Why Winter is the Perfect Time to Start Money Challenges

As the frost creeps over the windows and the world slows down, winter offers a unique opportunity to reassess and realign your finances. With holiday splurges behind you and the promise of a new year ahead, it’s the perfect season to embrace creative money challenges that both excite and empower.

The Thrill of a Fresh Start with Financial Goals

January isn’t just the start of a new calendar—it’s the ultimate refresh button for your wallet. Whether you’re digging out from holiday debt or simply eager to grow your savings, a little financial discipline can spark big change.

How Winter Savings Can Warm Your Wallet

Every dollar saved during the colder months translates to financial warmth as spring approaches. By starting now, you set the stage for a year of smarter spending and unexpected opportunities.

Identify Your Savings Goals: Big Dreams or Small Wins

Clarifying your “why” is the cornerstone of any savings effort. Are you planning a dreamy summer getaway, building an emergency fund, or tackling debt? Once you know your goals, the path becomes clearer.

How to Calculate a Realistic Savings Target

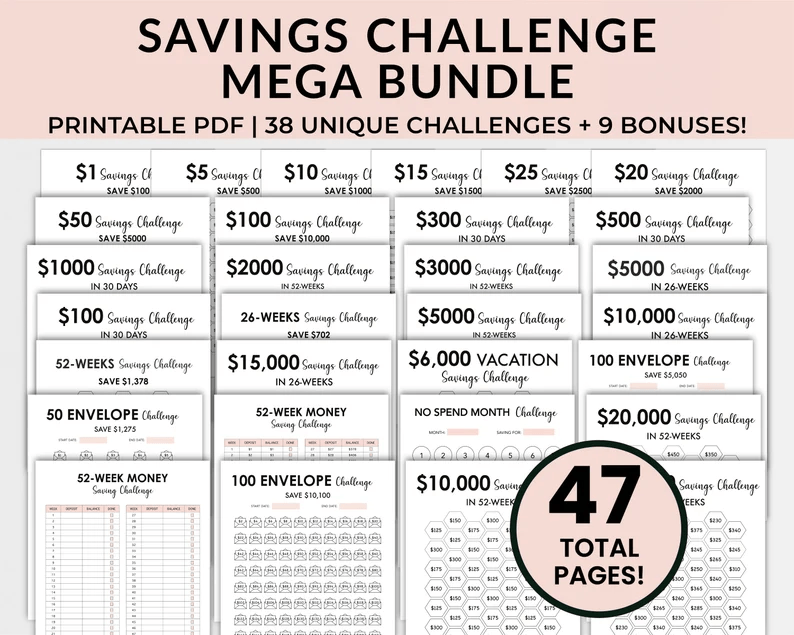

Dreams need structure. Break down your goal into achievable amounts. For instance, if you aim to save $500 in three months, that’s about $42 per week. Understanding the numbers keeps your goal from feeling overwhelming and ensures you stay on track.

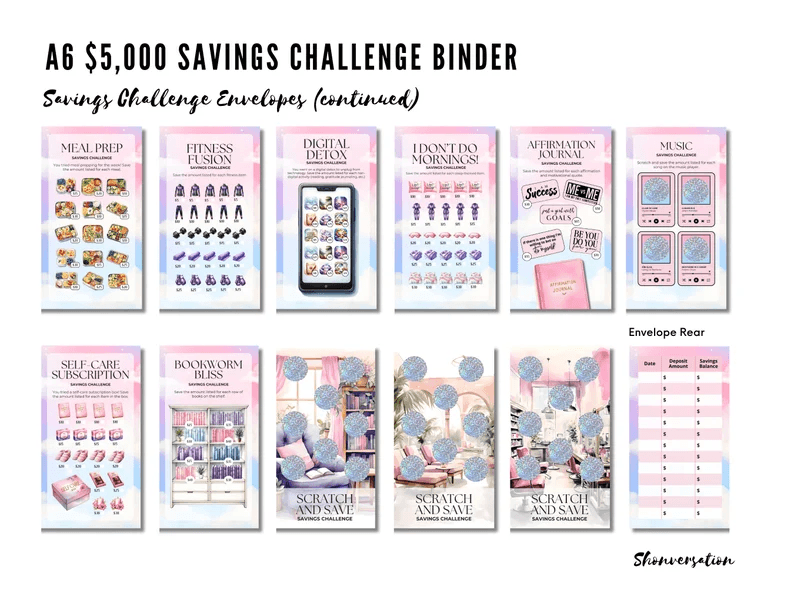

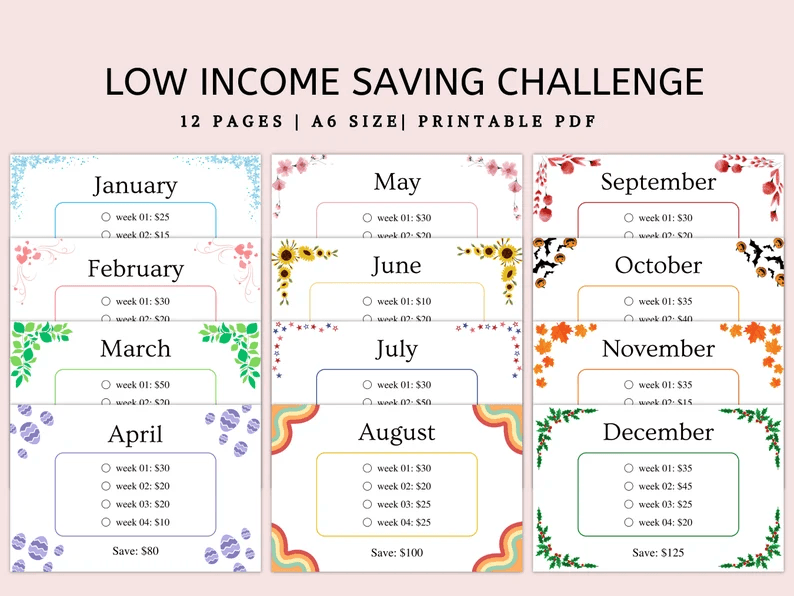

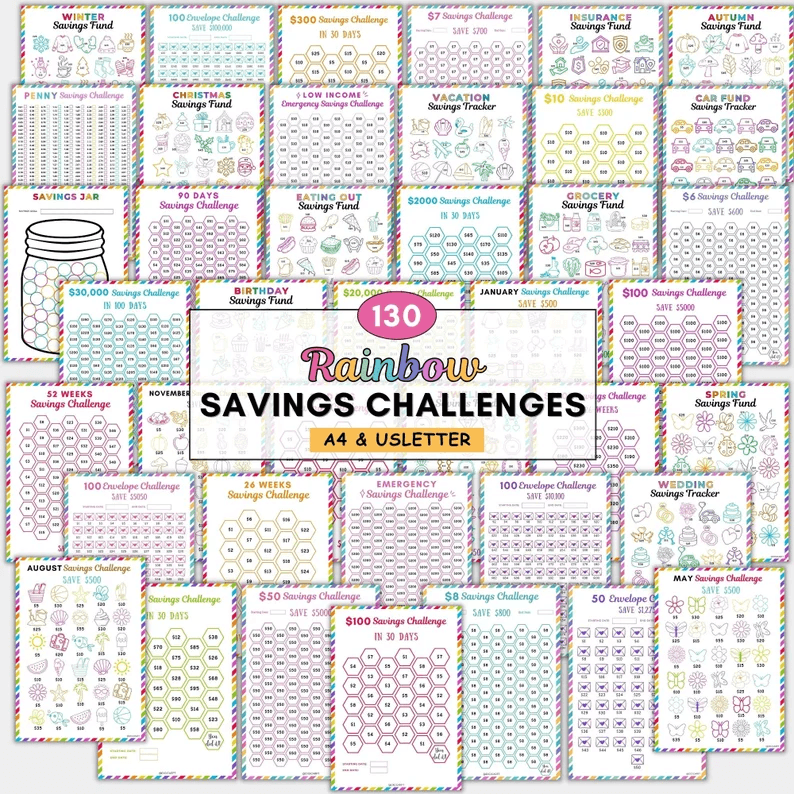

Tools to Track Your Progress: Apps, Planners, and Spreadsheets

Gone are the days of scribbling on the back of receipts. Budgeting apps like Mint, YNAB (You Need a Budget), or even Google Sheets can help you monitor your savings with ease. If you’re old-school, a printed savings tracker can be just as effective. The key is visibility—watching your progress grow is wildly motivating!

Creating a Support System for Accountability

Enlist a savings buddy or join a community group with similar financial goals. Sharing wins (and struggles) keeps the journey exciting and adds a layer of accountability. Plus, a little friendly competition never hurts.

Weekly and Monthly Money Challenges

The $1 Winter Wonderland Challenge

Saving doesn’t have to be complicated. Start by setting aside just $1 a day through winter. It’s small enough to manage but adds up to a tidy $90 by the end of the season. This challenge is perfect for beginners or anyone easing into saving.

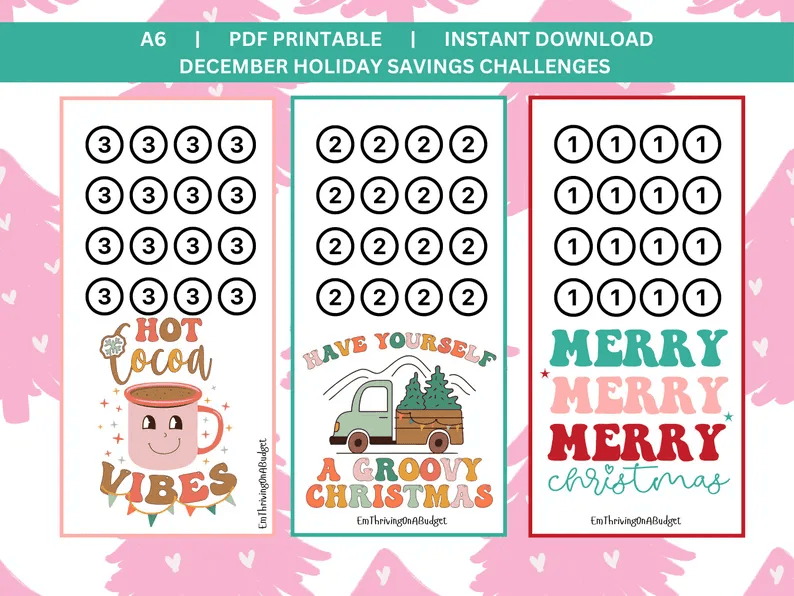

The Reverse Advent Calendar Challenge

Flip the script on the traditional Advent calendar. Instead of receiving a treat, deposit a small amount of cash each day into a jar or savings account. By the end of December, you’ll have a financial gift to kick off the year.

The No-Spend January Challenge

After holiday spending sprees, a no-spend month can be refreshing. Focus only on essentials—think groceries and bills—while avoiding dining out, shopping, or entertainment splurges. It’s a reset for both your wallet and your mindset.

52-Week Snowball Savings Challenge

Start small, with $1 in week one, $2 in week two, and so on. By the end of 52 weeks, you’ll have $1,378 saved. The gradual increase makes it manageable and rewarding, especially as you see the snowball effect in action.

The Frugal February Challenge

Shorter month, sharper focus. Spend February prioritizing needs over wants. Cook at home, cut back on subscriptions, and find free ways to entertain yourself. Watch your savings bloom even in the frostiest of months.

Creative Winter Savings Ideas

Decluttering for Dollars: Winter Closet Purge

Turn your unwanted winter coats, boots, and holiday sweaters into cash. Sites like Poshmark or local consignment shops can help you monetize your clutter while refreshing your space.

The “Pantry Challenge”: Eat What You Have

Before hitting the grocery store, challenge yourself to whip up meals from pantry and freezer items. It’s surprising how creative you can get while stretching your budget.

DIY Winter Entertainment Instead of Costly Outings

Movie nights, puzzle marathons, or snowman-building competitions are budget-friendly alternatives to pricey entertainment. Embrace the coziness of staying in while saving money.

Energy-Saving Tips for Winter: Cut Utility Bills

Lowering your thermostat, sealing drafts, and using energy-efficient lighting can slash your winter energy costs. Bonus: these habits also benefit the environment.

“Round-Up” Savings: A Small Change, Big Difference Approach

Use banking apps that round up your purchases to the nearest dollar, stashing the spare change into savings. Over time, these tiny amounts snowball into a significant sum.

Snowflake Savings: Micro-Wins Add Up

Set aside small, irregular amounts of money, like a $5 rebate or the cash from selling old books. Each “snowflake” contributes to your larger snowball savings goal.

Family-Friendly Money Challenges

Family Change Jar Competition

Get the whole family involved in saving. Set up a jar for spare change and turn it into a fun competition. The winner (or everyone) can decide how to spend or save the accumulated amount.

Kids’ Winter Craft Sale

Encourage kids to create and sell handmade crafts like snowflake ornaments or knitted scarves. It’s a fun way for them to learn entrepreneurship while contributing to the family fund.

Winter Movie Night on a Budget

Host a movie night at home with popcorn, hot cocoa, and cozy blankets. It’s an affordable way to spend quality time without theater prices.

The Cozy Cook-Off Challenge: Budget-Friendly Recipes

Have a family cook-off using inexpensive ingredients from your pantry. Not only does it save money, but it also sparks creativity and fills the house with warmth.

Teaching Kids to Save: A Winter Allowance Game

Introduce kids to saving by splitting their allowance into jars: one for spending, one for saving, and one for giving. Watching their savings grow teaches valuable money skills early on.

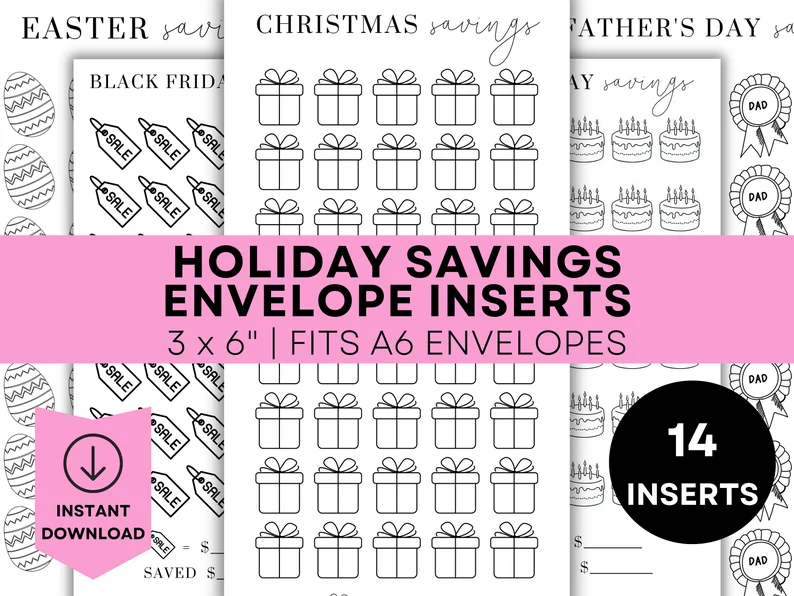

Holiday-Themed Savings Activities

Repurpose Leftover Holiday Gift Wrap and Décor

Don’t toss those rolls of half-used wrapping paper or extra bows! Use them for upcoming birthdays or DIY projects. Reusing decorations cuts costs and keeps the holiday spirit alive year-round.

Sell Unwanted Holiday Gifts for Extra Cash

Got a duplicate gift or something you won’t use? List it on platforms like eBay or Facebook Marketplace. Turning unused presents into cash is a win-win for your wallet and someone else’s wishlist.

The Re-Gifting Challenge: Save Without Spending

Carefully re-gift items you’ve received but don’t need. This thoughtful recycling of gifts helps reduce waste and keeps your budget intact. Just make sure not to regift within the same circle!

Holiday Card Recycling Projects for Cheap Fun

Turn old holiday cards into gift tags, bookmarks, or framed art. It’s a creative, cost-effective way to upcycle and add a personal touch to future gifts.

Community and Social Savings Challenges

Join a Winter Savings Facebook Group

Find or create an online community dedicated to winter savings. Share tips, tricks, and challenges with like-minded savers. The encouragement and ideas you’ll gain are priceless.

Organize a Community Swap Meet

Gather neighbors to swap gently used items like clothes, toys, or books. It’s a great way to save money, reduce waste, and strengthen local connections.

The Shared Subscription Savings Challenge

Team up with friends or family to split the cost of subscriptions like streaming services or meal kits. Everyone saves while still enjoying the perks.

Participate in a Local Thrift Challenge

Set a budget and see who can find the most unique thrifted treasures. From vintage jackets to secondhand furniture, you might discover hidden gems at unbeatable prices.

Fun Ways to Save on Everyday Expenses

Save on Groceries with Winter Meal Planning

Plan meals around what’s on sale or already in your pantry. Soups, stews, and casseroles are winter staples that are both affordable and comforting.

Carpooling for Winter Events

Share rides to holiday parties, school events, or work. Carpooling cuts down on fuel costs and fosters camaraderie during the chilly season.

DIY Winter Maintenance for Your Home and Car

Handle small maintenance tasks like weatherproofing windows or replacing wiper blades yourself. These DIY fixes can save significant amounts compared to professional services.

Coupons and Cashback Apps for Winter Necessities

Take advantage of coupons and cashback apps like Rakuten or Honey for discounts on everything from groceries to winter clothing. Every little bit adds up.

Rewarding Yourself Along the Way

Affordable Ways to Celebrate Milestones

Mark savings milestones with budget-friendly rewards, like a homemade dessert or a cozy night in with your favorite book. Celebrations don’t need to cost a fortune to feel special.

How Small Rewards Keep You Motivated

Breaking big goals into smaller, achievable steps keeps you from feeling overwhelmed. Celebrate each success to maintain momentum and enthusiasm.

Budget-Friendly Winter Splurges That Don’t Break the Bank

Indulge in small luxuries, like a discounted spa day or a thrifted cashmere sweater. Strategic splurges can feel like a treat without derailing your savings plan.

Planning Ahead for the New Year

Saving for Upcoming Spring Expenses

Use winter savings to prepare for spring costs like vacations, outdoor activities, or home repairs. Being proactive prevents financial stress later.

Budgeting for Tax Season

Set aside a portion of your winter savings for potential tax payments or to treat yourself if you get a refund. A little preparation goes a long way.

Creating a Financial Vision Board for the Year

Craft a vision board filled with images and words representing your financial goals. Seeing your dreams visualized can inspire and guide your decisions throughout the year.

Reflecting on Your Winter Savings Journey

How These Challenges Can Build Long-Term Habits

Winter money challenges aren’t just about saving now; they set the foundation for smarter financial habits all year. By practicing discipline and creativity, you build resilience for future goals.

Encouraging Others to Join Your Savings Journey

Inspire friends and family to try their own challenges. Share your progress on social media or host a savings workshop to spread the enthusiasm.

The Power of Starting the New Year with Financial Confidence

Starting the year with a stronger financial foundation feels empowering. With your winter savings in place, you’re ready to tackle whatever the year throws your way.

By embracing these winter money challenges, you’ll save more than just dollars—you’ll gain confidence, creativity, and a sense of accomplishment that lasts well beyond the snow. Warm up to the idea of saving, and watch your financial goals flourish.