Financial literacy is one of the most vital life skills for children today. In a world driven by economics, teaching kids about money from an early age prepares them for a successful future. Apps offer an interactive and accessible way to instill budgeting, saving, and spending habits that shape how kids view and handle money throughout their lives.

Why Teach Kids About Money Early?

Kids who learn about money early develop a foundation that encourages wise spending habits and financial stability. By understanding the basics of economics, they can make informed decisions, avoid debt, and appreciate the value of saving.

What to Look for in a Money Learning App

Not all apps are created equal, especially when it comes to educating young minds. When choosing a money learning app for kids, prioritize age-appropriate content and customization options that let kids learn at their own pace. Look for security and parental controls to monitor progress, while ensuring that the app’s financial content aligns with your goals for their learning.

Top Money Learning Apps for Kids: An Overview

To help you get started, here’s an in-depth look at some of the top-rated money learning apps for kids, each offering unique approaches to financial education.

1. PiggyBot

Overview and Key Features: PiggyBot is a fun and colorful app that encourages kids to keep track of their allowances and savings. It lets kids set financial goals and visually see their progress.

Fun Ways to Track Allowance and Savings: Kids can log their earnings, whether from allowances or gifts, and save toward specific goals, adding a tangible aspect to financial learning.

Pros and Cons for Kids’ Learning: PiggyBot is engaging and visually appealing, making it great for young kids. However, its features are relatively simple, which may limit its usefulness for older kids.

2. Bankaroo

Overview and Key Features: Created by a father-daughter duo, Bankaroo offers kids a virtual banking experience that teaches them about saving, budgeting, and setting goals.

Building Saving Goals and Budgeting Skills: Bankaroo is excellent for kids ready to take on more structured financial goals, like budgeting for a large purchase.

Pros and Cons for Different Age Groups: Ideal for older elementary school kids, Bankaroo may be too complex for younger children still learning basic money concepts.

3. Savings Spree

Overview and Key Features: This game-based app lets kids make choices about spending, saving, and donating. Kids learn the impact of different decisions on their virtual bank balance.

Learning Through Mini-Games and Challenges: Kids encounter real-world scenarios, such as unexpected expenses, helping them learn about consequences in a fun way.

Pros and Cons for Teaching Money Choices: While engaging and educational, Savings Spree’s interface might seem dated to some kids used to modern graphics.

4. iAllowance

Overview and Key Features: iAllowance links chores and earnings, giving kids an incentive to manage responsibilities and budget their rewards.

Reward System for Chores and Money Goals: This app lets parents customize chores, rewards, and money goals, which helps kids associate work with earnings.

Pros and Cons for Developing Responsibility: iAllowance promotes responsibility and work ethic, but requires regular parent engagement to set and update tasks.

5. GoHenry

Overview and Key Features: GoHenry offers a real-world debit card for kids, which parents can fund and track to help kids learn real spending habits.

Using a Real Debit Card for Money Management: GoHenry provides hands-on experience with money management by giving kids the freedom to make spending decisions.

Pros and Cons for Practical Money Experience: This app’s real-world approach is highly beneficial but may require more parental oversight due to its link to actual finances.

6. BusyKid

Overview and Key Features: BusyKid links chores to earnings, allowing kids to manage their money by choosing to spend, save, or invest.

Linking Chores to Earnings and Spending Choices: By earning real money, kids experience budgeting and financial prioritization firsthand.

Pros and Cons for Early Budgeting Practice: BusyKid is a comprehensive tool but may be too advanced for younger children due to its investment options.

7. Greenlight

Overview and Key Features: Greenlight combines a debit card with a savings, spending, and giving system, empowering kids to make choices with guided oversight.

Setting Spend, Save, and Give Goals: Greenlight’s flexible account settings enable kids to practice balancing spending, saving, and charity.

Pros and Cons for Advanced Money Lessons: Greenlight’s structure promotes responsible choices, though it may be best suited for older kids with higher spending needs.

8. FamZoo

Overview and Key Features: FamZoo is a family banking app that introduces kids to shared budgeting, loans, and tracking financial goals collaboratively.

Family Banking and Collaborative Saving: This app fosters family participation, letting everyone share financial responsibilities.

Pros and Cons for Family Learning: FamZoo works well for families interested in a collaborative approach but might be more complex for individual users.

9. RoosterMoney

Overview and Key Features: RoosterMoney is a digital allowance tracker where kids manage pocket money and save for specific goals.

Digital Tracker for Pocket Money and Spending: Kids can easily visualize how close they are to reaching their financial goals.

Pros and Cons for Younger Kids’ Learning: RoosterMoney’s simplicity is perfect for young kids, though it may lack advanced features for teens.

10. Kidibank

Overview and Key Features: Kidibank encourages kids to set both short-term and long-term savings goals, teaching them the value of patience.

Setting Short-Term and Long-Term Goals: With Kidibank, children can learn to set realistic goals and understand the concept of delayed gratification.

Pros and Cons for Developing Patience in Saving: Kidibank is easy for young kids to use, but advanced learners may want more complex functionalities.

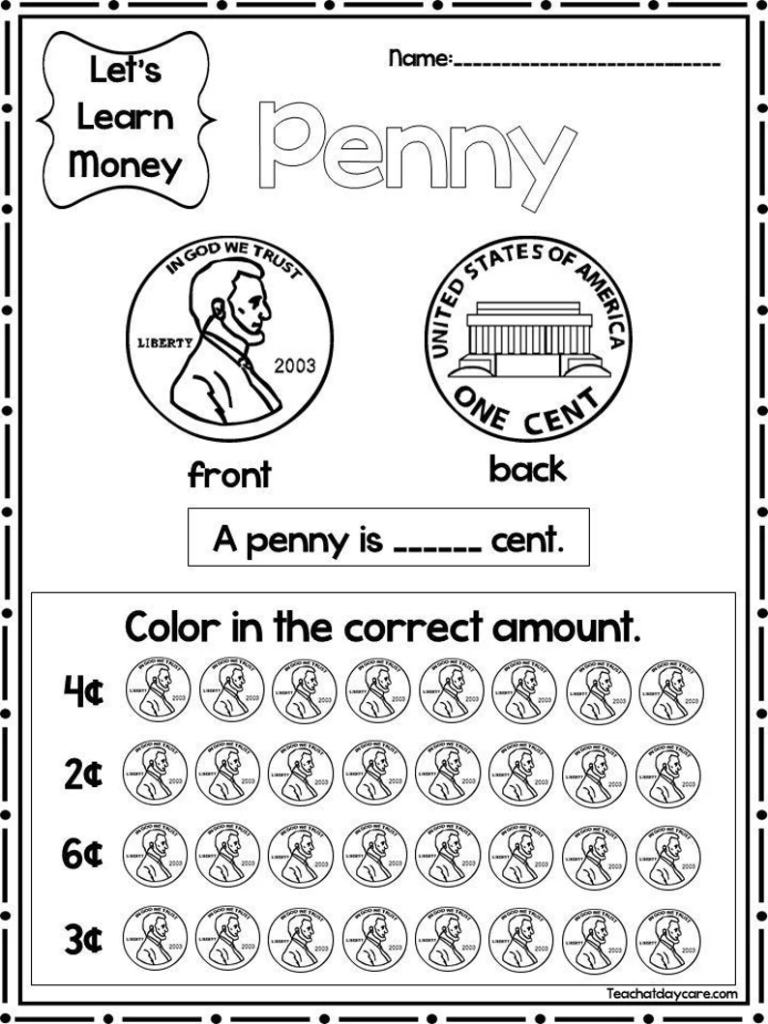

11. Count My Coins

Overview and Key Features

Count My Coins is a money-learning app tailored for preschoolers and young children. This simple and engaging app helps kids familiarize themselves with different coins and their values. It features colorful, interactive visuals that show coins in various denominations, allowing children to practice counting and performing basic money math.

Fun with Counting and Basic Money Math

The app turns learning money into a fun game by challenging kids to count coins, solve simple addition or subtraction problems, and match coins to their values. With each correct answer, the app rewards kids with encouraging feedback, helping them build confidence while learning essential math skills.

Pros and Cons for Preschoolers

Pros: Simple, intuitive design ideal for young children just starting to learn about money. Helps develop foundational math skills such as counting and simple addition and subtraction. Visual and auditory cues make learning more engaging for preschoolers.

Cons: Limited features for older children who may outgrow the basic concepts. Focuses mainly on counting rather than broader financial skills like saving or budgeting.

12. Money Up!

Overview and Key Features

Money Up! is an app specifically designed for kids with special learning needs. It uses bright, engaging visuals and an easy-to-navigate interface to teach children the fundamentals of money. The app adapts to the child’s pace, offering a variety of learning modes that focus on coin recognition, simple transactions, and budgeting.

Perfect for Kids with Special Learning Needs

With its visual cues and customizable options, Money Up! makes learning accessible for children with different learning abilities. The app offers a structured environment where kids can learn about money in a step-by-step, repetitive manner—perfect for reinforcing concepts and building familiarity with currency.

Pros and Cons for Diverse Learners

Pros: Adaptable to various learning styles, making it ideal for children with special learning needs. Offers a simple, clear interface that reduces overwhelm and frustration. Encourages gradual progress, allowing kids to learn at their own pace.

Cons: The simplicity of the app may not provide enough challenge for children who are already familiar with basic money concepts. The content may feel repetitive for children who prefer more dynamic or complex learning experiences.

13. Pennybox

Overview and Key Features

Pennybox is an interactive budgeting app for both kids and teens, aimed at teaching them how to set and track financial goals. The app uses a virtual savings box system, where users can allocate their money into different categories, such as saving for a toy, trip, or long-term goals like a car or college fund.

Interactive Budgeting for Kids and Teens

By helping kids set financial goals and track their progress, Pennybox introduces them to key budgeting concepts. Kids learn the value of saving for specific goals, while teens gain a better understanding of the importance of prioritizing spending and managing money over time.

Pros and Cons for Goal-Oriented Learning

Pros: Teaches kids how to manage their money with a focus on setting and achieving goals. Helps develop valuable budgeting and goal-setting habits early on. Ideal for older kids and teens who are ready to understand the concept of saving for long-term objectives.

Cons: Younger kids might struggle with the concept of long-term saving goals. The app focuses more on goal-setting and budgeting rather than on day-to-day money management or spending habits.

14. Allowance Manager

Overview and Key Features

Allowance Manager is an app designed to help parents manage their children’s allowance and chore-based earnings. Parents can track their kids’ earnings, set up regular allowances, and set spending limits, while kids can see how much they’ve earned and track their spending. It simplifies the process of giving kids responsibility for their finances.

Easy Management of Allowances for Young Kids

This app allows parents to set up a consistent allowance system and tie it to specific chores. Children can monitor their earnings and spending habits, encouraging responsibility and teaching them the value of work and money.

Pros and Cons for Family Finance Coordination

Pros: Simple, easy-to-use interface that works well for younger kids. Helps parents manage allowances and reinforce financial lessons by linking chores to earnings. Allows parents to set spending limits and monitor their kids’ financial activity.

Cons: Focuses mainly on allowance management, leaving out lessons about saving, investing, or budgeting for bigger goals. May not be suitable for older kids who are ready to handle more complex financial concepts.

15. Motion Math: Cupcake

Overview and Key Features

Motion Math: Cupcake is a unique app that teaches children about money through the process of running a virtual cupcake shop. Kids must calculate prices, balance expenses, and set appropriate prices for their cupcakes while making sure they stay profitable. The app combines math skills with basic business and money management concepts.

Real-Life Money Scenarios Through Play

This app introduces kids to real-life financial scenarios like managing inventory, budgeting for supplies, and adjusting pricing to make a profit. As they progress, kids develop problem-solving skills and learn about making money decisions in a fun and engaging way.

Pros and Cons for Hands-On Learning

Pros: Offers a hands-on, immersive experience that helps kids understand business and money management in a practical, fun context. Great for visual learners who prefer interactive, game-based learning. Teaches important skills like pricing, budgeting, and financial decision-making in a playful way.

Cons: The business-focused approach may be too complex for younger children or those unfamiliar with basic financial concepts. Focuses more on managing a business than personal financial skills, such as saving or spending.

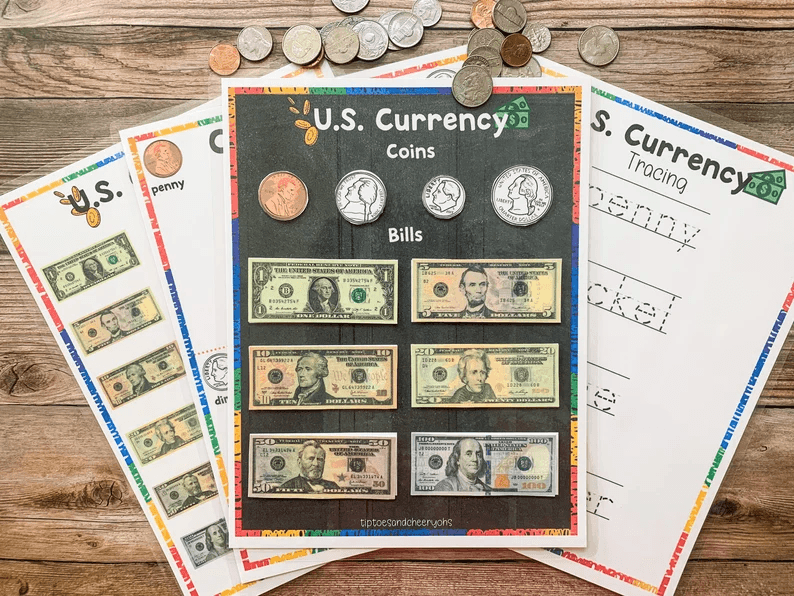

Educational Features of Each App

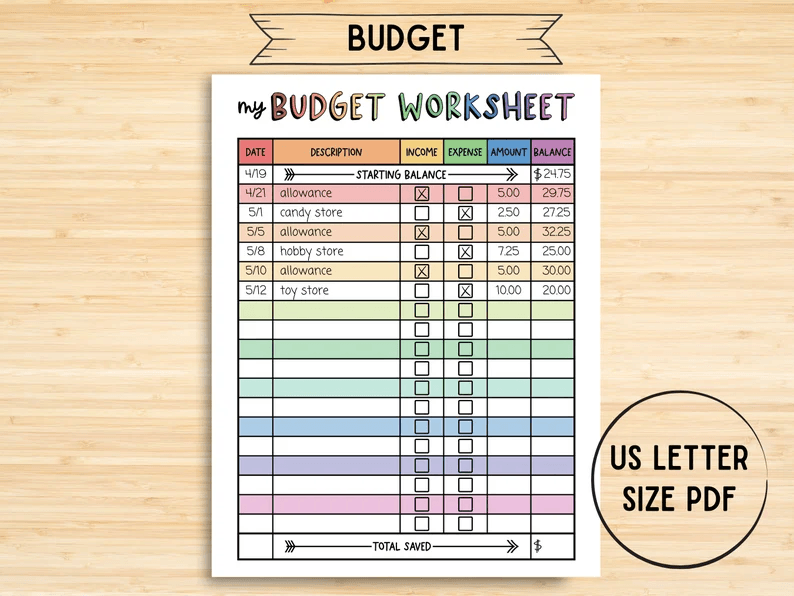

Money learning apps excel in teaching various skills, from counting coins and understanding currency to handling financial decision-making and monitoring spending habits.

App Security and Parental Controls

With online learning, security is paramount. Many apps include parental control features, allowing you to monitor spending and set spending limits, ensuring a safe experience for young users.

Customization Options in Money Learning Apps

Tailoring apps to each child’s age and comprehension level is essential. Most of these apps allow parents to adjust goals, chore lists, and rewards to match their kids’ individual learning needs.

Apps with Real Money Management Features

Apps like GoHenry and Greenlight go beyond virtual simulations, offering real debit cards for hands-on financial practice. These options introduce kids to real-world financial literacy but require responsible oversight.

Gamified Learning: How Games Make Money Fun

Gamified learning in money apps keeps kids entertained while teaching essential financial concepts. Mini-games, challenges, and virtual rewards make financial literacy an exciting adventure.

Teaching Values Through Money Apps

Learning about saving and spending is valuable, but many apps also encourage kids to give to charity, promoting empathy and a balanced approach to finances.

Conclusion

Money learning apps provide a modern approach to teaching kids financial literacy. By making money management fun and accessible, these apps equip kids with valuable skills that will serve them throughout their lives. As financial literacy becomes increasingly important, these tools offer a practical way to start kids on a journey to financial confidence and responsibility.