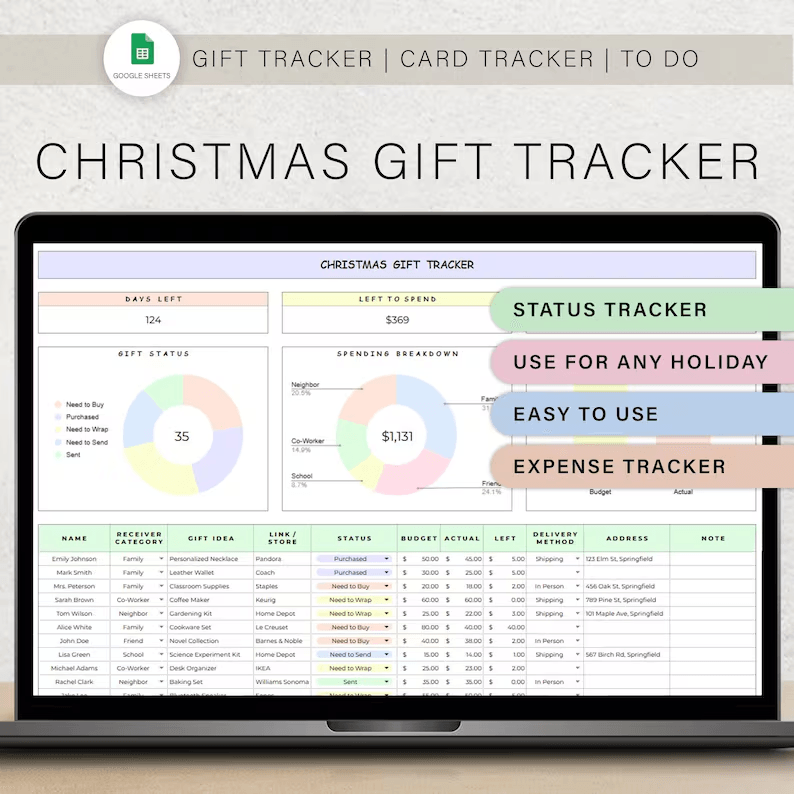

One of the easiest ways to save money is by starting your Christmas list early. Creating a gift list months ahead of the holiday rush allows you to track sales and avoid last-minute panic buying, which often leads to overspending. Plus, it gives you time to think about thoughtful, budget-friendly gifts instead of grabbing expensive impulse purchases.

Set a Realistic Christmas Budget

Set a budget that fits your financial situation, not the pressures of holiday advertising. Know your limits and plan accordingly, allocating funds for gifts, decorations, food, and any other holiday-related expenses. A well-thought-out budget helps you stay on track and avoid the post-holiday financial hangover.

Prioritize Your Gift List

Instead of buying something for everyone, prioritize your list. Who do you really need to buy for? Focus on immediate family, close friends, and others you have a personal relationship with. For distant relatives or acquaintances, consider sending a heartfelt card instead of a physical gift.

Smart Shopping Strategies

Price Comparison Tools: Your Secret Weapon

In today’s tech-driven world, there’s no excuse for not comparing prices. Use price comparison tools and apps like Honey or Camel to ensure you’re getting the best deal. Many retailers adjust prices throughout the holiday season, and these tools help you catch the best offer before committing.

Take Advantage of Cash Back Programs

Maximize your savings by using cashback programs and apps. Services like Rakuten or credit card rewards programs give you a percentage of your purchase back. It’s a small step that can make a big difference, especially during holiday shopping sprees.

Shop with Coupons and Promo Codes

Never hit the checkout button without searching for a coupon code first. Websites like RetailMeNot or CouponCabin are treasure troves of discount codes. A quick search can knock off a significant percentage, and every bit helps during the Christmas rush.

Black Friday and Cyber Monday Tactics

Black Friday and Cyber Monday are famous for holiday discounts, but the key is to go in with a game plan. Research which stores offer the best deals and compare them beforehand. Sometimes, waiting for Cyber Monday can yield better online deals without the in-store chaos.

Make Use of Loyalty Programs

Retail loyalty programs often offer exclusive discounts, early access to sales, or points that accumulate toward future purchases. If you’re a frequent shopper at a specific store, signing up can save you a significant amount in the long run.

Timing is Everything

The Best Time to Shop for Christmas Deals

Timing your shopping can make all the difference. Early December or the weeks following Black Friday can be a sweet spot for snagging deals. Retailers are eager to clear out inventory before the end of the year, so watch for discounts on big-ticket items.

Consider Off-Season Shopping

The best time to shop for Christmas presents is often months before the holiday season. Summer or fall can have clearance sales that allow you to grab gifts at a fraction of the price. It also spreads out your spending, making it more manageable.

Creative Gift Ideas on a Budget

DIY Gifts that Mean the World

Handmade gifts aren’t just thoughtful; they can also save you a ton of money. Consider making something personalized, like a scrapbook, a knitted scarf, or even homemade cookies. These kinds of gifts show love and care, without breaking the bank.

Experiences Over Things

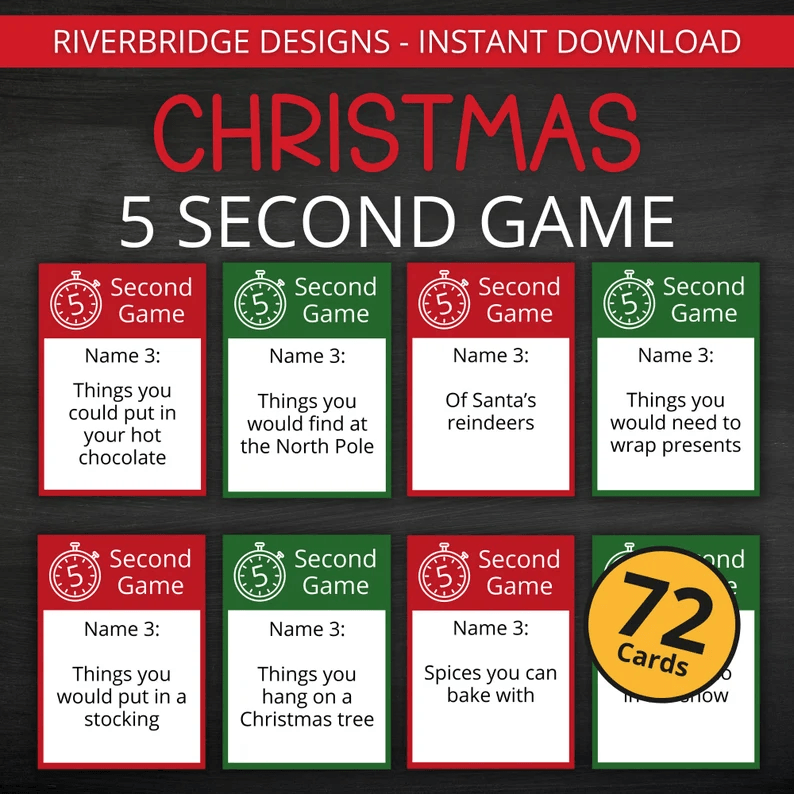

Instead of gifting material items, consider giving experiences. Movie tickets, a fun day out, or even offering your time for a special outing can often mean more than a physical gift. Plus, it often costs less while leaving a lasting memory.

Personalized Gifts Without the Price Tag

Personalization can make even the simplest gift feel special. From monogrammed mugs to custom photo albums, personalized presents can often be done on a budget through affordable online platforms.

Shopping Hacks for Online Bargains

Use Browser Extensions for Savings

Install browser extensions like Honey or Rakuten to automatically find and apply coupon codes when shopping online. They can also track prices over time, alerting you when an item you want is discounted.

Opt for Free Shipping Deals

Always look for free shipping promotions or use a site like FreeShipping.com to avoid those sneaky costs. Many retailers offer free shipping during the holiday season, and it’s one less thing to worry about when checking out.

Stack Discounts for Maximum Savings

Don’t stop at one discount—stack them! Use a promo code, cashback, and loyalty points all on the same purchase. When combined, these discounts can significantly reduce your final bill, allowing you to shop smartly.

Rethinking Gift Wrapping

Use Sustainable Wrapping Materials

Save money and help the planet by using sustainable wrapping options. Reuse old gift bags, wrap with fabric, or even get creative with newspaper or brown paper, which you can decorate yourself. It’s eco-friendly and cost-effective.

Repurpose Household Items for Gift Wrapping

Get creative with what you already have at home. Old scarves, leftover fabric, or even colorful magazine pages can make for unique and stylish gift wrapping, without spending a cent on new materials.

Ditch the Wrapping Altogether

For an extra touch of thoughtfulness, skip the wrapping and present the gift in a reusable container, like a basket or tote bag, that can serve as part of the gift itself. It’s functional, eco-friendly, and saves on wrapping costs.

Group Gifting and Secret Santa

Organize a Family Gift Exchange

Instead of buying gifts for every family member, organize a gift exchange where each person draws a name. It reduces the number of gifts you have to buy and adds an element of surprise and fun to the holiday.

Set Price Limits for Group Gifts

Whether it’s at the office or with friends, setting a price limit on group gifts ensures everyone can participate without feeling financially stretched. This keeps things fair and affordable for everyone involved.

Plan a Fun Secret Santa with Friends

Secret Santa is a classic holiday tradition, and it’s perfect for groups looking to save. Plan a fun exchange with a price cap, and you’ll find it’s possible to give and receive thoughtful gifts without overspending.

Budget-Friendly Stocking Stuffers

Creative DIY Stocking Fillers

Fill stockings with handmade goodies like bath bombs, hot cocoa kits, or homemade candles. These little tokens of affection are inexpensive but thoughtful, and they’re sure to delight.

Affordable Store-Bought Options

Dollar stores or discount retailers can be gold mines for stocking stuffers. From quirky gadgets to festive socks, you can find budget-friendly options that will bring joy without costing a fortune.

Fun and Thoughtful Mini Gifts

Small gifts like puzzles, keychains, or miniature games can be perfect stocking stuffers that won’t break the bank. It’s all about finding those small, thoughtful items that pack a lot of fun into a little package.

Reducing Costs on Holiday Décor

Craft Your Own Decorations

DIY decorations are not only fun to make but also a great way to save money. From homemade wreaths to ornaments crafted with the family, these projects can bring festive cheer without a hefty price tag.

Shop Thrift Stores for Festive Finds

Check out local thrift stores or secondhand shops for holiday décor. You’ll be surprised at the treasures you can find—sometimes even vintage or one-of-a-kind items that add charm to your holiday setup at a fraction of the cost.

Reuse and Repurpose Last Year’s Décor

There’s no need to buy new decorations every year. Reuse and refresh what you already have. A little creativity can go a long way in giving your old décor a new life, making it look fresh and festive without any extra spending.

Saving on Food and Entertaining

Host a Potluck Christmas Dinner

If you’re hosting a holiday gathering, suggest a potluck. Each guest can contribute a dish, which reduces your food costs while ensuring there’s a variety of tasty options for everyone to enjoy.

Stick to a Holiday Meal Budget

Plan your holiday menu in advance and stick to a set budget for ingredients. By avoiding expensive, last-minute grocery store trips, you can keep your costs down while still serving up a delicious holiday feast.

Cut Costs with Simple, Homemade Treats

Bake homemade holiday cookies or candies instead of purchasing pricey pre-made ones. It’s a fun activity, and homemade treats often taste better, while costing significantly less than store-bought alternatives.

Managing Post-Holiday Expenses

Avoid January Credit Card Shock

To prevent a financial hangover after the holidays, keep track of what you’re spending throughout the season. Stick to your budget, and avoid putting large amounts on credit cards that will lead to a painful January bill.

Start a Christmas Savings Fund for Next Year

Once the holidays are over, start setting aside a small amount each month into a Christmas savings fund. By next December, you’ll have a nice little nest egg specifically for holiday spending, making it easier to stay within your budget.

Take Advantage of Post-Holiday Sales

Post-holiday sales are the perfect opportunity to stock up on next year’s Christmas décor, cards, and wrapping paper at a fraction of the cost. It’s a savvy way to get a head start on saving for the following year.

Final Thoughts: Celebrating Christmas Without Breaking the Bank

Christmas is about love, laughter, and creating memories, not overspending. By being strategic, thoughtful, and creative, you can enjoy the holidays to the fullest without stressing over your bank account. Saving money while Christmas shopping doesn’t diminish the joy of giving—it enhances it by keeping the focus on what really matters: spreading joy, not draining your savings.